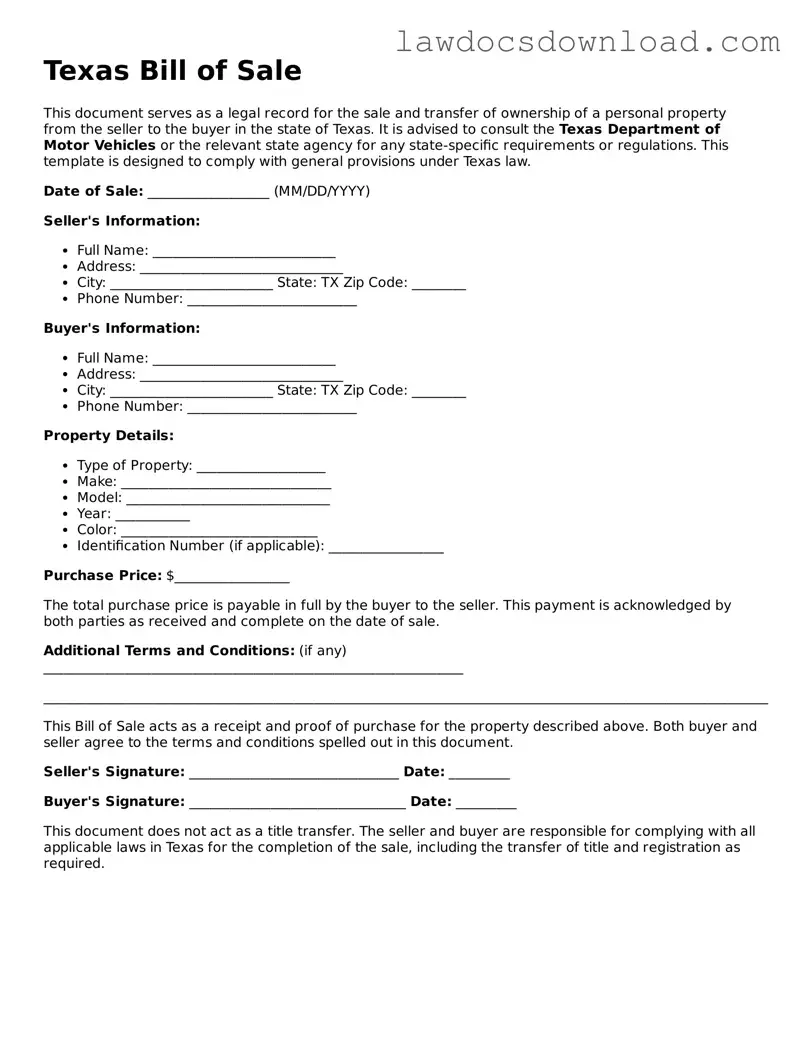

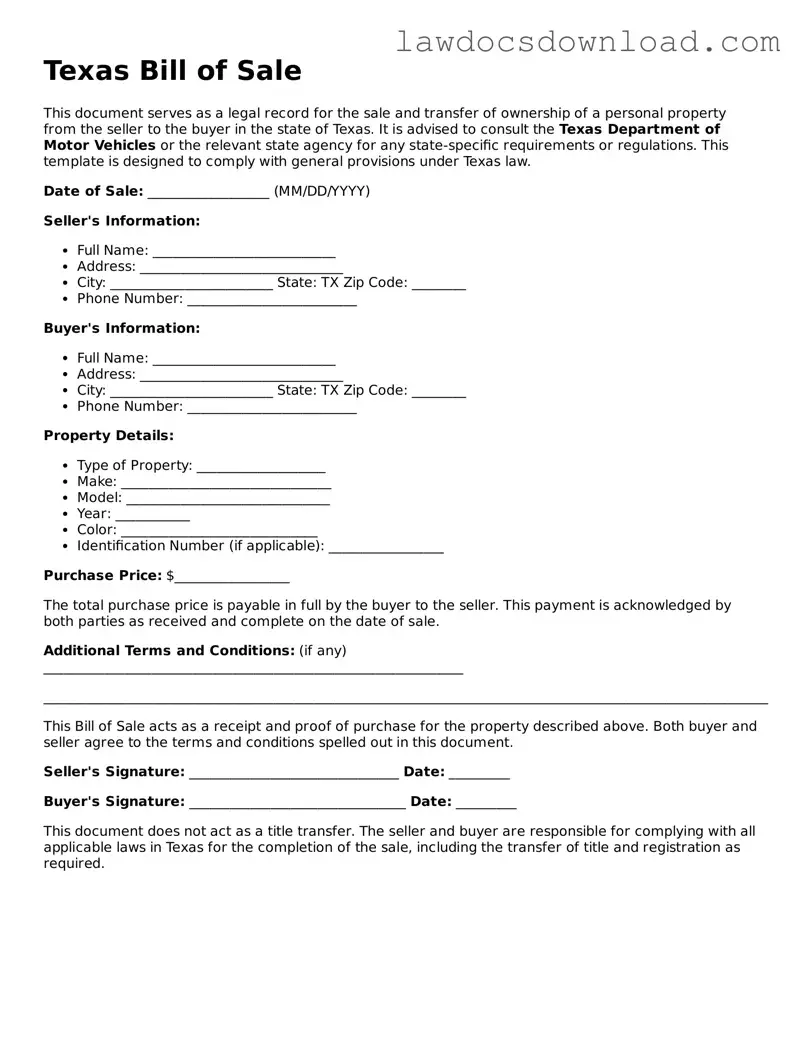

Filling out the Texas Bill of Sale form is a common requirement for various transactions, notably when buying or selling a vehicle or other significant assets in Texas. However, through oversight or misunderstanding, people often make mistakes that can complicate these transactions. One common error is not including all the necessary details about the item being sold. For a vehicle, this would mean forgetting to mention the make, model, year, VIN (Vehicle Identification Number), and accurate mileage. These specifics are critical for the document to hold legal validity and ensure the buyer knows exactly what they are purchasing.

Another frequent misstep involves neglecting to detail the payment information accurately. This includes the sale amount, payment method (e.g., cash, check, wire transfer), and whether the payment is made in full or in installments. If the sale involves payment plans, the schedule of payments should be clearly outlined. Omission of these details can lead to disputes or misunderstandings about the financial terms of the agreement.

Many individuals mistakenly believe they don't need to confirm the buyer's or seller's personal information. It's paramount to verify and include the full legal names, addresses, and contact information of both parties involved in the transaction. This information is not only vital for the validity of the document but also for any future communication that may be necessary if issues arise after the sale.

Failure to specify the condition of the item at the time of sale is another oversight. Whether the item is being sold "as is" or with certain guarantees, this should be clearly stated in the bill of sale. Without this specification, the seller might be held accountable for any issues that were not disclosed at the time of sale.

