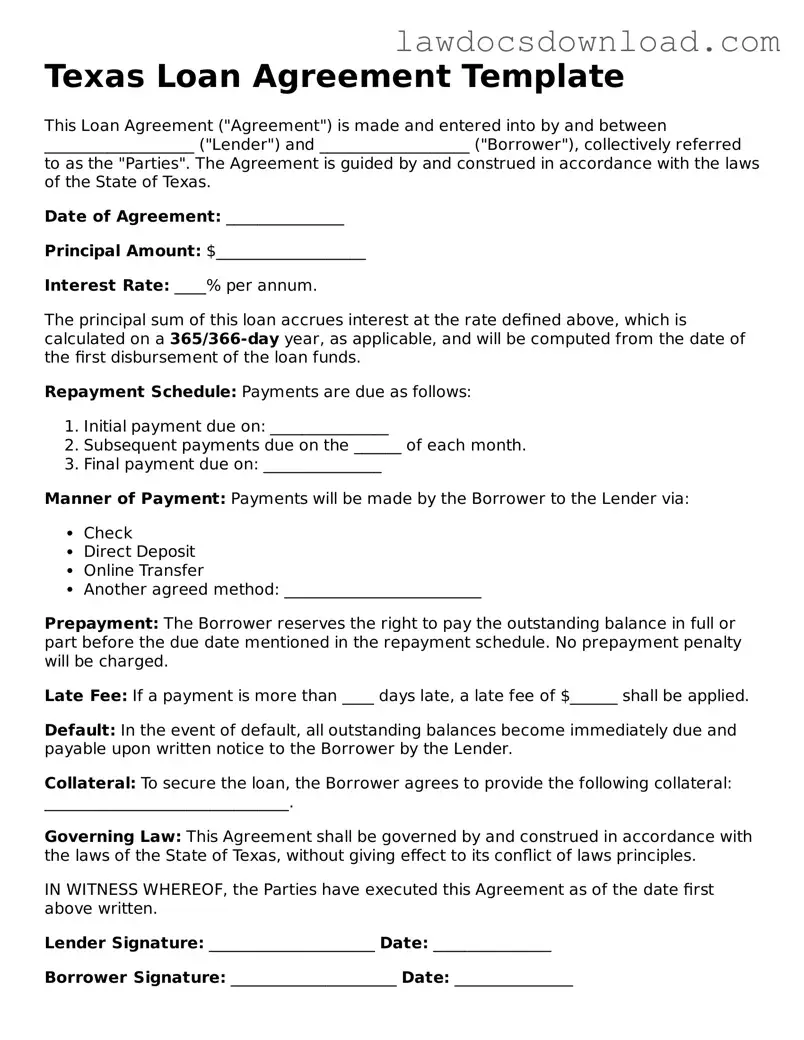

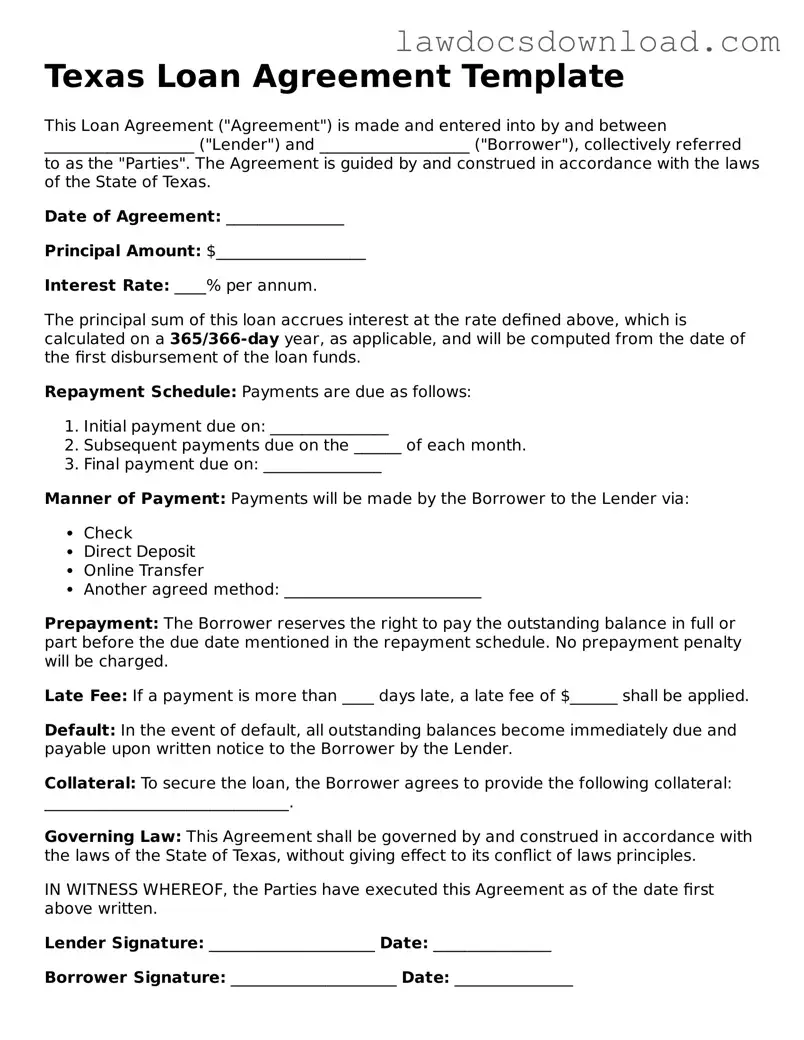

Legal Texas Loan Agreement Form

The Texas Loan Agreement form is a legal document that outlines the terms and conditions between a lender and a borrower. It specifies the loan amount, interest rate, repayment schedule, and other relevant details. Designed to provide clarity and prevent disputes, this form is essential for any loan transaction within the state of Texas.

Launch Loan Agreement Editor Here

Legal Texas Loan Agreement Form

Launch Loan Agreement Editor Here

Launch Loan Agreement Editor Here

or

Free Loan Agreement

Get this form done in minutes

Complete your Loan Agreement online and download the final PDF.