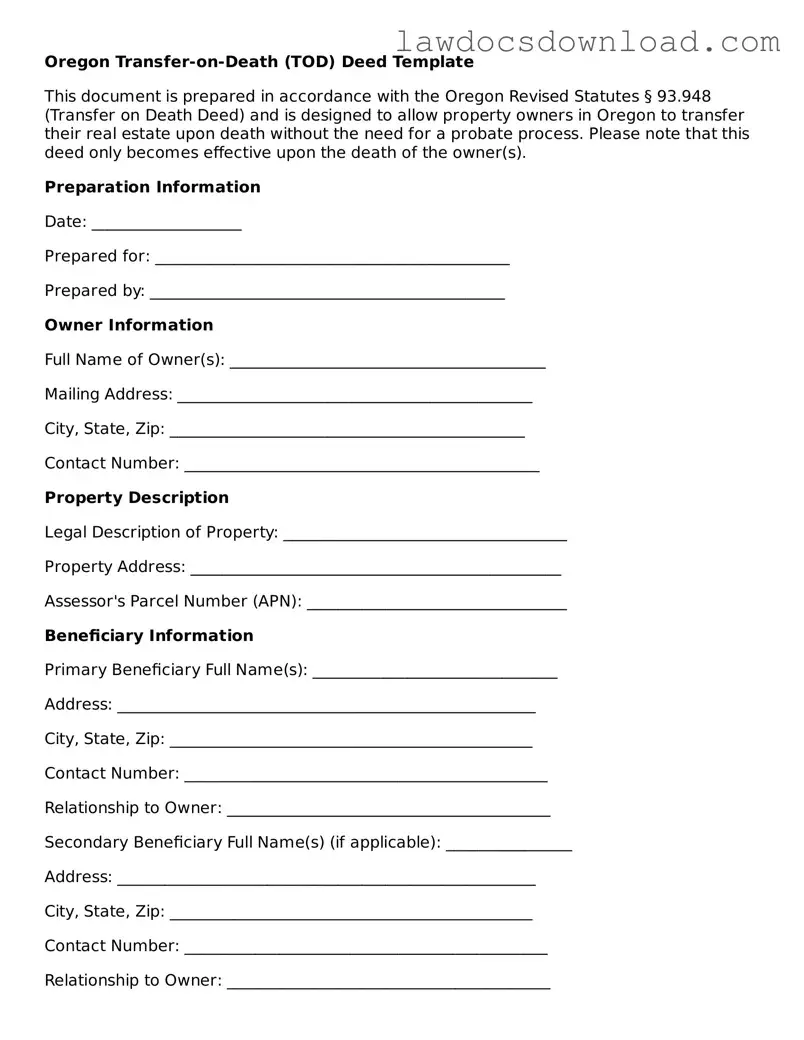

Legal Oregon Transfer-on-Death Deed Form

The Oregon Transfer-on-Death Deed form allows individuals to pass on property to a beneficiary without the need for probate court proceedings after their death. This document is a cost-effective and straightforward way for property owners to ensure their real estate is transferred according to their wishes. By naming a beneficiary, the property owner provides a smooth transition of ownership, bypassing the often lengthy and costly traditional methods.

Launch Transfer-on-Death Deed Editor Here

Legal Oregon Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.