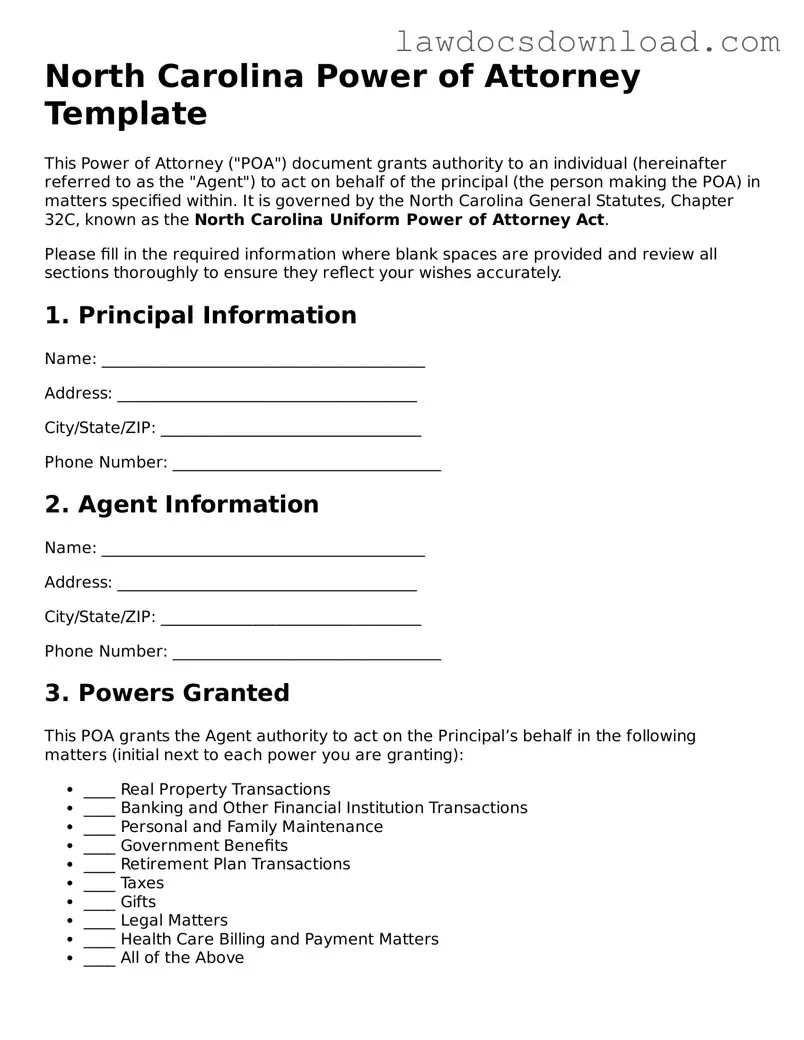

Legal North Carolina Power of Attorney Form

A North Carolina Power of Attorney form allows one person to grant another person the legal authority to make decisions on their behalf. This crucial document can cover financial, medical, and personal affairs, depending on the needs and preferences of the individual. It is essential for those wanting to ensure their matters are handled according to their wishes, especially in unforeseen circumstances.

Launch Power of Attorney Editor Here

Legal North Carolina Power of Attorney Form

Launch Power of Attorney Editor Here

Launch Power of Attorney Editor Here

or

Free Power of Attorney

Get this form done in minutes

Complete your Power of Attorney online and download the final PDF.