Filling out a Massachusetts Quitclaim Deed form is a straightforward process, however, it is surprisingly easy for people to make mistakes. These errors can lead to delays, financial losses, or even the invalidation of the deed. Awareness and avoidance of these common pitfalls can significantly smooth the transfer of property rights.

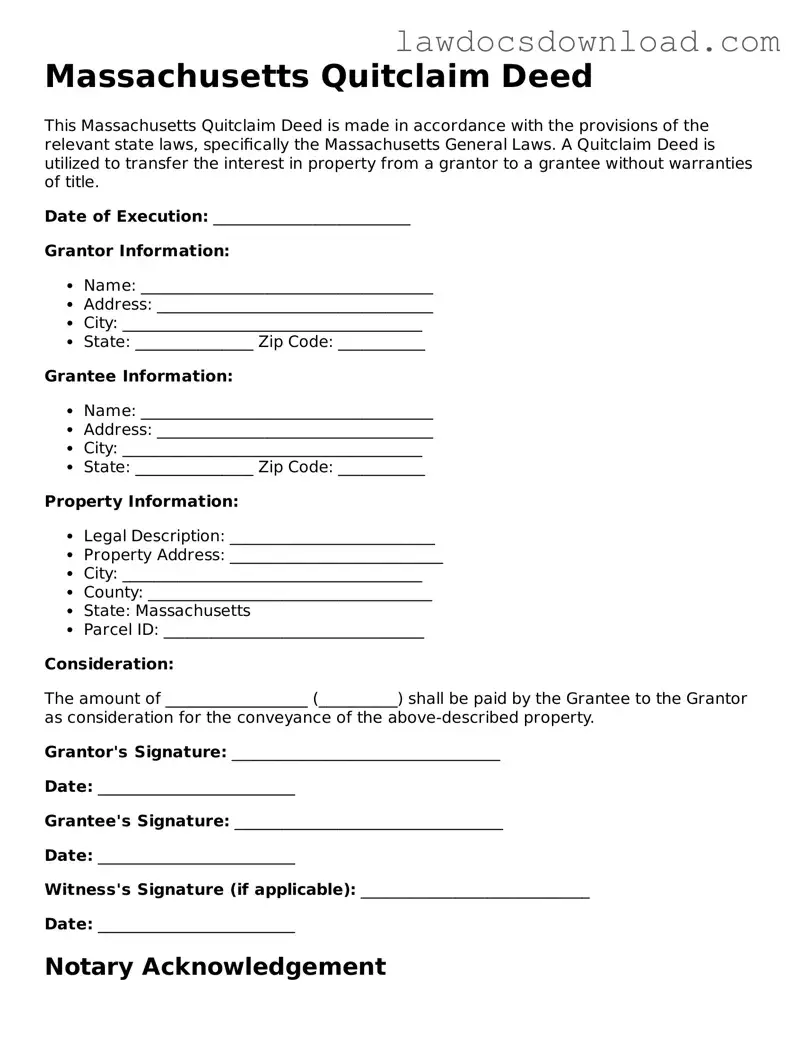

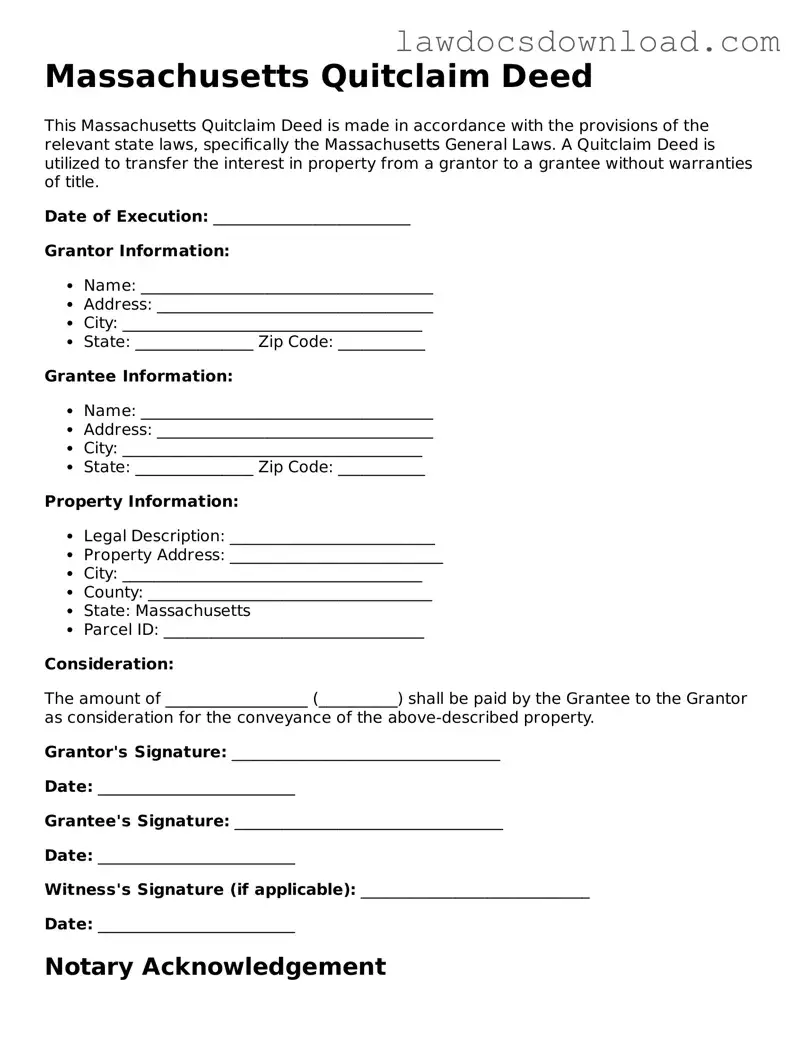

One common mistake is not providing the full, legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). This seemingly small oversight can create confusion about the parties involved, potentially complicating future legal processes. It is crucial that the names match those on the official documents, such as government-issued IDs.

Another frequent error is neglecting to include a complete legal description of the property. This description is not the street address, but rather a detailed account often found in the property's current deed or at the county recorder's office. Without this, it can become challenging to accurately identify the property being transferred.

Incorrectly signing the document is also a significant mistake. In Massachusetts, the law requires the grantor to sign the deed in the presence of a notary public. However, individuals often overlook this requirement, or they might have the deed notarized in a manner that does not comply with state regulations. Such missteps can render the deed void or unenforceable.

Often, individuals fail to specify the type of ownership or tenancy under which the grantee is receiving the property. Whether it is sole ownership, joint tenancy, or tenancy by entirety affects the rights of owners and what happens to the property if an owner passes away. A lack of clarity here can lead to future legal complications.

