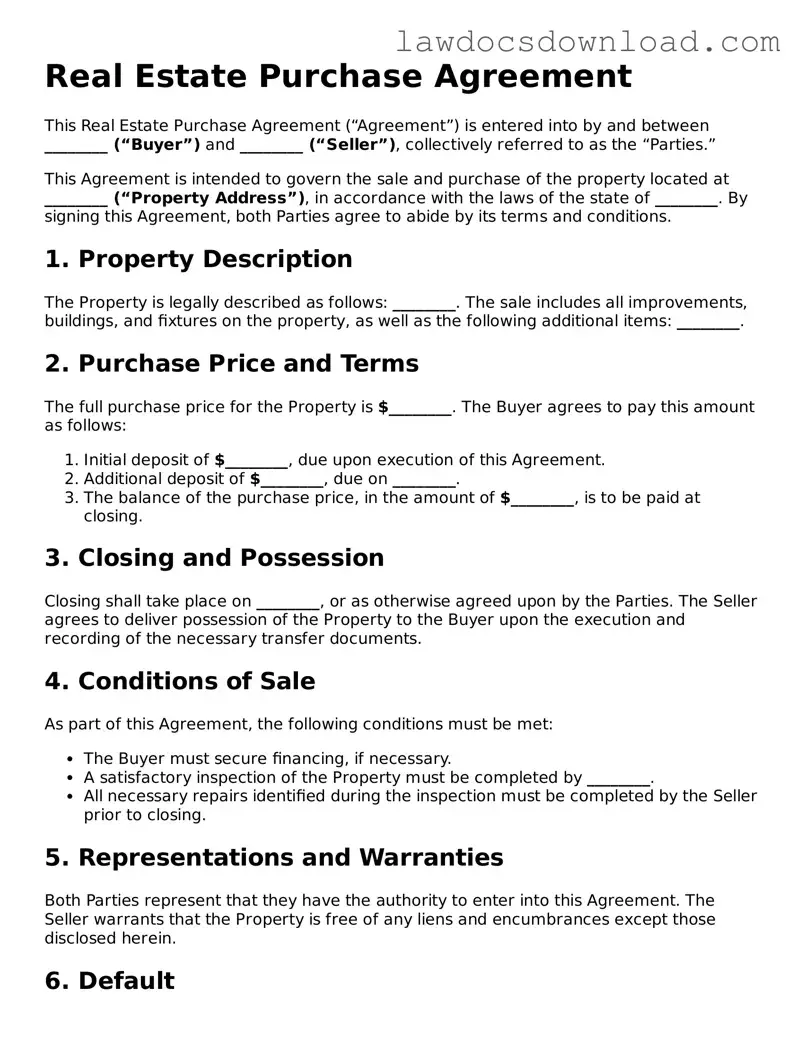

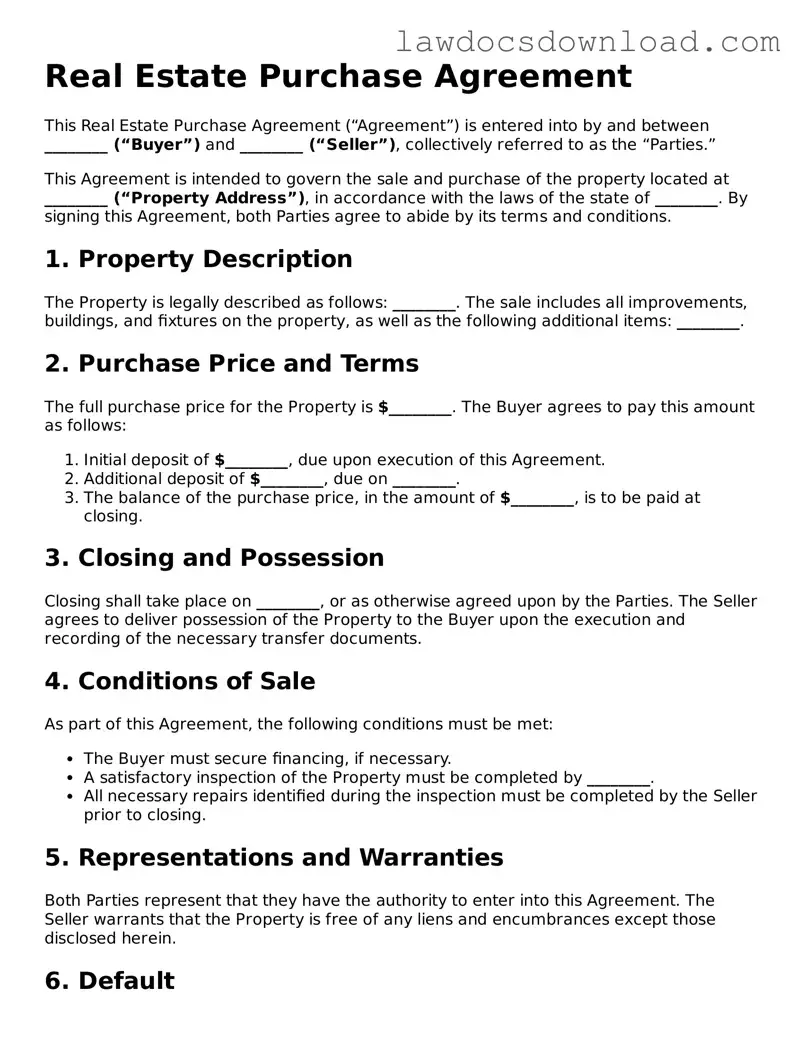

Blank Real Estate Purchase Agreement Template

A Real Estate Purchase Agreement form is a legally binding document between a buyer and a seller outlining the terms and conditions for the sale of a property. This comprehensive form details the agreed-upon purchase price, closing date, and any contingencies that must be met before the sale is finalized. It serves as a blueprint for the transaction, providing both parties with a clear understanding of their obligations and the steps required to complete the sale.

Launch Real Estate Purchase Agreement Editor Here

Blank Real Estate Purchase Agreement Template

Launch Real Estate Purchase Agreement Editor Here

Launch Real Estate Purchase Agreement Editor Here

or

Free Real Estate Purchase Agreement

Get this form done in minutes

Complete your Real Estate Purchase Agreement online and download the final PDF.