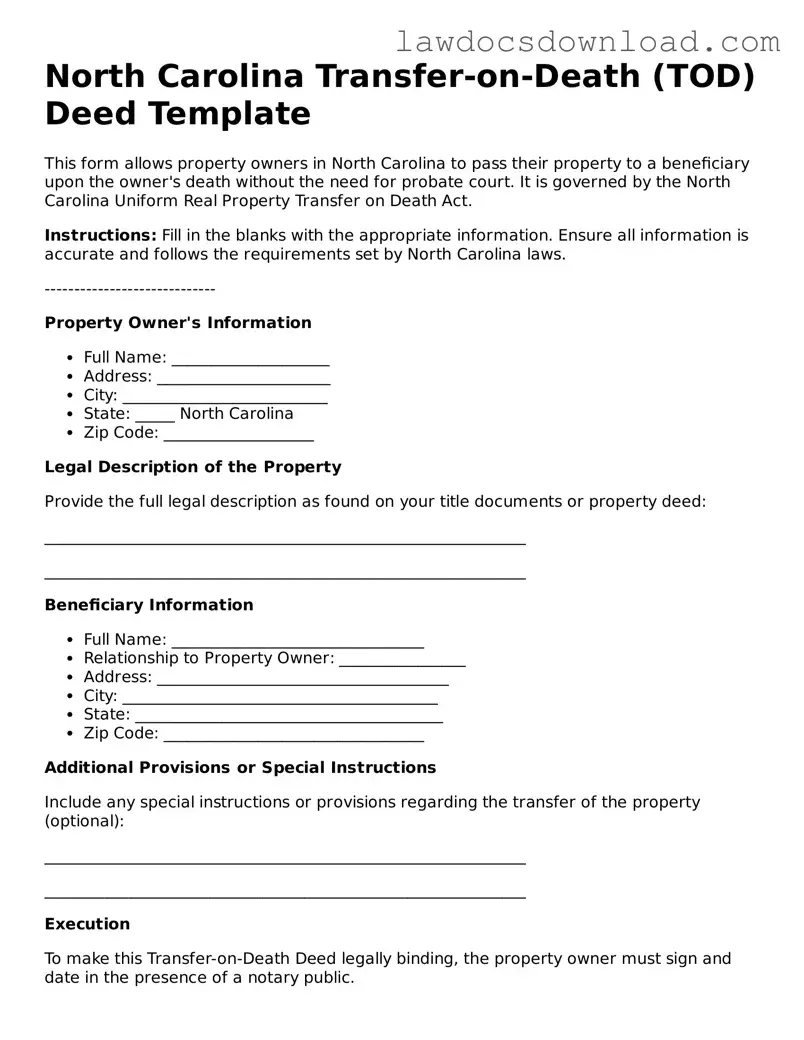

Legal North Carolina Transfer-on-Death Deed Form

A Transfer-on-Death (TOD) Deed form allows property owners in North Carolina to pass real estate to a beneficiary upon their death, bypassing the probate process. This legally binding document ensures a smoother transition of property ownership without the need for court intervention. It's an effective estate planning tool that provides peace of mind and clarity on the future of one's real estate assets.

Launch Transfer-on-Death Deed Editor Here

Legal North Carolina Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.