Another misstep is failing to file the quitclaim deed with the appropriate county registry after it is notarized. This recording is a critical step in making the deed public record, which protects the grantee's interest in the property. Failing to record the deed can result in disputes over property ownership.

Some individuals also misspell names or provide incorrect information regarding the property or parties involved. This can include wrong dates, addresses, or identification numbers. Typos or inaccuracies can invalidate the entire document or necessitate legal action to correct.

It's not uncommon for people to overlook obtaining a release of mortgage from lenders if the property being transferred still has an outstanding mortgage. Without this release, the grantee may unexpectedly become responsible for the remainder of the mortgage, or the transfer may not legally take effect.

Choosing the wrong form is a mistake that can have significant ramifications. Massachusetts has specific requirements for quitclaim deeds. Utilizing a generic form or a deed not tailored to Massachusetts law can result in a document that doesn't legally transfer property rights as intended.

Lastly, overlooking the consideration stated in the deed, even if it is a nominal amount like $1, can cause issues. The consideration, or value exchanged for the property, should be clearly articulated in the deed to meet legal standards and to provide a complete and enforceable document.

Avoiding these common mistakes requires attention to detail and an understanding of Massachusetts law. When in doubt, seeking professional advice can help ensure that the quitclaim deed process is completed correctly and efficiently.