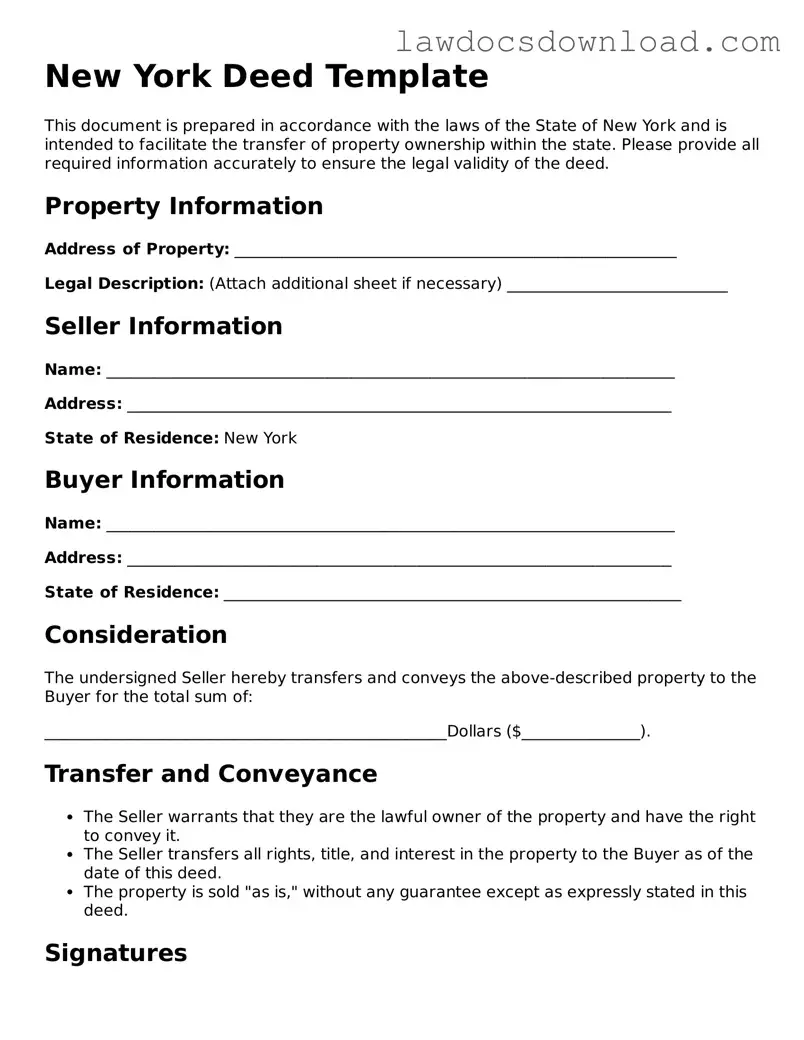

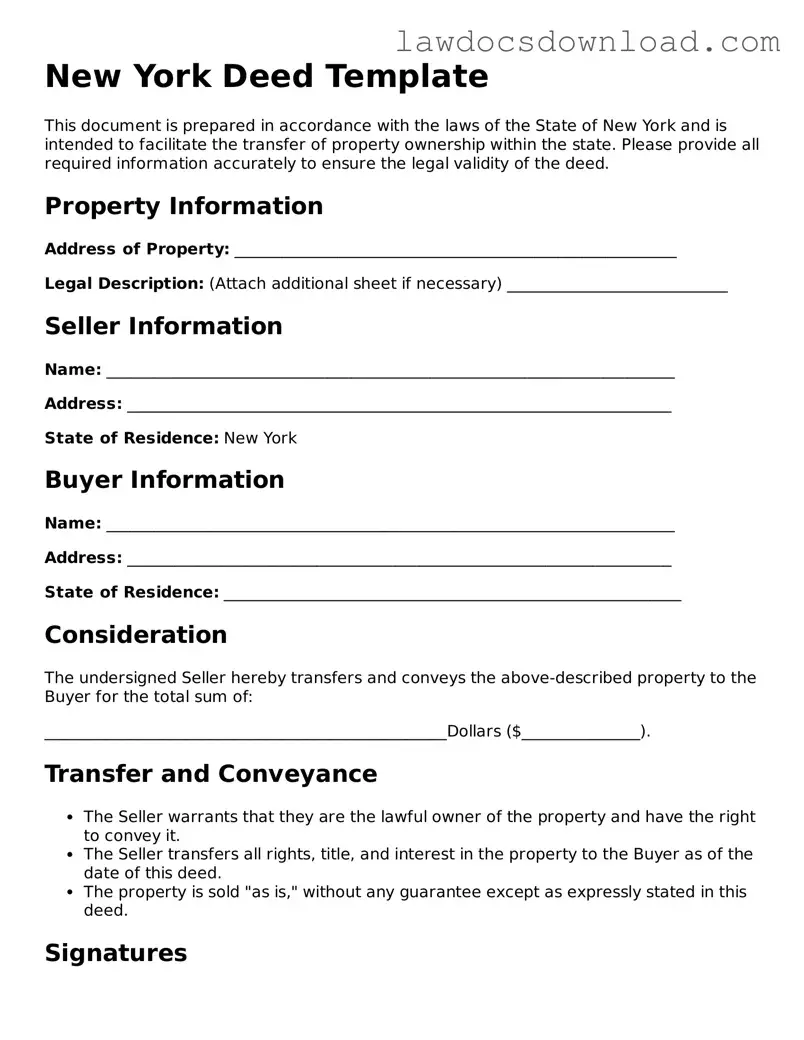

Legal New York Deed Form

A New York Deed form serves as a legal document that transfers real estate ownership from a seller to a buyer. It must contain specific information, such as a description of the property, to be considered valid. Ensuring accuracy and thoroughness in this document is critical for both parties involved in the transaction.

Launch Deed Editor Here

Legal New York Deed Form

Launch Deed Editor Here

Launch Deed Editor Here

or

Free Deed

Get this form done in minutes

Complete your Deed online and download the final PDF.