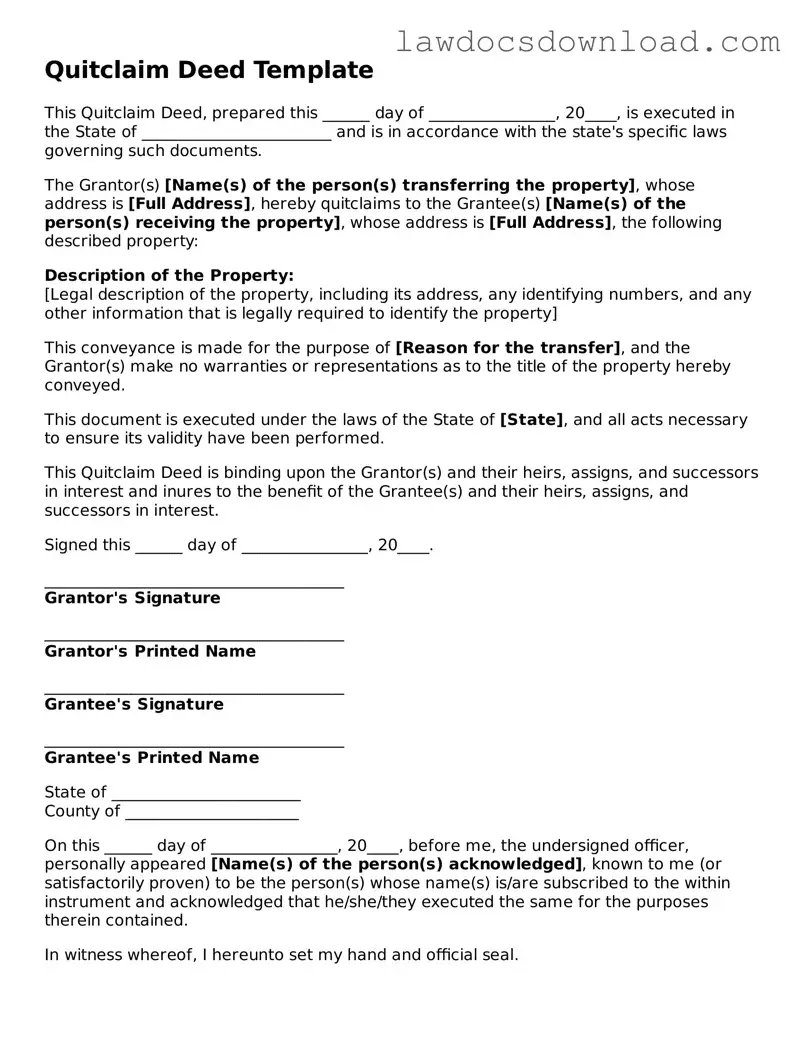

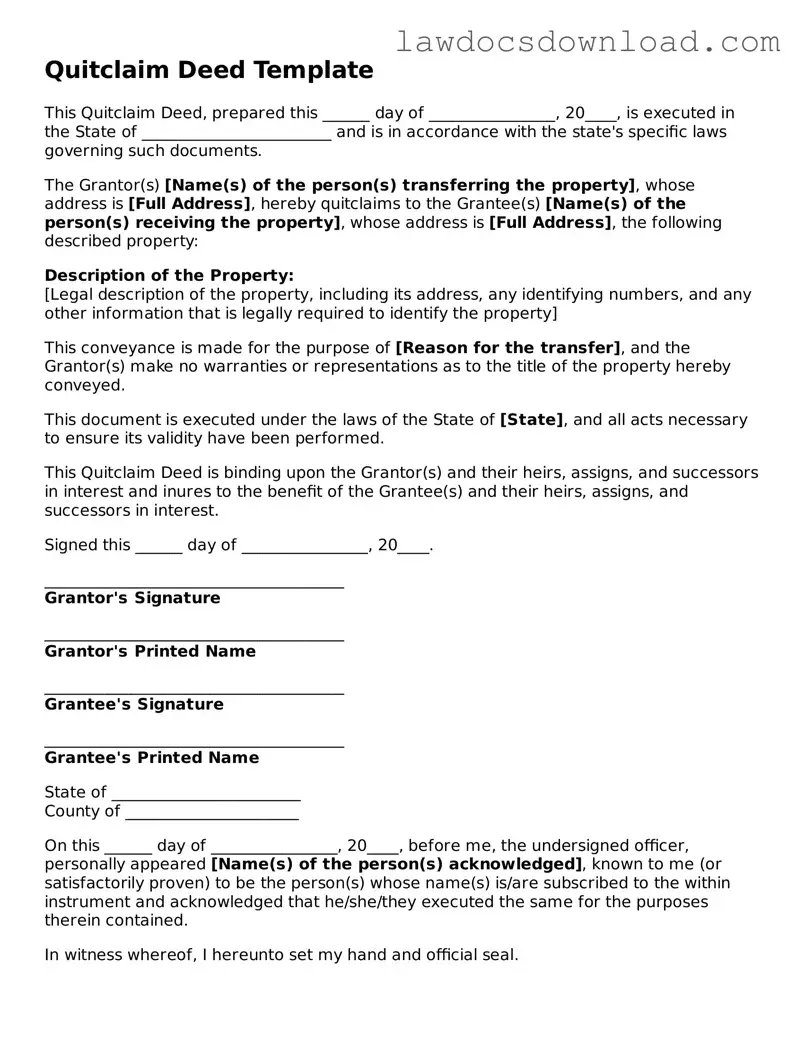

Blank Quitclaim Deed Template

A Quitclaim Deed is a legal document that allows a property owner to transfer their interest in the property to another person without guaranteeing the title's validity. This form is often used between family members or to clear up title issues. It is a straightforward yet powerful tool in property transactions, emphasizing simplicity and trust between the parties involved.

Launch Quitclaim Deed Editor Here

Blank Quitclaim Deed Template

Launch Quitclaim Deed Editor Here

Launch Quitclaim Deed Editor Here

or

Free Quitclaim Deed

Get this form done in minutes

Complete your Quitclaim Deed online and download the final PDF.