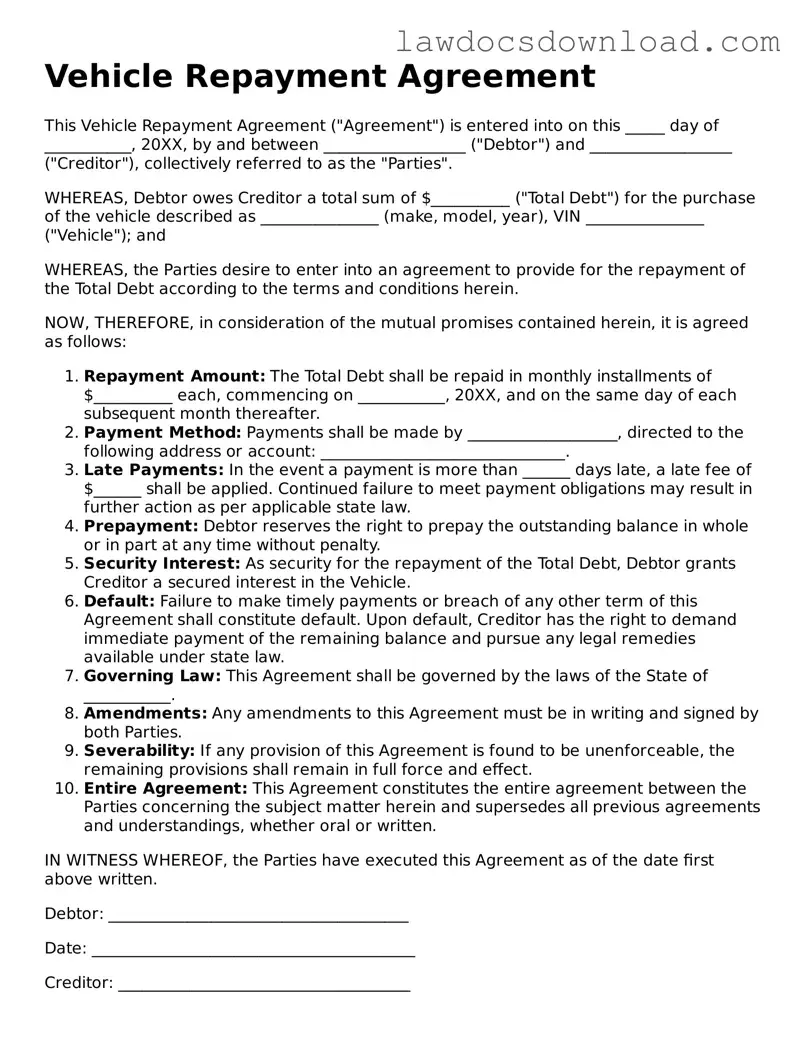

Blank Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. It serves as a critical tool for both lenders and borrowers, ensuring clarity and preventing misunderstandings regarding the repayment arrangement. This agreement typically includes details such as loan amount, interest rate, repayment schedule, and consequences of default.

Launch Vehicle Repayment Agreement Editor Here

Blank Vehicle Repayment Agreement Template

Launch Vehicle Repayment Agreement Editor Here

Launch Vehicle Repayment Agreement Editor Here

or

Free Vehicle Repayment Agreement

Get this form done in minutes

Complete your Vehicle Repayment Agreement online and download the final PDF.