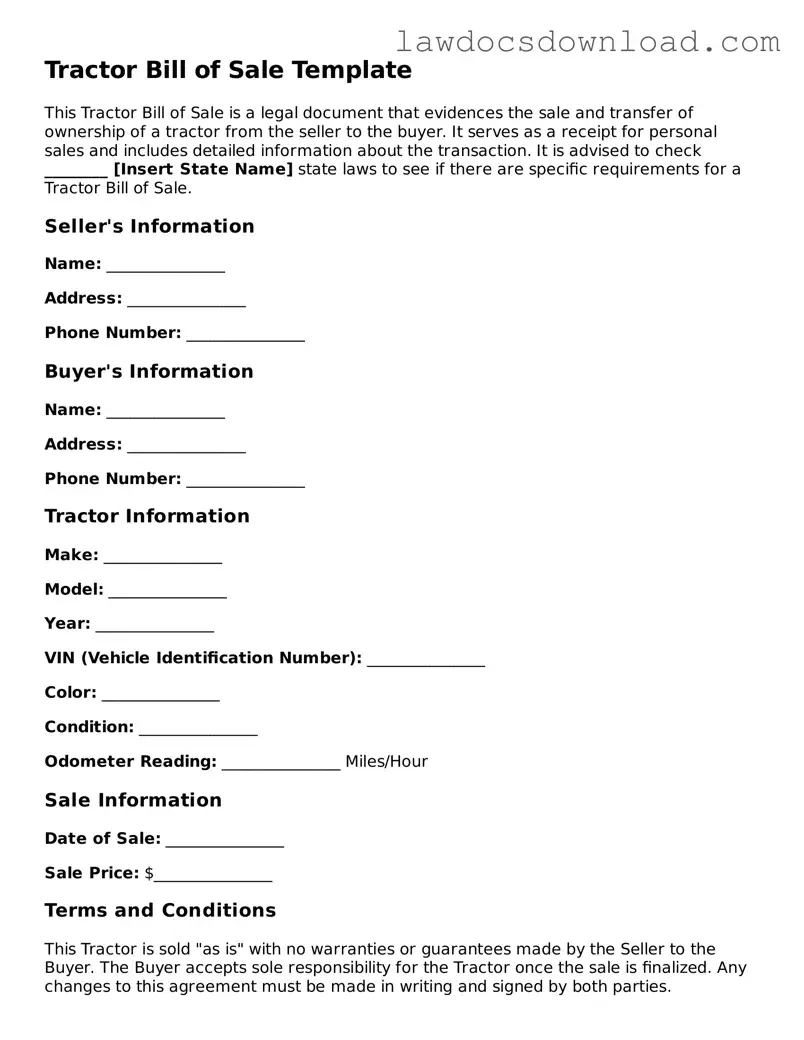

Blank Tractor Bill of Sale Template

A Tractor Bill of Sale Form is a legal document that records the sale and transfer of ownership of a tractor from a seller to a buyer. It serves as proof of purchase and can be vital for the registration of the vehicle, as well as for tax and insurance purposes. Ensuring both parties have this document adds a layer of security and clarity to the transaction.

Launch Tractor Bill of Sale Editor Here

Blank Tractor Bill of Sale Template

Launch Tractor Bill of Sale Editor Here

Launch Tractor Bill of Sale Editor Here

or

Free Tractor Bill of Sale

Get this form done in minutes

Complete your Tractor Bill of Sale online and download the final PDF.