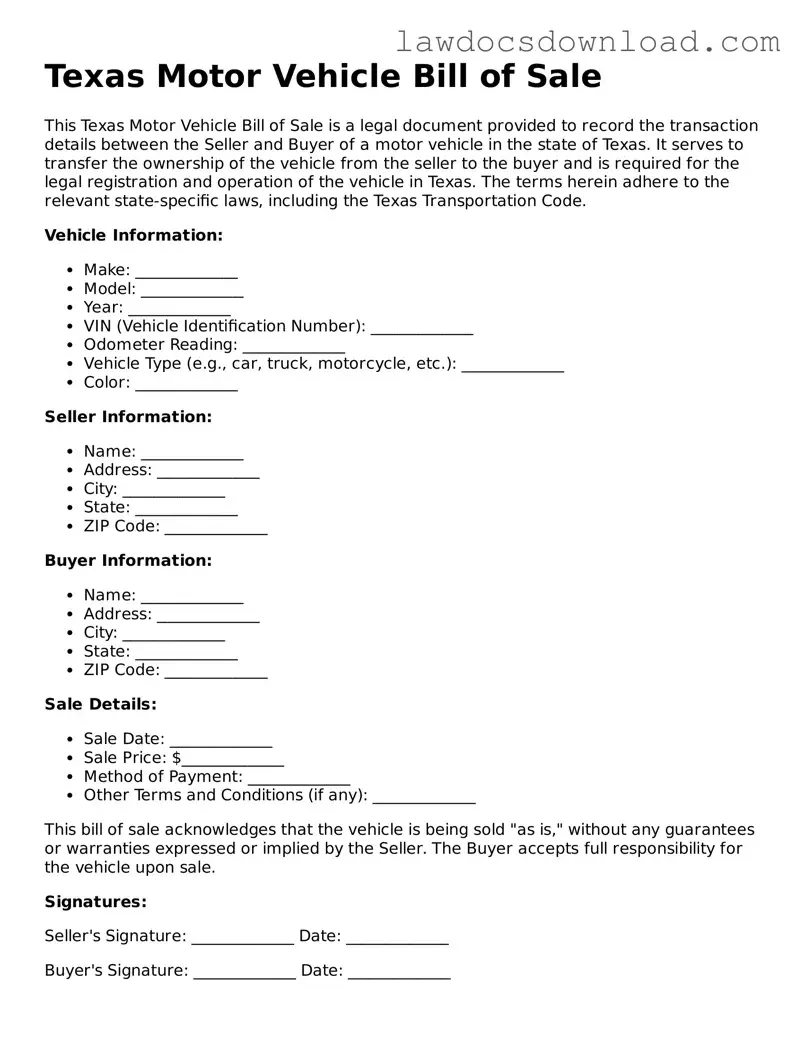

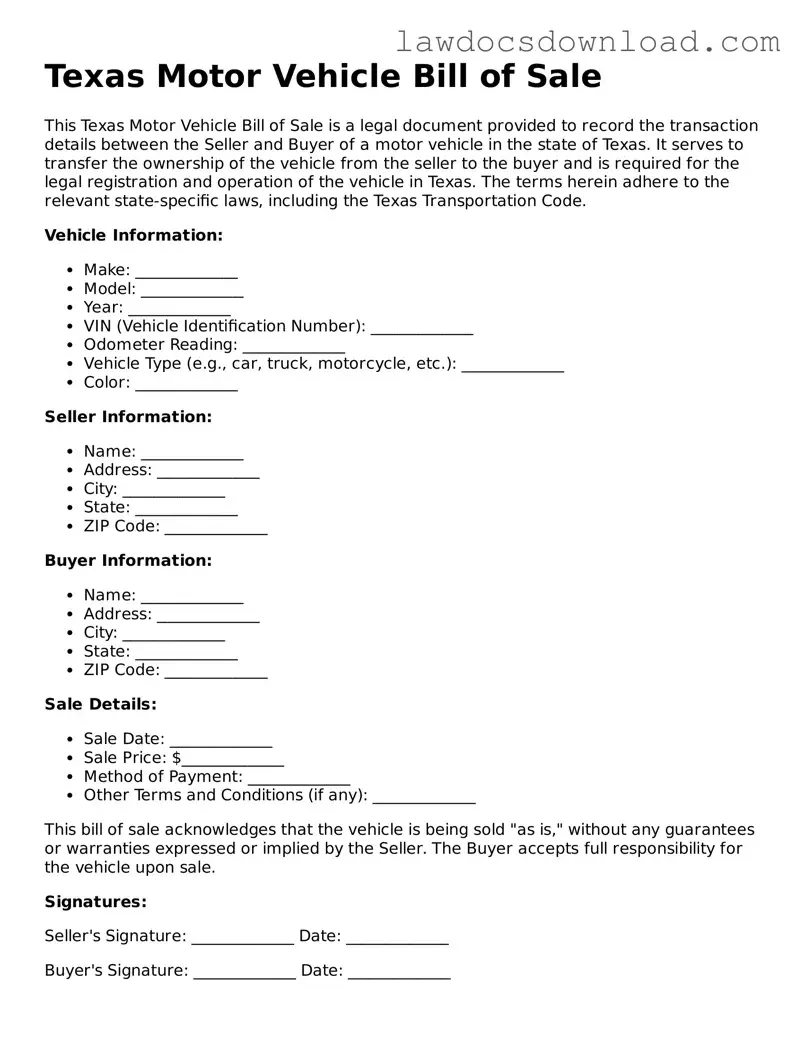

Completing the Texas Motor Vehicle Bill of Sale form is a critical step in the process of buying or selling a vehicle. However, it's easy to make mistakes that can cause unnecessary complications or delays. One common error is not providing complete details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). This information is crucial for the document to be legally binding and to ensure the vehicle can be properly registered by the new owner.

Another mistake often made is failing to accurately state the vehicle's sale price. This figure is not only important for tax purposes but also affects the legal contract between the buyer and seller. It's essential to list the exact sale price, even if the vehicle is a gift, in which case the value of the vehicle should be stated.

Many individuals overlook the requirement to have the document notarized, assuming that a simple handshake agreement will suffice. In Texas, having the bill of sale notarized can add an extra layer of protection for both parties, making it harder for either party to dispute the sale or terms of the agreement later on.

Incorrectly describing the condition of the vehicle is another frequent mistake. Sellers should be honest and transparent about the vehicle’s condition, including any known defects or issues. Misrepresentation can lead to disputes or legal action after the sale.

Leaving out crucial personal information, such as the full names and addresses of both the buyer and seller, is another common oversight. This information is not just bureaucratic paperwork; it's vital for establishing the identity of the parties involved and can be used if any legal issues arise after the sale.

A significant error made by some is not checking the buyer's or seller's identification at the time of sale. This step verifies that the parties are who they claim to be, which is particularly important when the transaction involves significant amounts of money.

Some people mistakenly believe they don't need to keep a copy of the bill of sale once the transaction is completed. However, both the buyer and the seller should keep a copy for their records. This document serves as proof of transfer of ownership and can be important for tax reporting or in the event of a dispute.

Not including a liability disclaimer, which states that the vehicle is sold "as is," is a potential pitfall. This means that once the transaction is completed, the seller is not responsible for any issues that arise with the vehicle that were not disclosed before the sale.

Finally, forgetting to date the document is a small but critical mistake. The date of the sale is important for many reasons, including determining when the responsibility for the vehicle, from insurance to registration, transfers from the seller to the buyer.

In summary, when filling out the Texas Motor Vehicle Bill of Sale form, attention to detail and a clear understanding of the form's requirements are key. Both buyer and seller must review all the information carefully to ensure that the sale proceeds smoothly and legally.