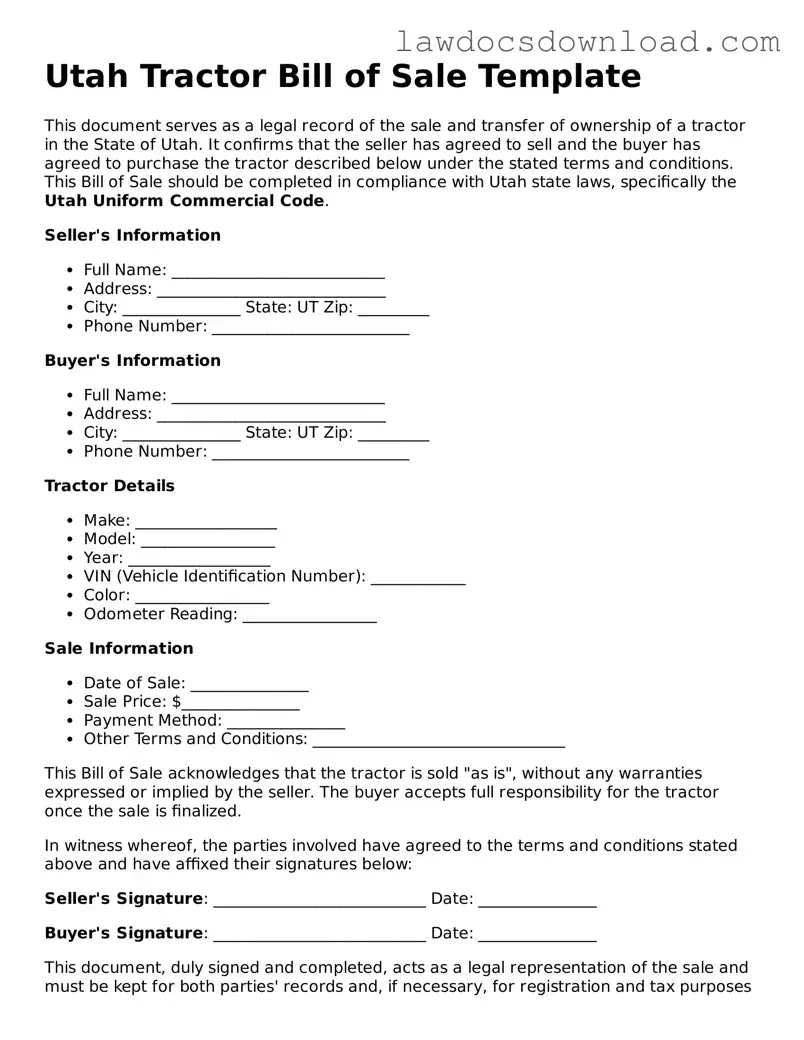

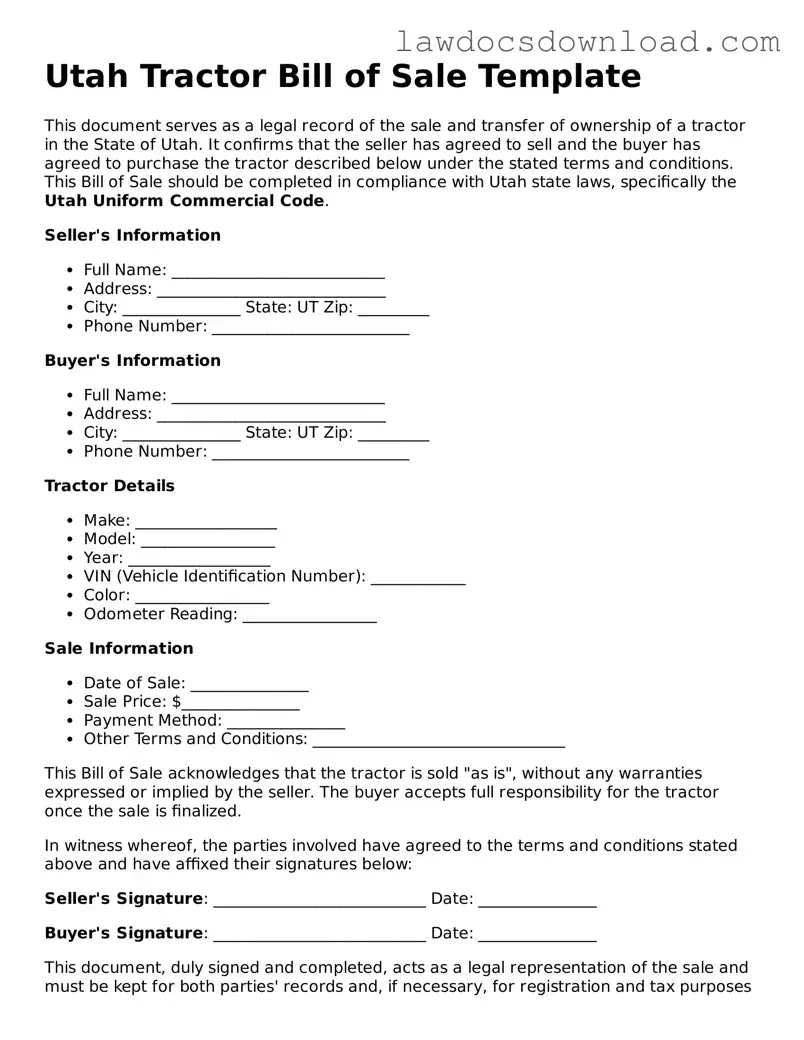

The Utah Tractor Bill of Sale form shares similarities with a Vehicle Bill of Sale, as they both serve as legal documents that verify the sale and transfer of ownership of a piece of property – a tractor and a vehicle, respectively. These documents record the transaction details, including the buyer and seller's information, sale date, and sale amount. Furthermore, they often require notarization to confirm authenticity, providing legal protection for both parties involved.

Similarly, a Boat Bill of Sale mirrors the function of a Tractor Bill of Sale by documenting the sale and transfer of ownership of a boat. It includes specific details about the boat, such as make, model, year, and hull identification number, paralleling how a tractor's details are outlined. Both documents ensure the rights and obligations of the buyer and seller are clear, facilitating a smooth transfer of ownership.

Another comparable document is the Firearm Bill of Sale. This document acts as a legal record for the sale of a firearm, detailing the transaction between buyer and seller, much like the Tractor Bill of Sale. It includes critical information about the firearm and parties involved, providing proof of change in ownership, which is crucial for items that require registration and legal compliance.

The General Bill of Sale is broader but still closely related to the Tractor Bill of Sale. It is used for transactions involving the sale of personal property items not specifically covered by more specialized forms. Despite their varied applications, both documents serve the primary purpose of recording a transaction and protecting the legal interests of the parties involved.

A Real Estate Bill of Sale, while focusing on the transfer of property rights rather than movable goods, bears resemblance to the Tractor Bill of Sale in its function of formalizing the details of a transaction. It records information pertinent to the sale of real estate property, ensuring transparency and legal safeguarding for the buyer and seller, akin to the tractor sale process.

The Equipment Bill of Sale is especially similar to the Tractor Bill of Sale, as it is often used for the sale of machinery and heavy equipment. This document includes detailed descriptions of the equipment being sold, the conditions of the sale, and assurances about the item's current status, mirroring the detailed nature of the tractor sale document.

Lastly, the Livestock Bill of Sale parallels the Tractor Bill of Sale in its agricultural context. This document records the sale of animals, such as cattle or horses, detailing the specifics of each animal and the terms of the sale. Like the tractor document, it ensures that the sale is conducted legally and that the transfer of ownership is clearly documented and agreed upon.