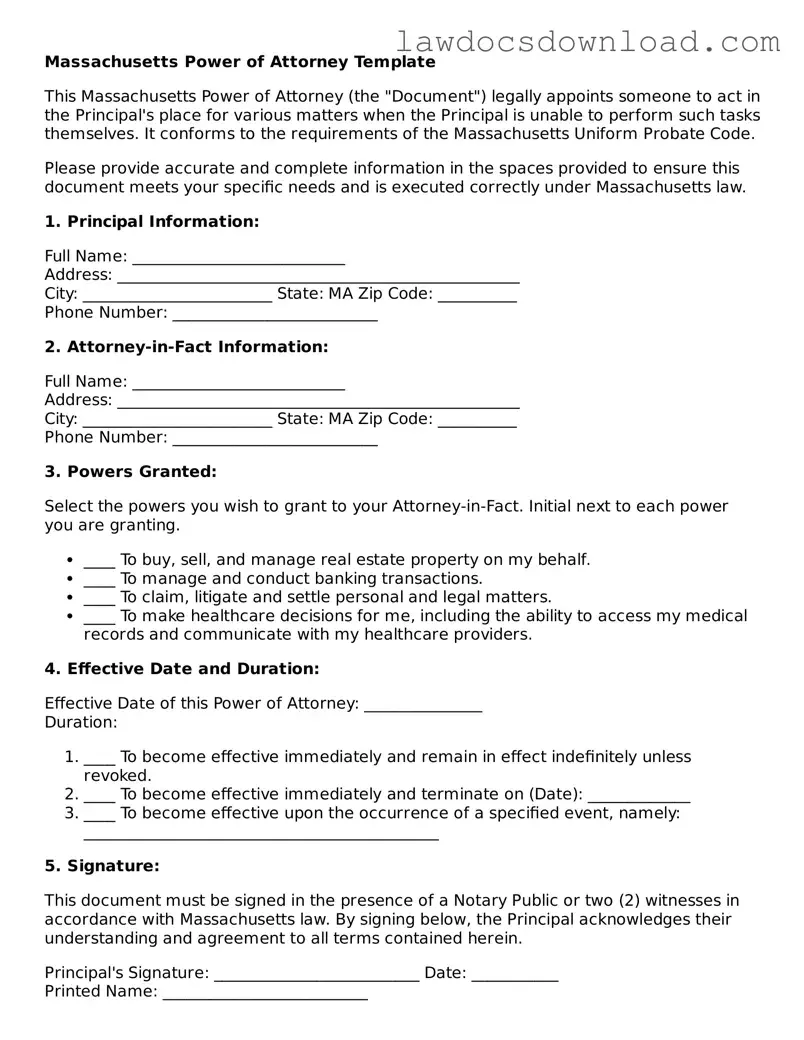

Massachusetts Power of Attorney Template

This Massachusetts Power of Attorney (the "Document") legally appoints someone to act in the Principal's place for various matters when the Principal is unable to perform such tasks themselves. It conforms to the requirements of the Massachusetts Uniform Probate Code.

Please provide accurate and complete information in the spaces provided to ensure this document meets your specific needs and is executed correctly under Massachusetts law.

1. Principal Information:

Full Name: ___________________________

Address: ___________________________________________________

City: ________________________ State: MA Zip Code: __________

Phone Number: __________________________

2. Attorney-in-Fact Information:

Full Name: ___________________________

Address: ___________________________________________________

City: ________________________ State: MA Zip Code: __________

Phone Number: __________________________

3. Powers Granted:

Select the powers you wish to grant to your Attorney-in-Fact. Initial next to each power you are granting.

- ____ To buy, sell, and manage real estate property on my behalf.

- ____ To manage and conduct banking transactions.

- ____ To claim, litigate and settle personal and legal matters.

- ____ To make healthcare decisions for me, including the ability to access my medical records and communicate with my healthcare providers.

4. Effective Date and Duration:

Effective Date of this Power of Attorney: _______________

Duration:

- ____ To become effective immediately and remain in effect indefinitely unless revoked.

- ____ To become effective immediately and terminate on (Date): _____________

- ____ To become effective upon the occurrence of a specified event, namely: _____________________________________________

5. Signature:

This document must be signed in the presence of a Notary Public or two (2) witnesses in accordance with Massachusetts law. By signing below, the Principal acknowledges their understanding and agreement to all terms contained herein.

Principal's Signature: __________________________ Date: ___________

Printed Name: __________________________

Attorney-in-Fact's Signature: __________________________ Date: ___________

Printed Name: __________________________

Notarization (if applicable):

This section should be completed by a Notary Public if required by the circumstances.

State of Massachusetts)

County of __________________)

On this ___ day of ___________, 20__, before me, the undersigned notary public, personally appeared _______________________ (Principal) and _______________________ (Attorney-in-Fact), known to me (or satisfactorily proven) to be the persons whose names are signed to the foregoing instrument and acknowledged that they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

Notary Public: __________________________

My Commission Expires: _______________