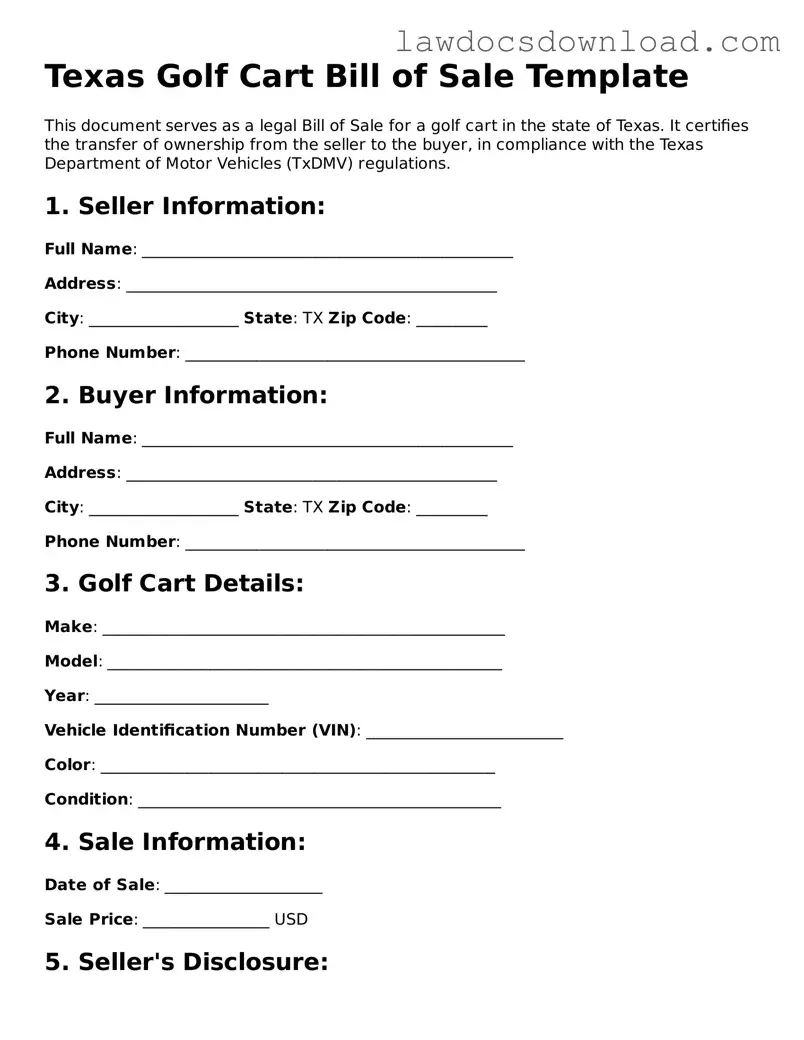

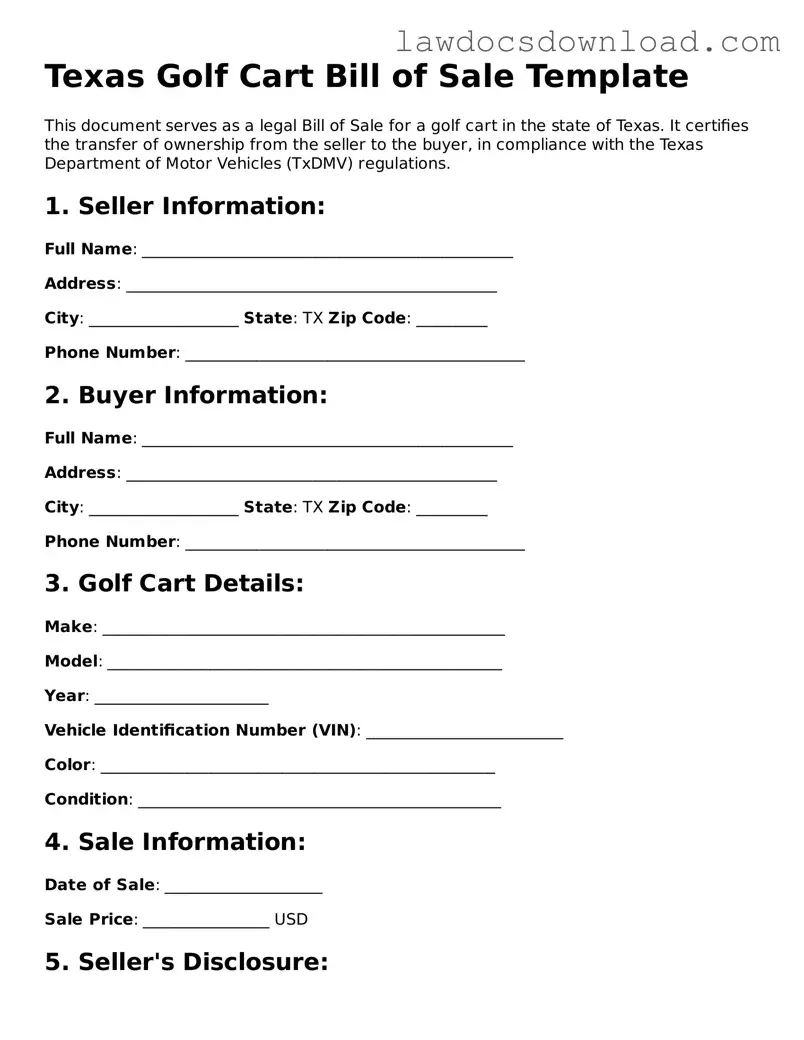

Legal Texas Golf Cart Bill of Sale Form

A Texas Golf Cart Bill of Sale form is a legal document that records the transaction details between a seller and a buyer for the sale of a golf cart in the state of Texas. It serves as proof of purchase and documents the transfer of ownership from one party to another. This form is essential for both parties to ensure that the transaction is recognized legally and to protect their rights.

Launch Golf Cart Bill of Sale Editor Here

Legal Texas Golf Cart Bill of Sale Form

Launch Golf Cart Bill of Sale Editor Here

Launch Golf Cart Bill of Sale Editor Here

or

Free Golf Cart Bill of Sale

Get this form done in minutes

Complete your Golf Cart Bill of Sale online and download the final PDF.