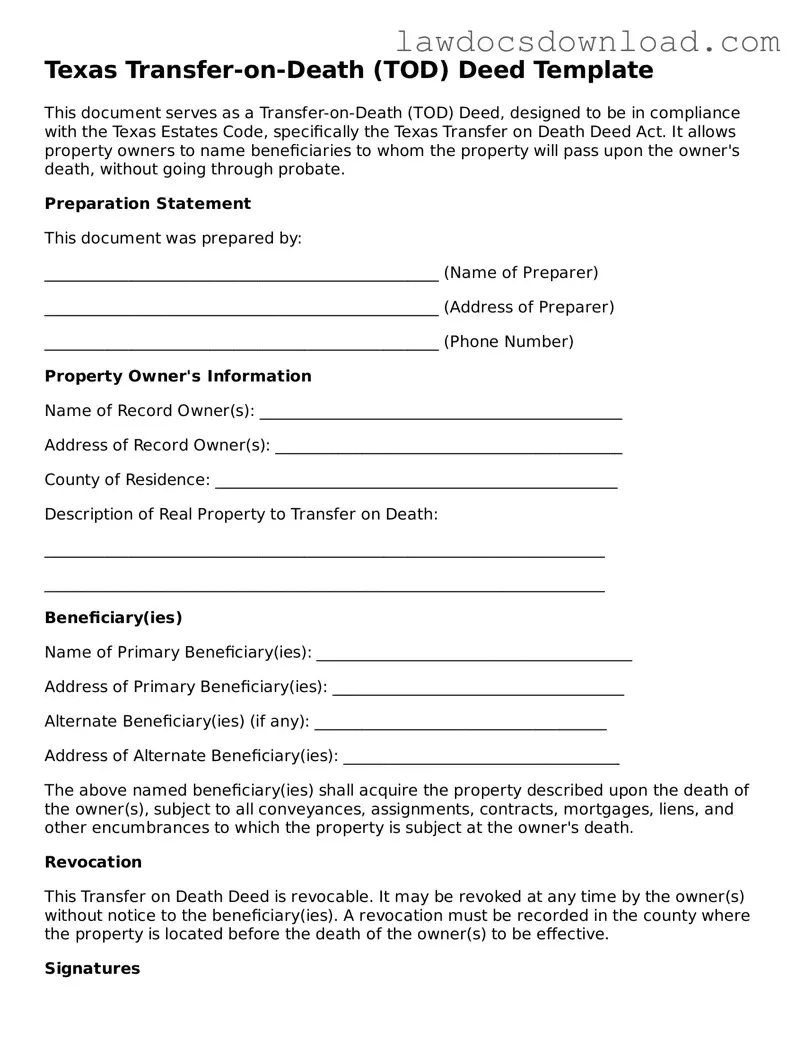

Legal Texas Transfer-on-Death Deed Form

The Texas Transfer-on-Death Deed form allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the sometimes lengthy and complex process of going through probate. This legal document offers a convenient way for homeowners to ensure their property ends up in the right hands without the need for a will to be probated. By simply completing this form and following the proper recording procedures, individuals can provide for a smoother transition of their assets.

Launch Transfer-on-Death Deed Editor Here

Legal Texas Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.