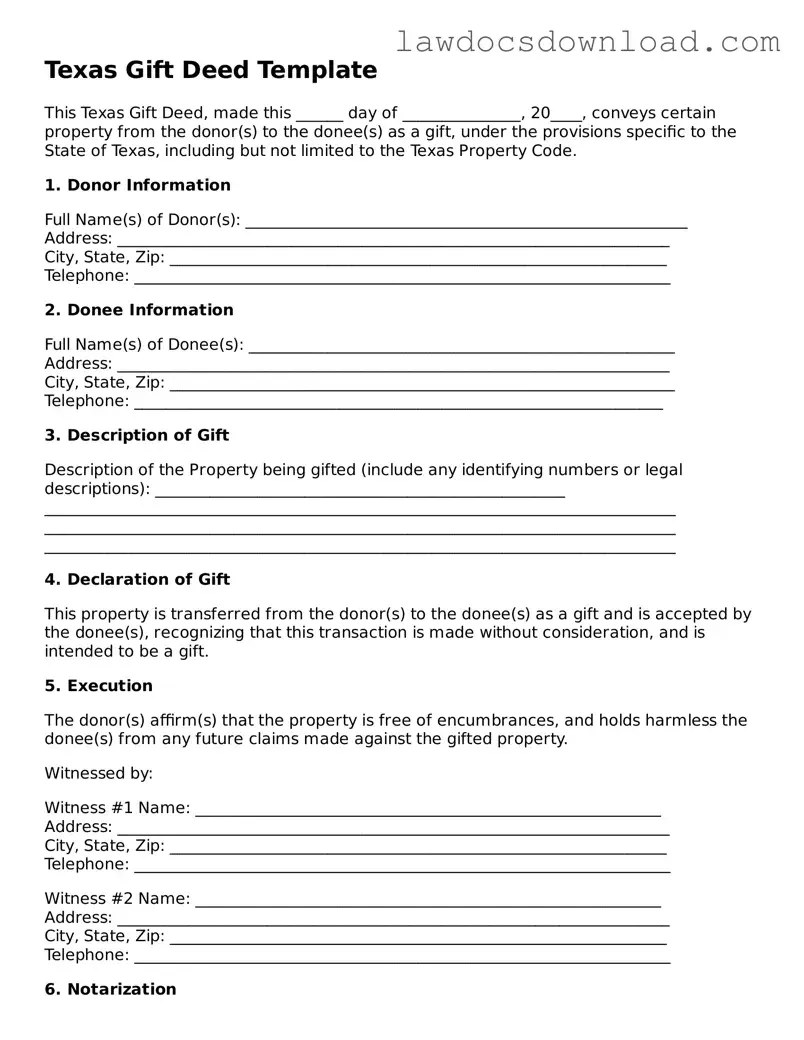

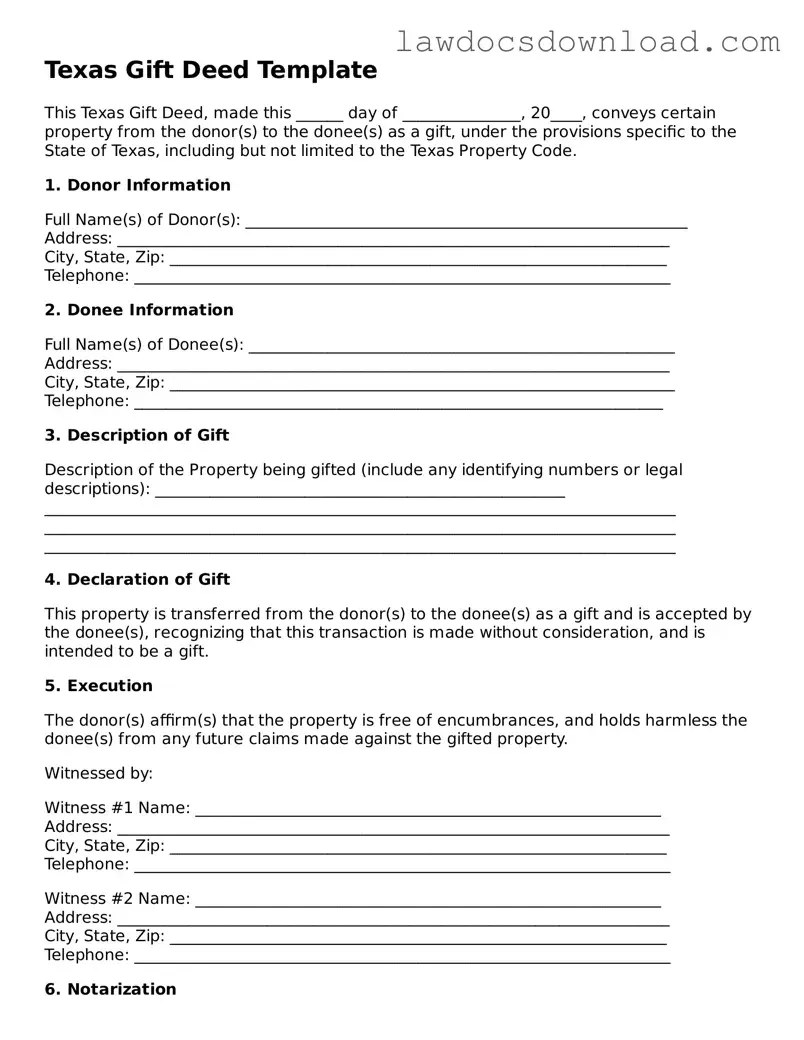

Texas Gift Deed Template

This Texas Gift Deed, made this ______ day of _______________, 20____, conveys certain property from the donor(s) to the donee(s) as a gift, under the provisions specific to the State of Texas, including but not limited to the Texas Property Code.

1. Donor Information

Full Name(s) of Donor(s): ________________________________________________________

Address: ______________________________________________________________________

City, State, Zip: _______________________________________________________________

Telephone: ____________________________________________________________________

2. Donee Information

Full Name(s) of Donee(s): ______________________________________________________

Address: ______________________________________________________________________

City, State, Zip: ________________________________________________________________

Telephone: ___________________________________________________________________

3. Description of Gift

Description of the Property being gifted (include any identifying numbers or legal descriptions): ____________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

4. Declaration of Gift

This property is transferred from the donor(s) to the donee(s) as a gift and is accepted by the donee(s), recognizing that this transaction is made without consideration, and is intended to be a gift.

5. Execution

The donor(s) affirm(s) that the property is free of encumbrances, and holds harmless the donee(s) from any future claims made against the gifted property.

Witnessed by:

Witness #1 Name: ___________________________________________________________

Address: ______________________________________________________________________

City, State, Zip: _______________________________________________________________

Telephone: ____________________________________________________________________

Witness #2 Name: ___________________________________________________________

Address: ______________________________________________________________________

City, State, Zip: _______________________________________________________________

Telephone: ____________________________________________________________________

6. Notarization

This document was acknowledged before me on (date) _______________ by the above-named donor(s).

_____________________________________

(Notary Public)

My Commission Expires: ________________

7. Acknowledgement of Receipt by Donee(s)

I/we, the undersigned donee(s), hereby acknowledge the receipt of the above-described property as a gift and affirm acceptance of the gift.

_____________________________________

(Signature of Donee(s))

Date: _________________________________