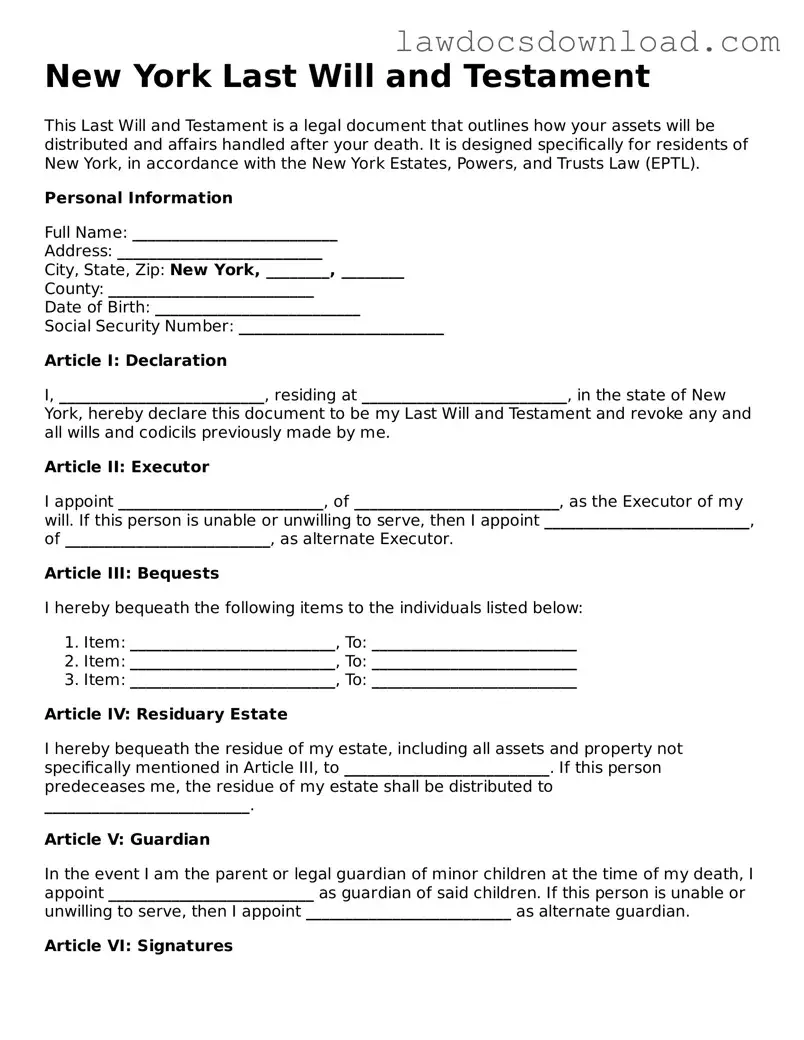

New York Last Will and Testament

This Last Will and Testament is a legal document that outlines how your assets will be distributed and affairs handled after your death. It is designed specifically for residents of New York, in accordance with the New York Estates, Powers, and Trusts Law (EPTL).

Personal Information

Full Name: __________________________

Address: __________________________

City, State, Zip: New York, ________, ________

County: __________________________

Date of Birth: __________________________

Social Security Number: __________________________

Article I: Declaration

I, __________________________, residing at __________________________, in the state of New York, hereby declare this document to be my Last Will and Testament and revoke any and all wills and codicils previously made by me.

Article II: Executor

I appoint __________________________, of __________________________, as the Executor of my will. If this person is unable or unwilling to serve, then I appoint __________________________, of __________________________, as alternate Executor.

Article III: Bequests

I hereby bequeath the following items to the individuals listed below:

- Item: __________________________, To: __________________________

- Item: __________________________, To: __________________________

- Item: __________________________, To: __________________________

Article IV: Residuary Estate

I hereby bequeath the residue of my estate, including all assets and property not specifically mentioned in Article III, to __________________________. If this person predeceases me, the residue of my estate shall be distributed to __________________________.

Article V: Guardian

In the event I am the parent or legal guardian of minor children at the time of my death, I appoint __________________________ as guardian of said children. If this person is unable or unwilling to serve, then I appoint __________________________ as alternate guardian.

Article VI: Signatures

This document shall be executed on the date written below, in the presence of three witnesses, who will in turn sign the document in my presence and in the presence of each other, thus validating the execution of my Last Will and Testament in accordance with New York State law.

Date: __________________________

Signature of Testator: __________________________

Printed Name of Testator: __________________________

Witness Acknowledgement

This Last Will and Testament of __________________________ was signed in our presence. We affirm that the testator, in our presence, declared this to be their Last Will and Testament, and appeared to execute it willingly and under no duress or undue influence. We are of legal age and sound mind, and under no legal constraint.

Witness 1 Signature: __________________________

Printed Name: __________________________

Address: __________________________

Witness 2 Signature: __________________________

Printed Name: __________________________

Address: __________________________

Witness 3 Signature: __________________________

Printed Name: __________________________

Address: __________________________