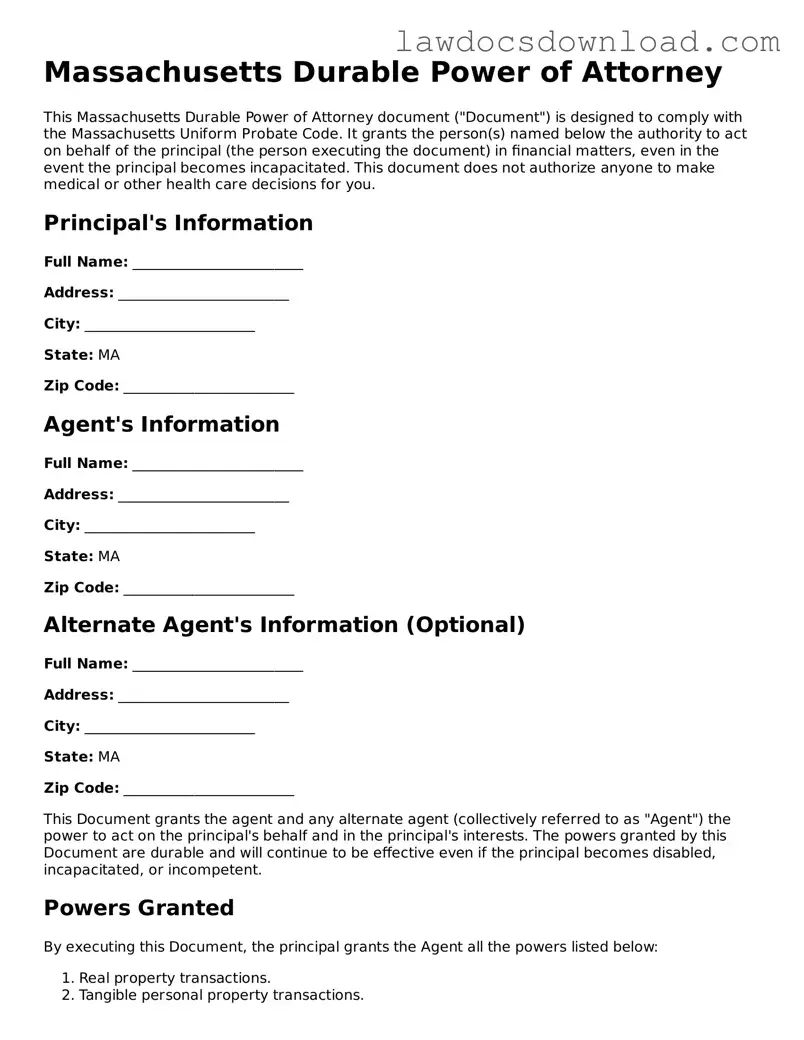

Massachusetts Durable Power of Attorney

This Massachusetts Durable Power of Attorney document ("Document") is designed to comply with the Massachusetts Uniform Probate Code. It grants the person(s) named below the authority to act on behalf of the principal (the person executing the document) in financial matters, even in the event the principal becomes incapacitated. This document does not authorize anyone to make medical or other health care decisions for you.

Principal's Information

Full Name: ________________________

Address: ________________________

City: ________________________

State: MA

Zip Code: ________________________

Agent's Information

Full Name: ________________________

Address: ________________________

City: ________________________

State: MA

Zip Code: ________________________

Alternate Agent's Information (Optional)

Full Name: ________________________

Address: ________________________

City: ________________________

State: MA

Zip Code: ________________________

This Document grants the agent and any alternate agent (collectively referred to as "Agent") the power to act on the principal's behalf and in the principal's interests. The powers granted by this Document are durable and will continue to be effective even if the principal becomes disabled, incapacitated, or incompetent.

Powers Granted

By executing this Document, the principal grants the Agent all the powers listed below:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

The above powers are granted subject to any specifications and limitations detailed below:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Execution

This Document must be signed in front of a notary public and in the presence of two witnesses, neither of whom is the agent. All parties, including the principal, the agent, and the witnesses, must be present during the signing.

Principal's Signature

Date: ________________________

Signature: ________________________

Agent's Acknowledgment

I, ________________________ (Agent), affirm that I understand and accept the responsibility of acting as the principal's agent. I agree to act in accordance with the principal's expectations to the best of my knowledge and ability and in the principal's best interests.

Date: ________________________

Signature: ________________________

Alternate Agent's Acknowledgment (If Applicable)

I, ________________________ (Alternate Agent), affirm that I understand and accept the responsibility of acting as the principal's alternate agent. I agree to act in accordance with the principal's expectations to the best of my knowledge and ability and in the principal's best interests.

Date: ________________________

Signature: ________________________

Witnesses

The undersigned witnesses affirm that the principal appeared to be of sound mind and free from duress at the time this Document was signed, and that they are not named as an agent or alternate agent in this Document.

Witness 1:

Date: ________________________

Signature: ________________________

Witness 2:

Date: ________________________

Signature: ________________________

Notary Public

This Document was acknowledged before me on (date) ________________________, by the principal, ________________________.

State of Massachusetts

County of ________________________

Date: ________________________

Signature of Notary Public: ________________________

Seal: