Filling out the North Carolina Trailer Bill of Sale form can seem straightforward, but several common mistakes can complicate what should be a simple process. Awareness of these pitfalls is the first step towards ensuring that the transaction proceeds smoothly and without unnecessary delay.

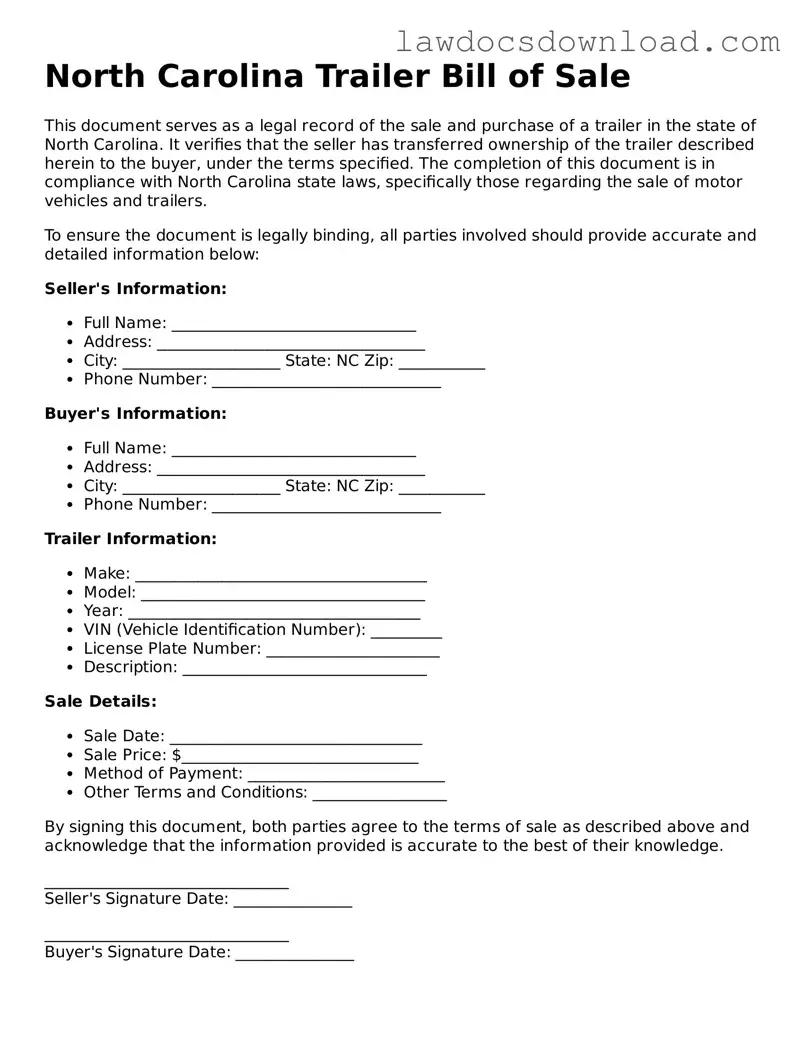

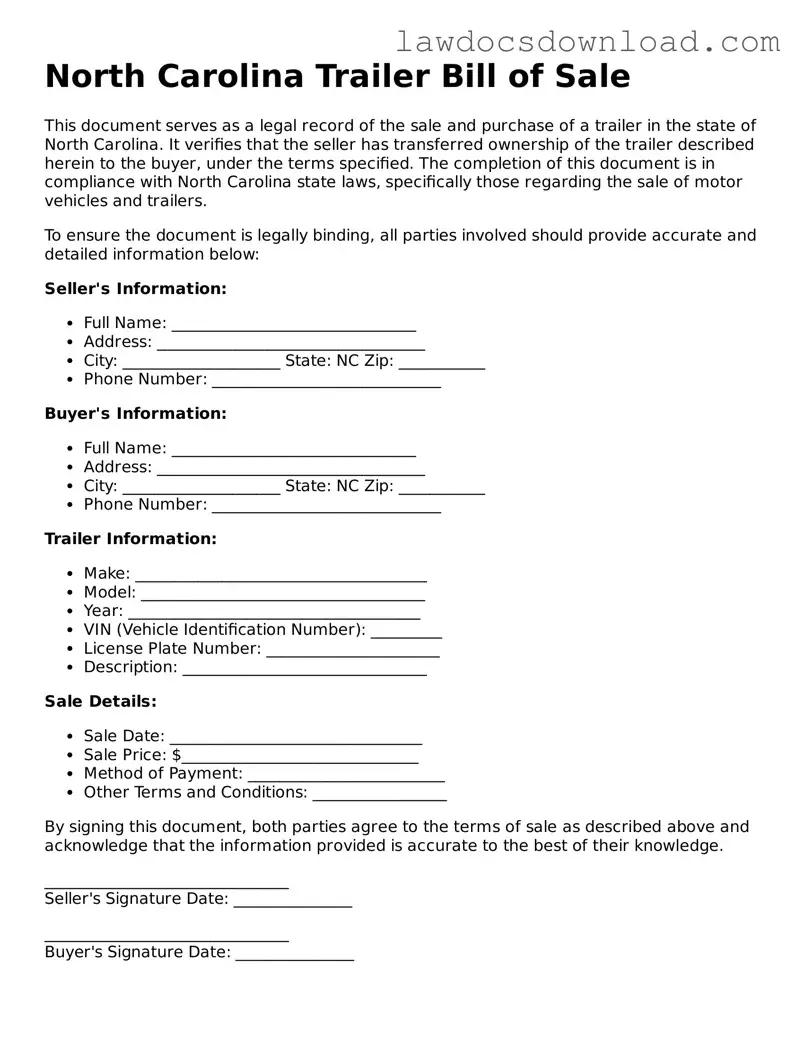

One widely encountered mistake is not thoroughly verifying the information. This involves ensuring that the make, model, and year of the trailer, as well as the Vehicle Identification Number (VIN), are accurately recorded. Even minor errors can lead to significant problems down the line, potentially affecting legal ownership and the registrability of the trailer.

Another mistake lies in neglecting to check the buyer’s or seller’s information for accuracy. The full names and addresses should be clearly and correctly detailed. Inaccuracies here can lead to difficulties in establishing accountability or pursuing legal remedies if disputes arise post-sale.

Often, individuals fail to ensure that the form is signed and dated by both the buyer and the seller. These signatures are crucial as they legalise the document, making the transaction formally binding. Without them, the bill of sale may be considered invalid, rendering it useless in the event of a disagreement or for registration purposes.

Some sellers forget to provide a complete description of the trailer. Besides the basics like make and model, including information about the trailer's condition, any included accessories, and distinguishing features can prevent misunderstandings and protect both parties if the condition of the trailer is contested after the sale.

