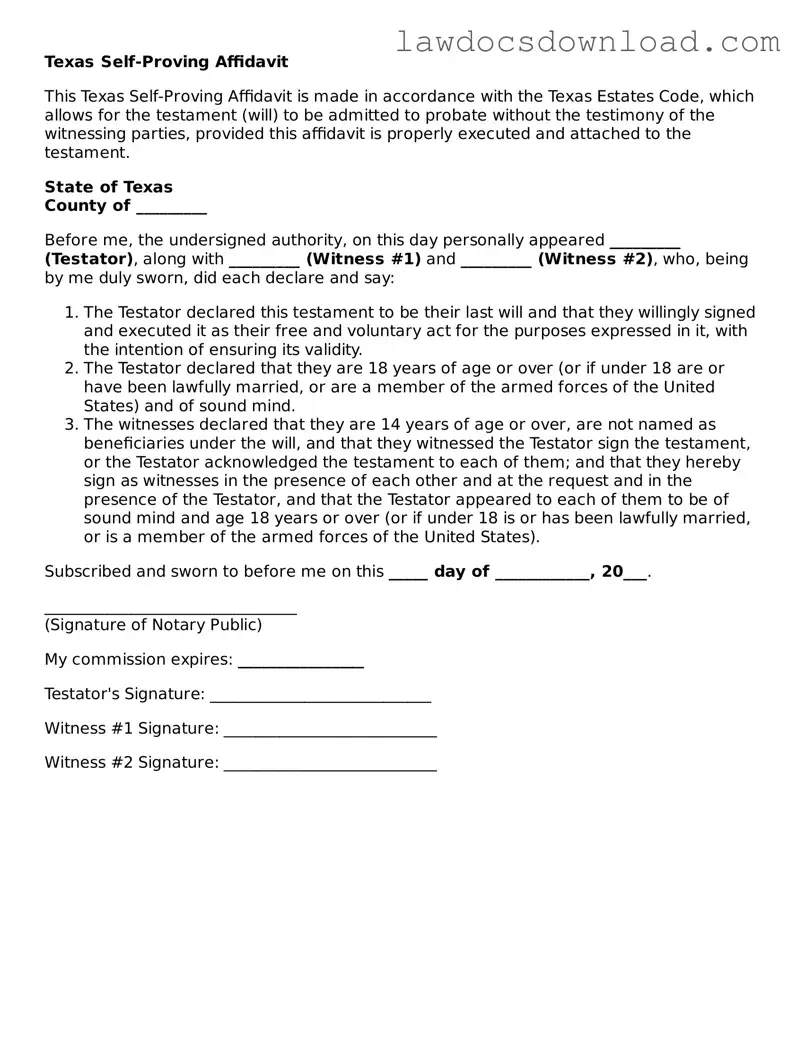

The Texas Self-Proving Affidavit form is closely related to a Last Will and Testament in its function and purpose. This legal document, often appended to a Will, helps streamline the probate process by verifying the authenticity of the Will without the need for in-person testimony from witnesses. It serves as a testamentary device, making it easier for executors to carry out the wishes outlined in a Will after someone's death.

A Power of Attorney form shares similarities with the Self-Proving Affidavit due to its role in affirming someone's authority to act on another's behalf. Though it covers a different legal ground — granting an individual (the agent) the power to make decisions for another (the principal) — both documents are centered on establishing legal permissions and validating the document signer's intentions.

A Living Trust is another document that aligns with the purposes of a Self-Proving Affidavit. While the Affidavit certifies the authenticity of a Will, a Living Trust provides a mechanism for property management and asset distribution without the need for probate. Both serve to simplify legal processes related to asset disposition, but through different estate planning tools.

Medical Directives or Advanced Healthcare Directives also exhibit a parallel to the Self-Proving Affidavit by recording specific directions regarding medical treatments and interventions. These directives, while focusing on healthcare decisions rather than estate matters, still rely on the foundational principle of documenting and affirming an individual's wishes in a legally recognized form.

A Codicil, which is an amendment to a Will, operates under a framework similar to that of a Self-Proving Affidavit. By modifying or adding provisions to a Will, it necessitates a level of legal formalization and validation akin to that provided by a Self-Proving Affidavit for the original Will document.

Declarations of Guardianship in Texas serve a purpose related to yet distinct from that of a Self-Proving Affidavit. These declarations specify an individual's choice of guardian for themselves or their minor children in the event of incapacity or death. Although focused on guardianship rather than estate validation, both documents underscore the importance of planning ahead and legally recording one's preferences.

A Transfer on Death Deed, used to pass on real property outside of the probate process, shares the aim of facilitating smoother transitions upon death, akin to the goal of a Self-Proving Affidavit attached to a Will. By bypassing probate, it aligns with the Affidavit’s purpose of simplifying legal procedures following someone's passing.

Joint Tenancy Agreements offer a method for co-ownership of property with rights of survivorship, directly passing ownership to the surviving tenant upon death. This mechanism, while primarily concerned with property co-ownership, similarly seeks to avoid complicated legal processes post-death, much like the usage of a Self-Proving Affidavit aims to streamline the probate of a Will.

Finally, a Revocable Living Trust parallels the Self-Proving Affidavit through its provision for property management and asset distribution according to the grantor's wishes, without undergoing probate. Like the Affidavit, it plays a significant role in estate planning, focusing on the ease of transitioning assets to beneficiaries.