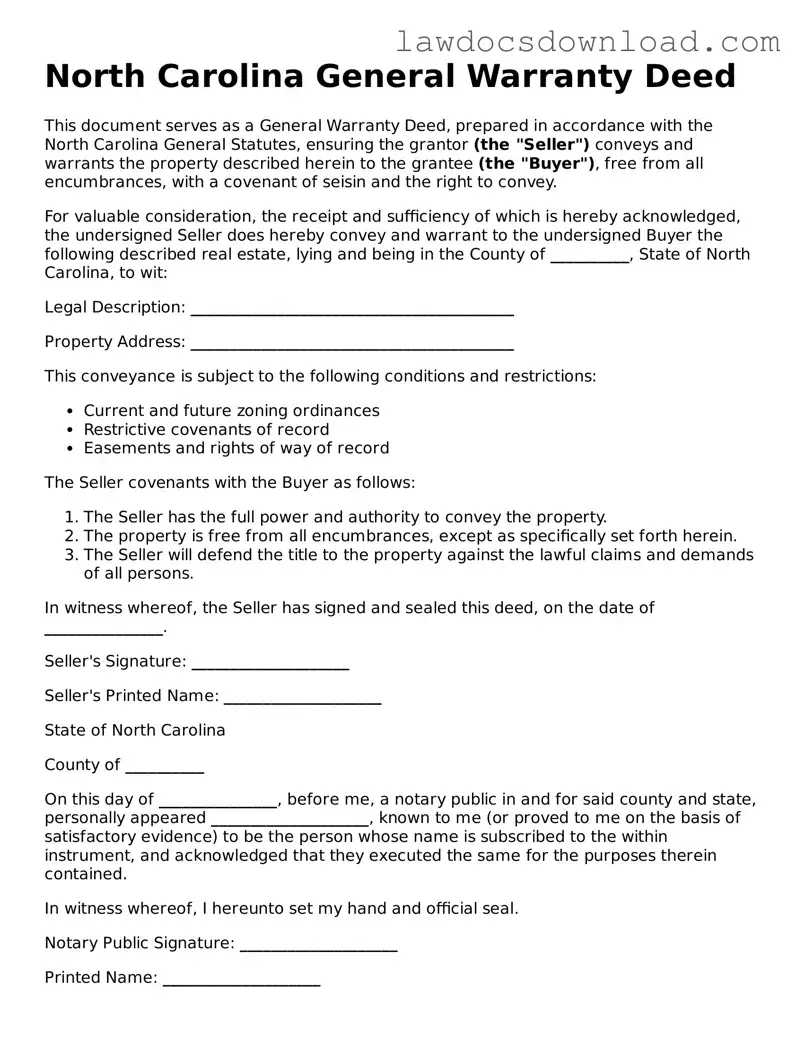

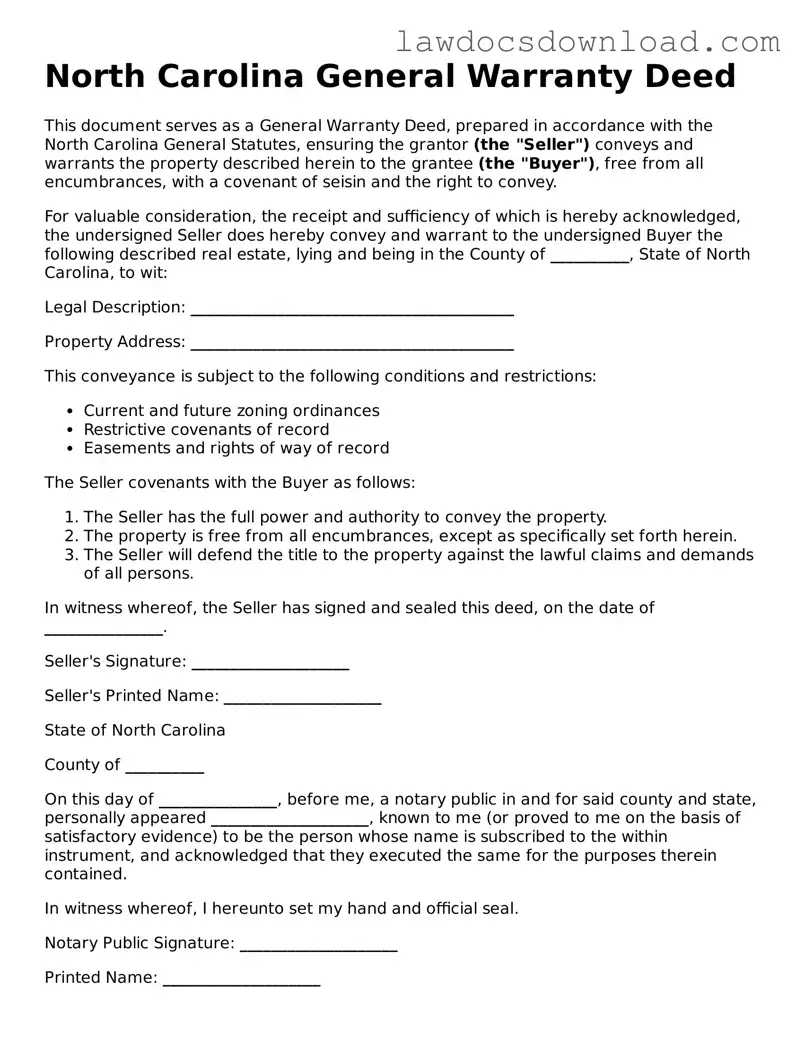

Legal North Carolina Deed Form

A North Carolina Deed form is a legal document used to transfer property ownership from one person to another within the state. This form is an essential tool in real estate transactions, ensuring that the transfer is legally binding and recognized by law. Given its significance, understanding the structure and requirements of this document is paramount for anyone involved in buying or selling property in North Carolina.

Launch Deed Editor Here

Legal North Carolina Deed Form

Launch Deed Editor Here

Launch Deed Editor Here

or

Free Deed

Get this form done in minutes

Complete your Deed online and download the final PDF.