A common misunderstanding is that the Texas Bill of Sale does not need to be notarized. While not always a legal requirement, having the document notarized can add a layer of protection and authenticity to the transaction. Skipping this step could make the bill of sale less credible in legal situations.

Leaving the date of sale blank or incorrect is a surprisingly frequent issue. The correct date of sale is crucial for both parties to determine the start of any warranty period and to protect against any potential legal claims that may arise after the transaction.

Another mistake is not providing a receipt of sale or proof of transaction. After completing the bill of sale, it’s important to provide copies to both the buyer and the seller. This serves as a receipt and proof of ownership transfer, which is essential for registration and legal purposes.

Inaccuracies or lack of signatures can invalidate the document or delay legal proceedings. Both the buyer and the seller must sign the bill of sale to affirm their agreement to the terms. Neglecting to sign or improperly signing the document can lead to unnecessary complications.

One of the more critical errors people make is not checking the requirements specific to Texas. Depending on the item being sold, there may be additional stipulations or disclosure requirements that are unique to the state. Assuming that a generic bill of sale will suffice can lead to legal and financial repercussions.

Lastly, failing to securely store the bill of sale post-transaction is a mistake that can have long-term implications. This document serves as legal evidence of the sale and ownership transfer. Losing it means losing proof of ownership and rights to the item, which can be particularly problematic in cases of disputes or claims.