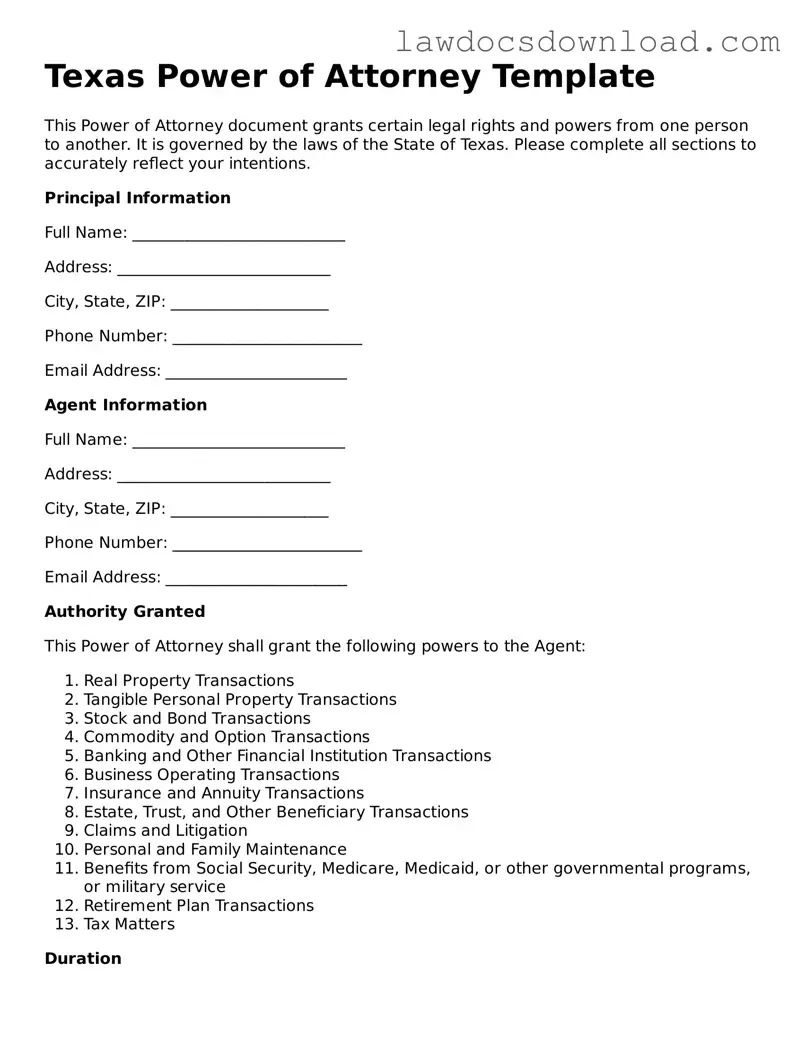

Legal Texas Power of Attorney Form

A Texas Power of Attorney form enables an individual to appoint someone else to make decisions on their behalf concerning financial, medical, or legal matters. This legal document can be essential in times of unexpected illness or absence. Knowing how it works and the benefits it provides is crucial for residents of Texas.

Launch Power of Attorney Editor Here

Legal Texas Power of Attorney Form

Launch Power of Attorney Editor Here

Launch Power of Attorney Editor Here

or

Free Power of Attorney

Get this form done in minutes

Complete your Power of Attorney online and download the final PDF.