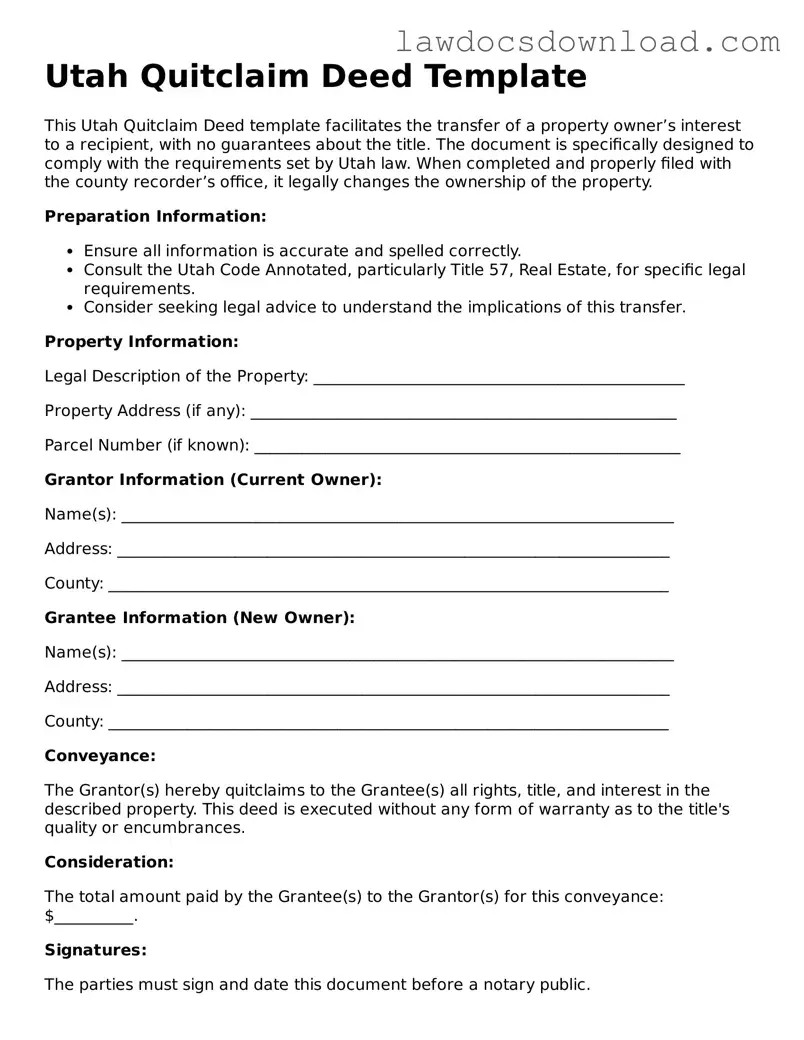

Utah Quitclaim Deed Template

This Utah Quitclaim Deed template facilitates the transfer of a property owner’s interest to a recipient, with no guarantees about the title. The document is specifically designed to comply with the requirements set by Utah law. When completed and properly filed with the county recorder’s office, it legally changes the ownership of the property.

Preparation Information:

- Ensure all information is accurate and spelled correctly.

- Consult the Utah Code Annotated, particularly Title 57, Real Estate, for specific legal requirements.

- Consider seeking legal advice to understand the implications of this transfer.

Property Information:

Legal Description of the Property: _______________________________________________

Property Address (if any): ______________________________________________________

Parcel Number (if known): ______________________________________________________

Grantor Information (Current Owner):

Name(s): ______________________________________________________________________

Address: ______________________________________________________________________

County: _______________________________________________________________________

Grantee Information (New Owner):

Name(s): ______________________________________________________________________

Address: ______________________________________________________________________

County: _______________________________________________________________________

Conveyance:

The Grantor(s) hereby quitclaims to the Grantee(s) all rights, title, and interest in the described property. This deed is executed without any form of warranty as to the title's quality or encumbrances.

Consideration:

The total amount paid by the Grantee(s) to the Grantor(s) for this conveyance: $__________.

Signatures:

The parties must sign and date this document before a notary public.

Grantor(s) Signature: _______________________________ Date: ________________

Grantee(s) Signature: _______________________________ Date: ________________

Notary Acknowledgment:

This section is to be completed by a notary public, affirming the identities of the signatories.

State of Utah

County of ____________

On this day, __________, before me, __________________________________ (name of notary), personally appeared _________________________________, recognized as the signer(s) of this Quitclaim Deed who affirmed to me that he/she/they executed the same for purposes stated herein.

Notary Public: ___________________________________________

Commission Expires: _____________________________________

Recording:

Upon completion, this document should be filed with the recorder’s office in the county where the property is located. Filing fees may apply and vary by county.