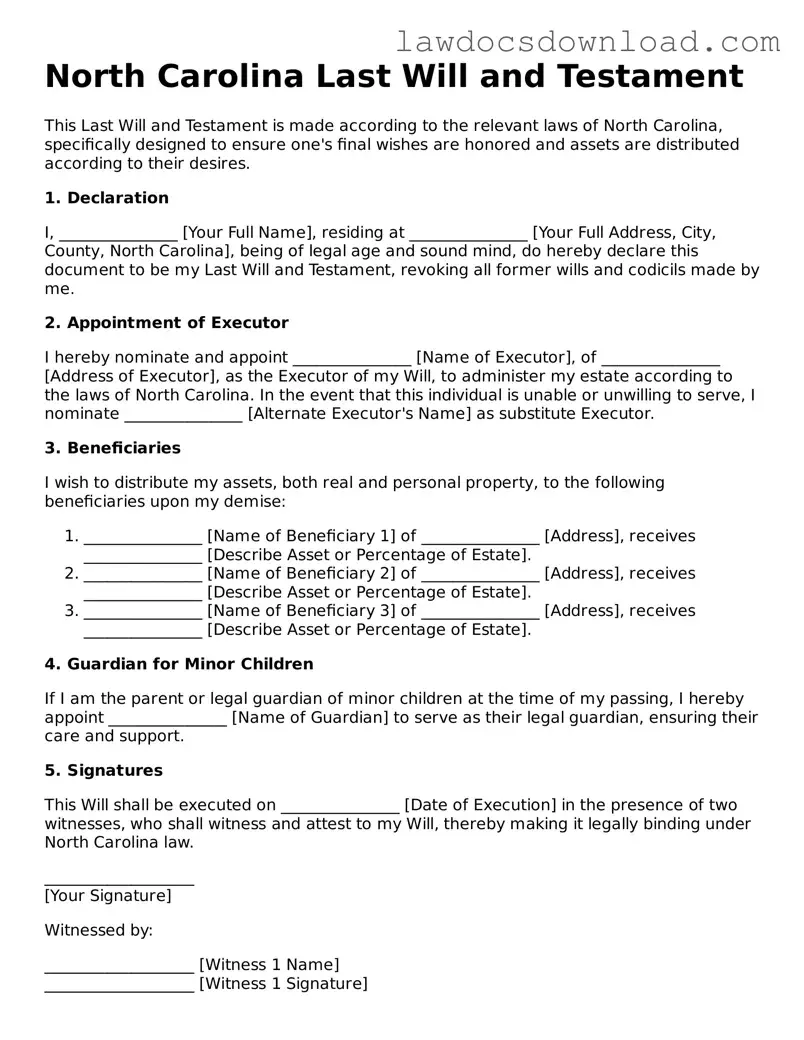

Legal North Carolina Last Will and Testament Form

A North Carolina Last Will and Testament form is a legal document that allows a person to outline how their assets and property should be distributed after their death. It ensures that the person's final wishes are respected and followed through by the appointed executor. This document is crucial for providing peace of mind to both the individual and their loved ones.

Launch Last Will and Testament Editor Here

Legal North Carolina Last Will and Testament Form

Launch Last Will and Testament Editor Here

Launch Last Will and Testament Editor Here

or

Free Last Will and Testament

Get this form done in minutes

Complete your Last Will and Testament online and download the final PDF.