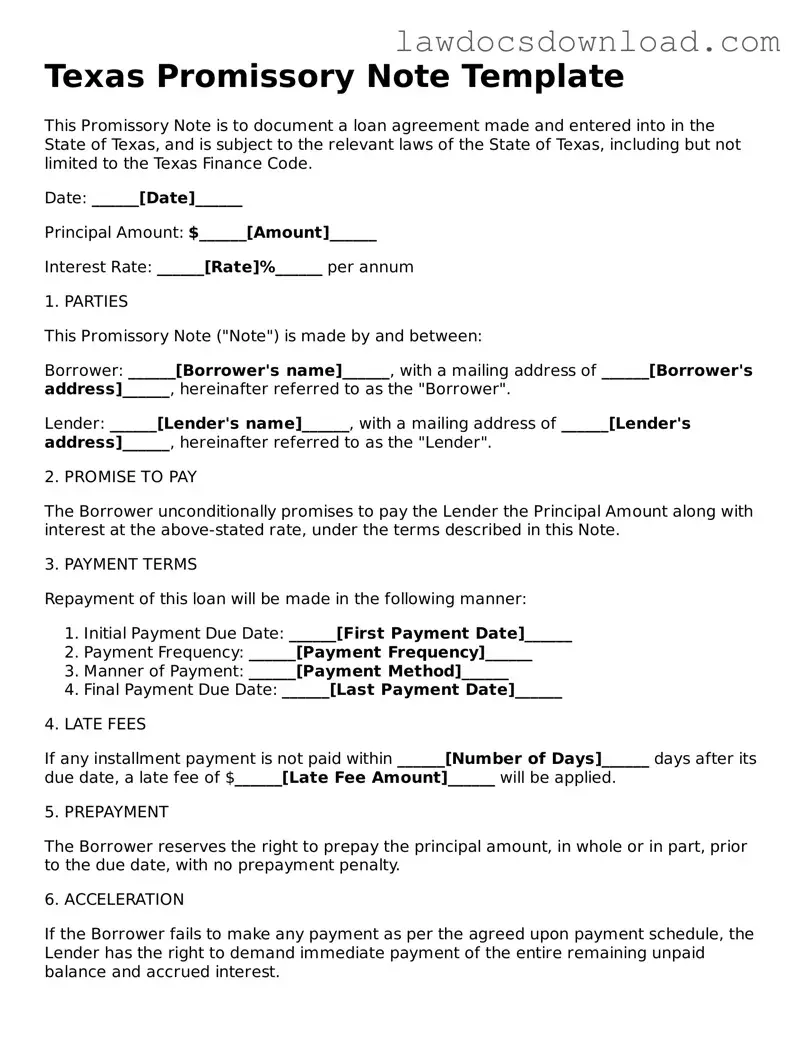

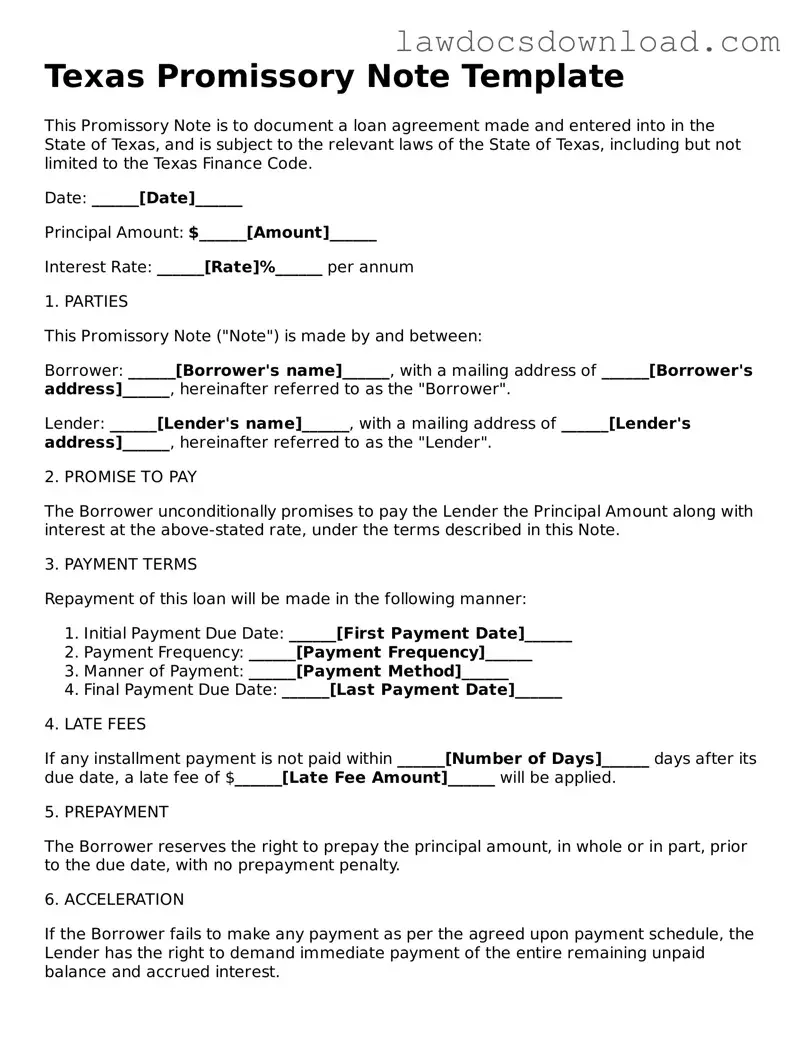

Legal Texas Promissory Note Form

A Texas Promissory Note form is a legal document that outlines the repayment terms and conditions between a borrower and a lender within the state of Texas. This form is crucial because it legally binds the borrower to repay the borrowed amount under agreed-upon terms. It serves not only as proof of the loan but also details the responsibilities and obligations of both parties.

Launch Promissory Note Editor Here

Legal Texas Promissory Note Form

Launch Promissory Note Editor Here

Launch Promissory Note Editor Here

or

Free Promissory Note

Get this form done in minutes

Complete your Promissory Note online and download the final PDF.