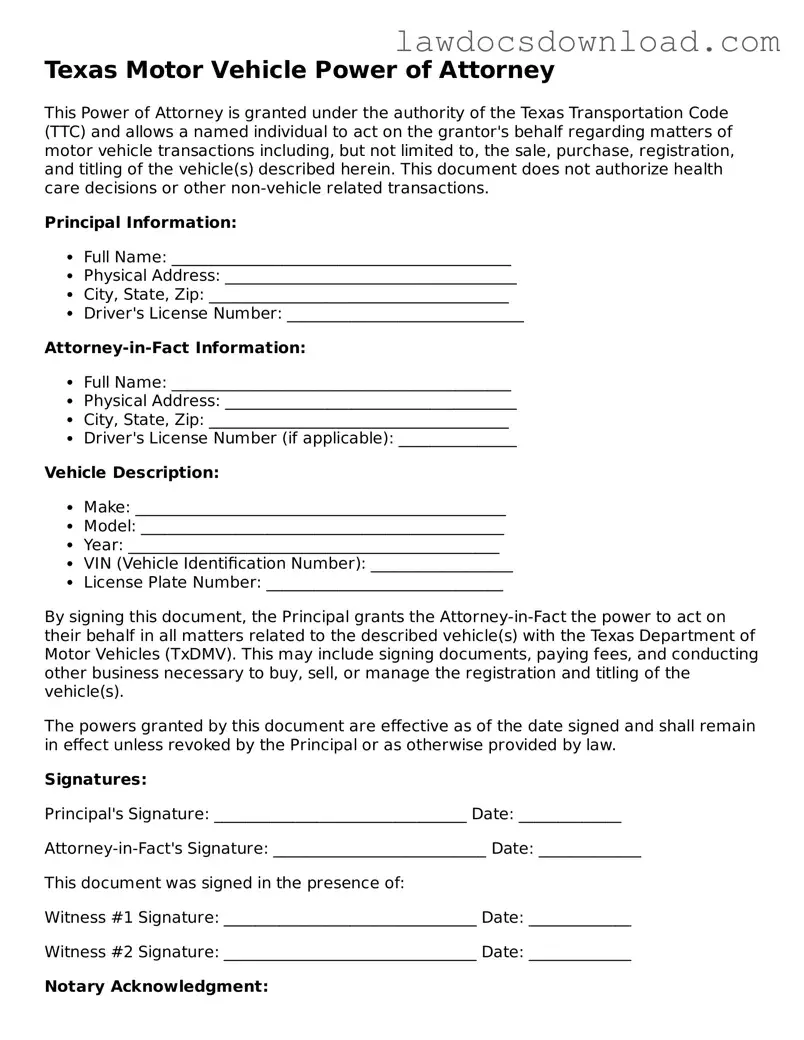

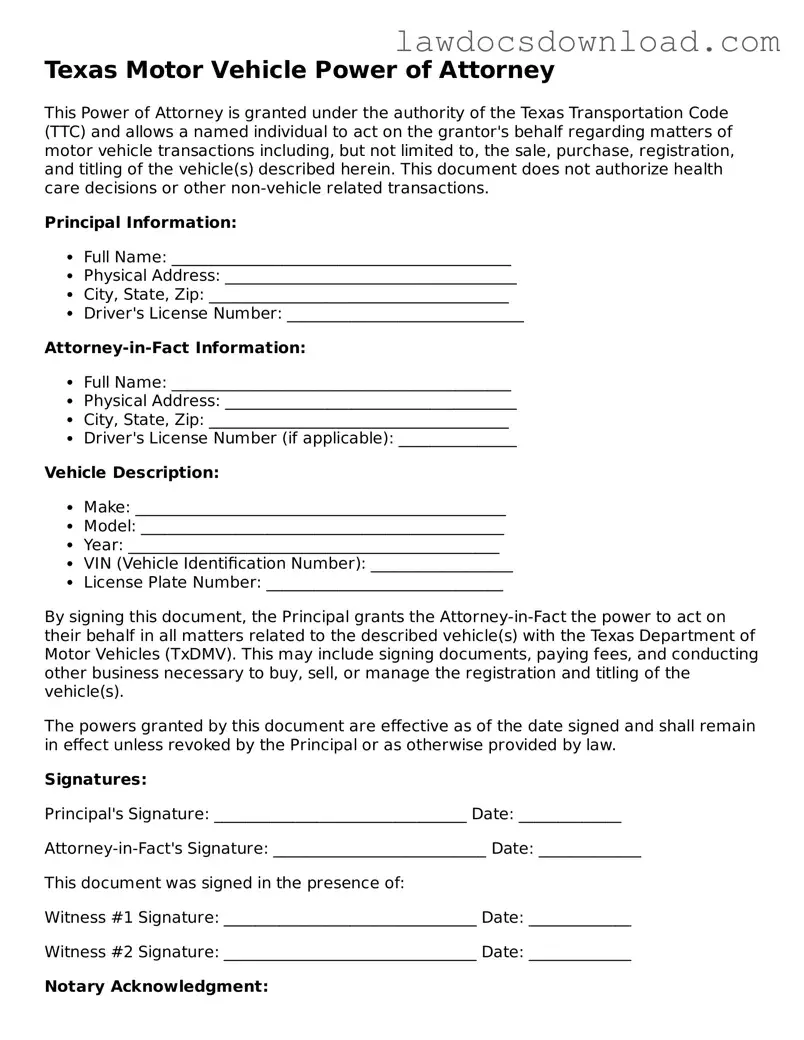

Legal Texas Motor Vehicle Power of Attorney Form

The Texas Motor Vehicle Power of Attorney form is a legal document that allows an individual to grant another person the authority to act on their behalf in matters related to the ownership, registration, or operation of a motor vehicle in Texas. This powerful tool is designed to simplify processes and transactions that involve vehicles, providing a convenient way for owners to ensure their affairs are handled even when they cannot attend to them personally. Utilizing this form can save time and streamline legal procedures, making it a go-to solution for vehicle-related matters.

Launch Motor Vehicle Power of Attorney Editor Here

Legal Texas Motor Vehicle Power of Attorney Form

Launch Motor Vehicle Power of Attorney Editor Here

Launch Motor Vehicle Power of Attorney Editor Here

or

Free Motor Vehicle Power of Attorney

Get this form done in minutes

Complete your Motor Vehicle Power of Attorney online and download the final PDF.