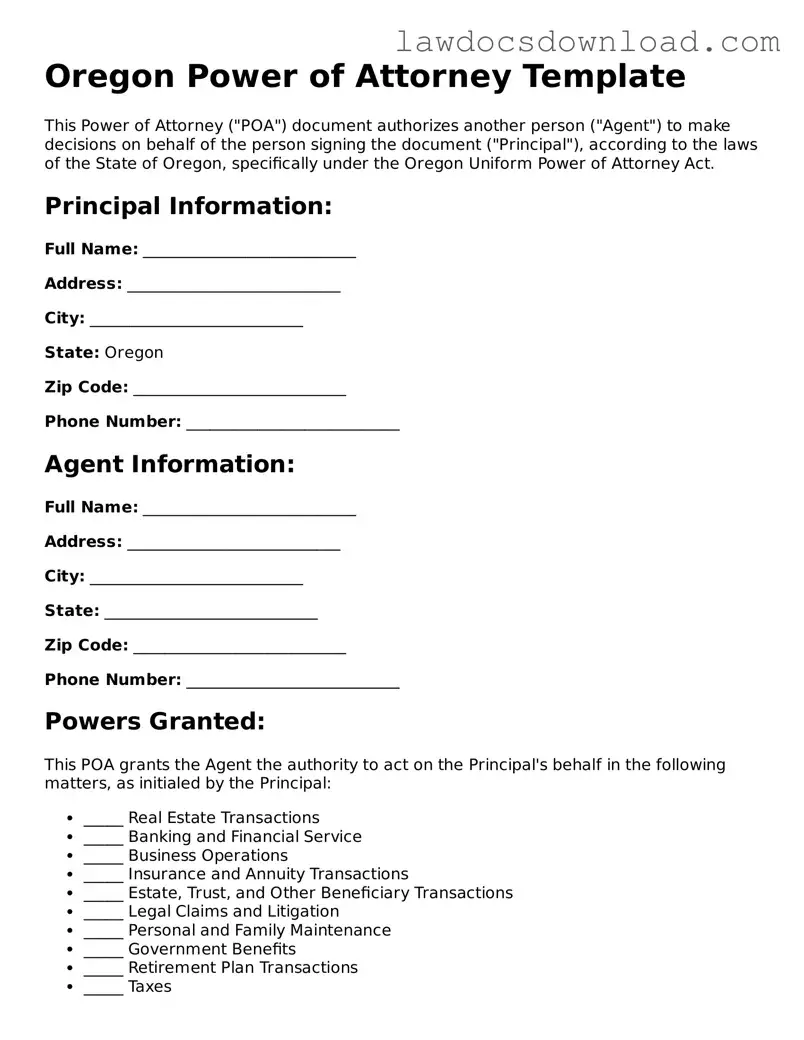

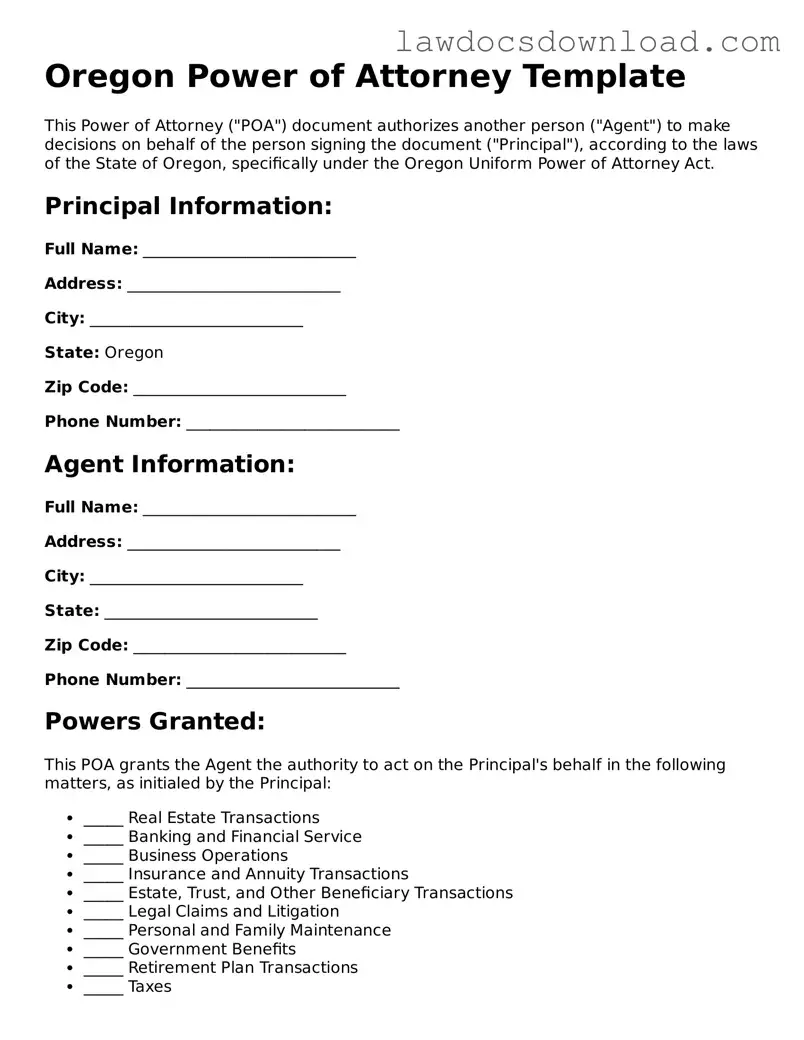

Oregon Power of Attorney Template

This Power of Attorney ("POA") document authorizes another person ("Agent") to make decisions on behalf of the person signing the document ("Principal"), according to the laws of the State of Oregon, specifically under the Oregon Uniform Power of Attorney Act.

Principal Information:

Full Name: ___________________________

Address: ___________________________

City: ___________________________

State: Oregon

Zip Code: ___________________________

Phone Number: ___________________________

Agent Information:

Full Name: ___________________________

Address: ___________________________

City: ___________________________

State: ___________________________

Zip Code: ___________________________

Phone Number: ___________________________

Powers Granted:

This POA grants the Agent the authority to act on the Principal's behalf in the following matters, as initialed by the Principal:

- _____ Real Estate Transactions

- _____ Banking and Financial Service

- _____ Business Operations

- _____ Insurance and Annuity Transactions

- _____ Estate, Trust, and Other Beneficiary Transactions

- _____ Legal Claims and Litigation

- _____ Personal and Family Maintenance

- _____ Government Benefits

- _____ Retirement Plan Transactions

- _____ Taxes

Effective Date and Duration:

This Power of Attorney becomes effective on ________________ and will remain in effect until ________________, unless revoked sooner by the Principal.

Signature:

I, ___________________________ (Principal's Full Name), hereby appoint ___________________________ (Agent's Full Name) as my Attorney-in-Fact to act in my capacity to the extent described above. I affirm that this document is being signed freely and voluntarily, and understand its contents.

______________________________________

Principal’s Signature & Date

______________________________________

Agent's Signature & Date

Witness Statement:

We, the undersigned witnesses, declare that the Principal is personally known to us, appeared to be of sound mind and free of duress or undue influence, and signed this Power of Attorney in our presence.

______________________________________

Witness 1’s Signature & Date

Printed Name: ___________________________

______________________________________

Witness 2’s Signature & Date

Printed Name: ___________________________

Notary Acknowledgment:

This document was acknowledged before me on ___________________________ (date) by ___________________________ (Principal's Name).

Notary Public: ___________________________

Commission Number: ___________________________

My Commission Expires: ___________________________

Disclaimer:

This template provides a basic framework for creating a Power of Attorney in the State of Oregon. It's important to consult with a legal professional to ensure that it meets all necessary legal requirements and accurately reflects the Principal's wishes.