Omitting the sale price is a surprisingly common error. Clearly stating the sale price in the document is essential for tax purposes and, if necessary, for conflict resolution. Additionally, specifying whether the sale price includes applicable taxes can save both parties significant confusion and potential disputes later on.

A crucial oversight is not retaining a copy of the bill of sale for personal records. Keeping a copy can be invaluable for tax reporting, title transfer, registration purposes, or when legal issues arise. Additionally, it serves as proof of ownership until the new title is issued in the buyer’s name.

Some sellers fail to provide disclosure about the trailer's current liens or encumbrances. This information is critical as it affects the buyer's ability to assume clear ownership. Hidden liens can result in financial and legal complications for the new owner.

Handing over the document too early or too late in the transaction process is another mistake. The bill of sale should ideally be exchanged at the same time as the payment and the trailer itself to ensure all parties have the necessary proof of the transaction's terms and its completion.

Avoiding the issuance of a receipt along with the bill of sale is a minor yet frequent oversight. A receipt is an additional proof of payment that may be required for registration or taxation purposes, offering an extra layer of security for both buyer and seller.

Lastly, not using a notary to witness the signing is a missed opportunity for added legal certainty. While not mandatory, having a notary public witness the bill of sale can lend additional validity and help safeguard against future disputes by certifying the authenticity of the signatures.

By paying close attention to these details, parties involved in the sale of a trailer in North Carolina can avoid common mistakes and ensure a smooth and legally sound transaction.