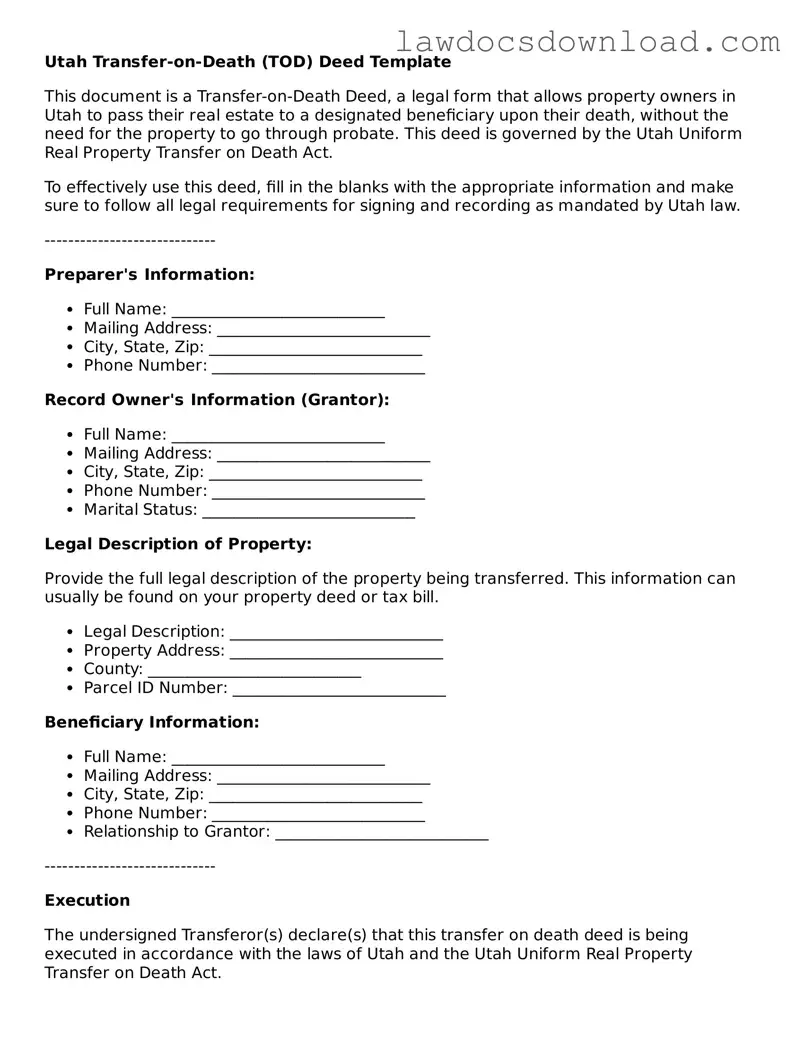

Utah Transfer-on-Death (TOD) Deed Template

This document is a Transfer-on-Death Deed, a legal form that allows property owners in Utah to pass their real estate to a designated beneficiary upon their death, without the need for the property to go through probate. This deed is governed by the Utah Uniform Real Property Transfer on Death Act.

To effectively use this deed, fill in the blanks with the appropriate information and make sure to follow all legal requirements for signing and recording as mandated by Utah law.

-----------------------------

Preparer's Information:

- Full Name: ___________________________

- Mailing Address: ___________________________

- City, State, Zip: ___________________________

- Phone Number: ___________________________

Record Owner's Information (Grantor):

- Full Name: ___________________________

- Mailing Address: ___________________________

- City, State, Zip: ___________________________

- Phone Number: ___________________________

- Marital Status: ___________________________

Legal Description of Property:

Provide the full legal description of the property being transferred. This information can usually be found on your property deed or tax bill.

- Legal Description: ___________________________

- Property Address: ___________________________

- County: ___________________________

- Parcel ID Number: ___________________________

Beneficiary Information:

- Full Name: ___________________________

- Mailing Address: ___________________________

- City, State, Zip: ___________________________

- Phone Number: ___________________________

- Relationship to Grantor: ___________________________

-----------------------------

Execution

The undersigned Transferor(s) declare(s) that this transfer on death deed is being executed in accordance with the laws of Utah and the Utah Uniform Real Property Transfer on Death Act.

Date: ___________________________

Signature of Transferor (Grantor): ___________________________

Witnessed by:

- Witness #1

Name: ___________________________

Signature: ___________________________

Date: ___________________________

- Witness #2

Name: ___________________________

Signature: ___________________________

Date: ___________________________

Notarization

This document was acknowledged before me on (date) ____________ by (name of Transferor) ____________________________________.

___________________________

(Seal) Notary Public

My Commission Expires: ____________

-----------------------------

Instructions for Recording:

After completing and signing this deed in front of a notary, record the deed with the county recorder's office of the county where the property is located. Make sure to comply with all local requirements, including any fees or taxes associated with recording this deed. The recording of this document is critical as it validates the transfer on death deed.