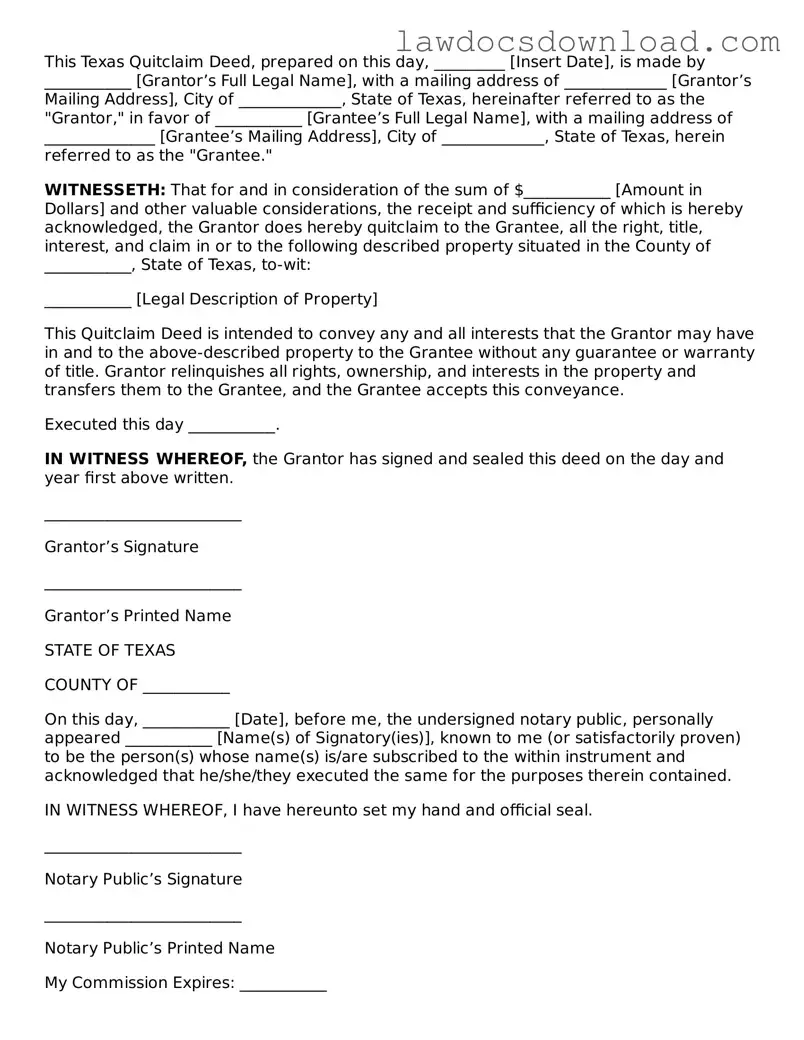

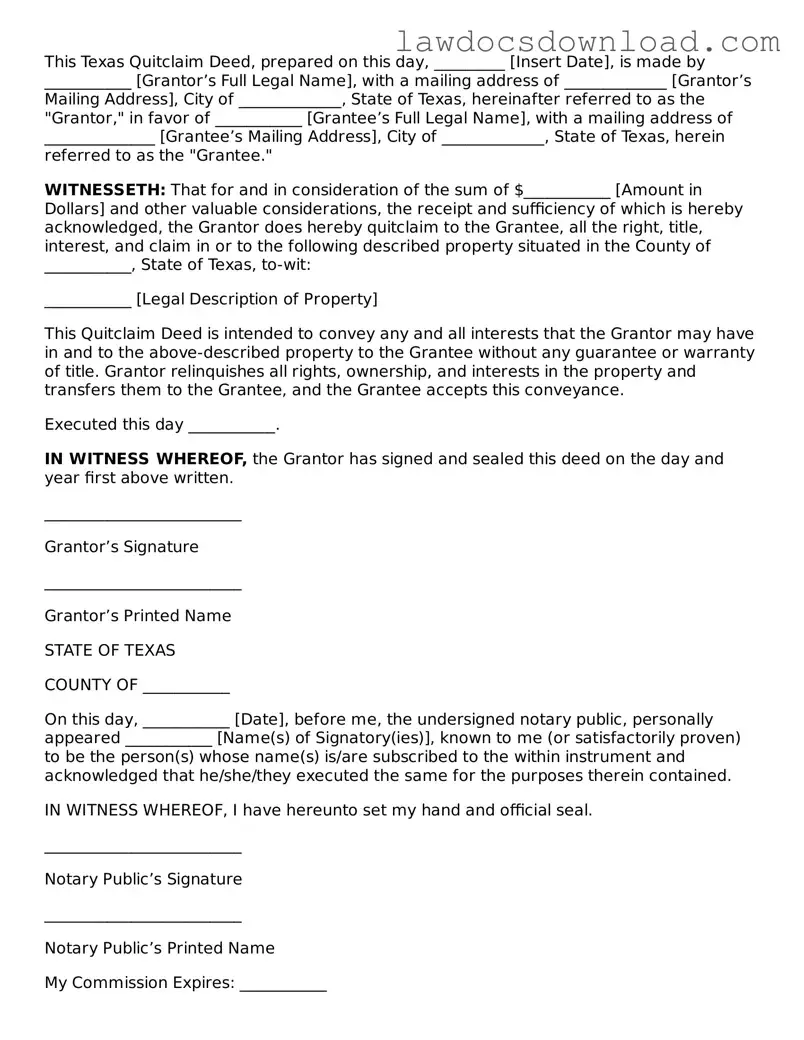

Legal Texas Quitclaim Deed Form

A Texas Quitclaim Deed form is a legal document used to transfer interest in property from a grantor (seller or giver) to a grantee (buyer or recipient) without any warranties regarding the title. This type of deed is often utilized in situations where property is transferred between family members or to clear up title issues. Despite its simplicity, understanding the implications and correct use of the form is crucial for a smooth transaction.

Launch Quitclaim Deed Editor Here

Legal Texas Quitclaim Deed Form

Launch Quitclaim Deed Editor Here

Launch Quitclaim Deed Editor Here

or

Free Quitclaim Deed

Get this form done in minutes

Complete your Quitclaim Deed online and download the final PDF.