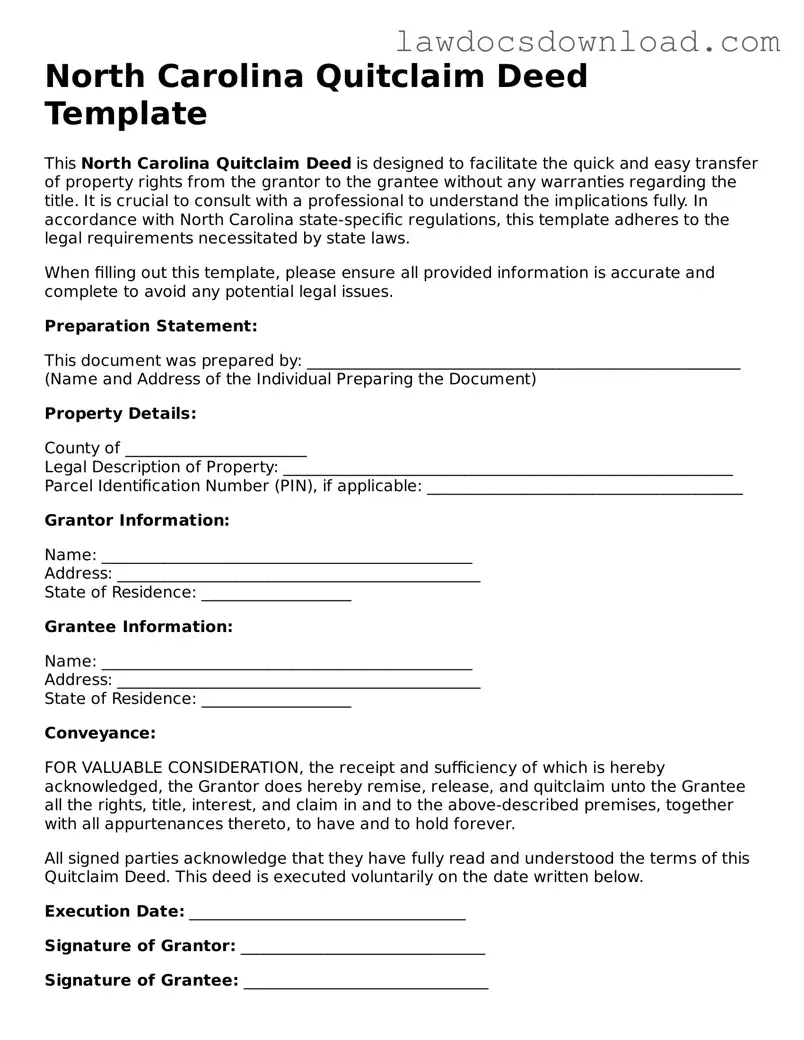

North Carolina Quitclaim Deed Template

This North Carolina Quitclaim Deed is designed to facilitate the quick and easy transfer of property rights from the grantor to the grantee without any warranties regarding the title. It is crucial to consult with a professional to understand the implications fully. In accordance with North Carolina state-specific regulations, this template adheres to the legal requirements necessitated by state laws.

When filling out this template, please ensure all provided information is accurate and complete to avoid any potential legal issues.

Preparation Statement:

This document was prepared by: _______________________________________________________

(Name and Address of the Individual Preparing the Document)

Property Details:

County of _______________________

Legal Description of Property: _________________________________________________________

Parcel Identification Number (PIN), if applicable: ________________________________________

Grantor Information:

Name: _______________________________________________

Address: ______________________________________________

State of Residence: ___________________

Grantee Information:

Name: _______________________________________________

Address: ______________________________________________

State of Residence: ___________________

Conveyance:

FOR VALUABLE CONSIDERATION, the receipt and sufficiency of which is hereby acknowledged, the Grantor does hereby remise, release, and quitclaim unto the Grantee all the rights, title, interest, and claim in and to the above-described premises, together with all appurtenances thereto, to have and to hold forever.

All signed parties acknowledge that they have fully read and understood the terms of this Quitclaim Deed. This deed is executed voluntarily on the date written below.

Execution Date: ___________________________________

Signature of Grantor: _______________________________

Signature of Grantee: _______________________________

Witness Signature (if required): _________________________

Notary Public Acknowledgment:

State of North Carolina

County of _______________________

On this, the ________ day of ____________, 20__, before me, a Notary Public, personally appeared ________________________, known or identified to me to be the Grantor in this Quitclaim Deed, and acknowledged that they executed the same as their voluntary act and deed.

Notary Public: _______________________________________

My commission expires: ________________________________