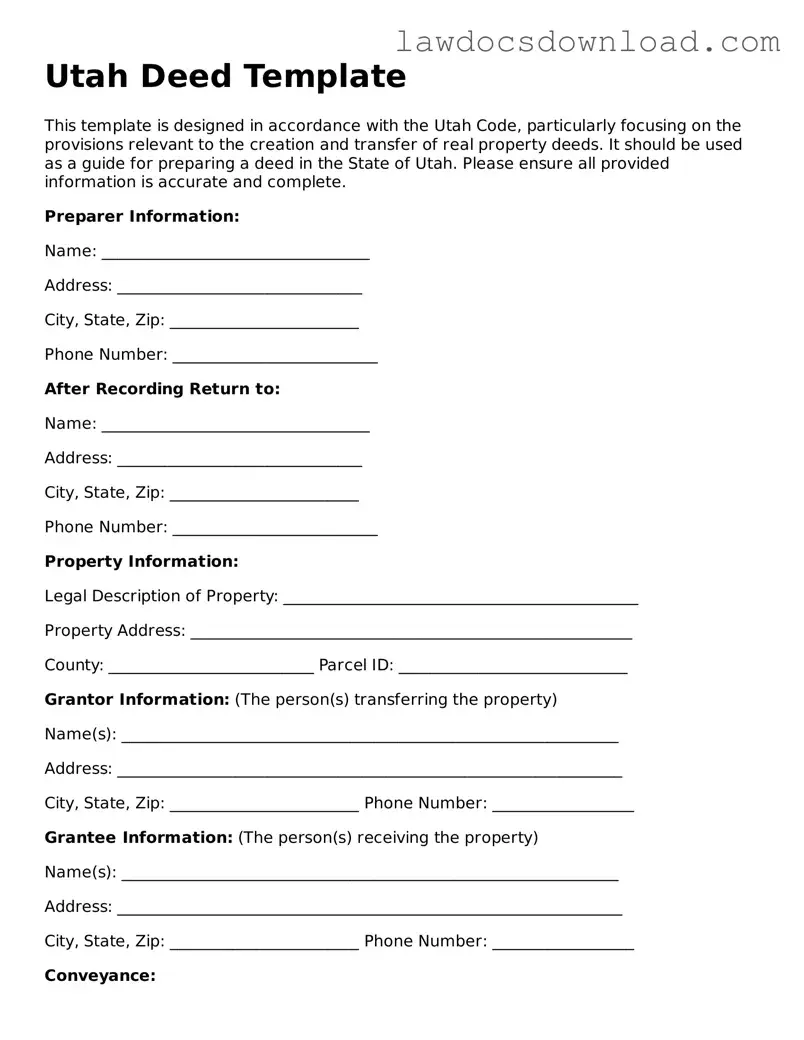

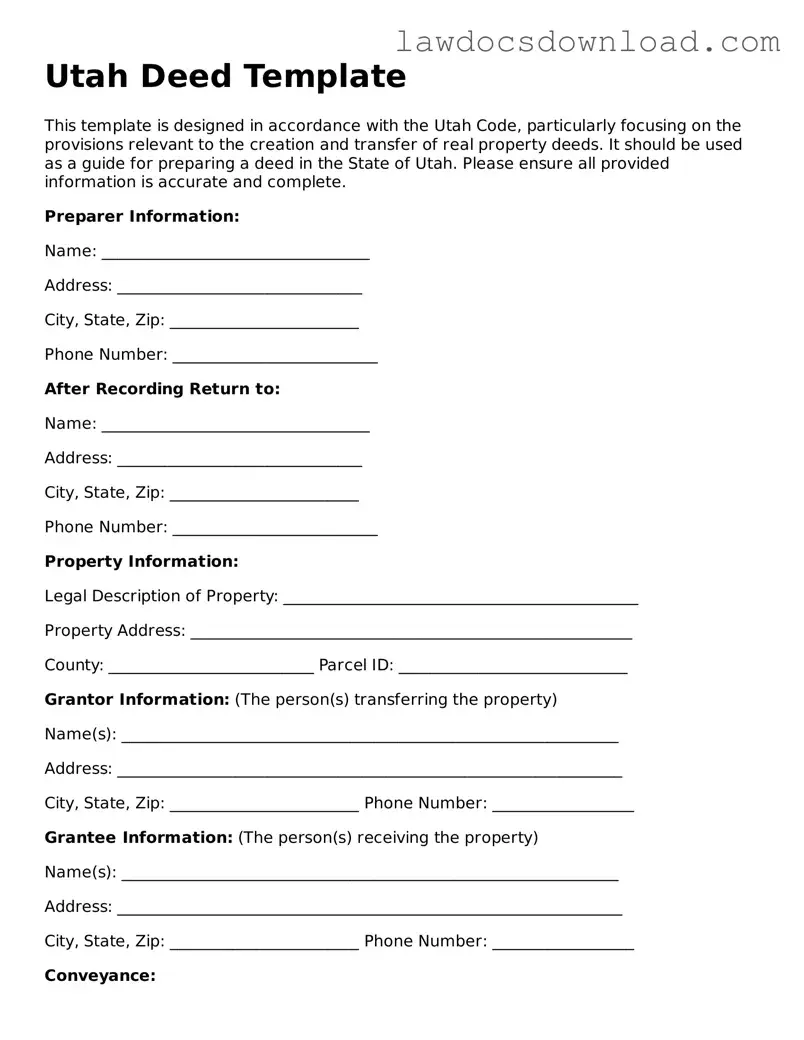

Utah Deed Template

This template is designed in accordance with the Utah Code, particularly focusing on the provisions relevant to the creation and transfer of real property deeds. It should be used as a guide for preparing a deed in the State of Utah. Please ensure all provided information is accurate and complete.

Preparer Information:

Name: __________________________________

Address: _______________________________

City, State, Zip: ________________________

Phone Number: __________________________

After Recording Return to:

Name: __________________________________

Address: _______________________________

City, State, Zip: ________________________

Phone Number: __________________________

Property Information:

Legal Description of Property: _____________________________________________

Property Address: ________________________________________________________

County: __________________________ Parcel ID: _____________________________

Grantor Information: (The person(s) transferring the property)

Name(s): _______________________________________________________________

Address: ________________________________________________________________

City, State, Zip: ________________________ Phone Number: __________________

Grantee Information: (The person(s) receiving the property)

Name(s): _______________________________________________________________

Address: ________________________________________________________________

City, State, Zip: ________________________ Phone Number: __________________

Conveyance:

The Grantor(s) hereby convey(s) to the Grantee(s) the real property described above, free of all encumbrances except as specifically noted herein:

Encumbrances: ___________________________________________________________

Consideration:

The total consideration for this conveyance is $____________________________________.

Signatures:

All parties involved in this transaction shall sign and date this document in the presence of a notary public.

_____________________________ ______________

Grantor Signature Date

_____________________________ ______________

Grantee Signature Date

This document was acknowledged before me on (date) ________ by (name(s) of individual(s)) ________________________________________________.

_____________________________ ______________

Notary Public Signature Date

My commission expires: ____________.

This template provides a basic outline for a Utah deed. It is crucial for individuals to consult with a legal professional to ensure that all aspects of the deed comply with Utah law and are appropriate for the specific circumstances of the property transfer.