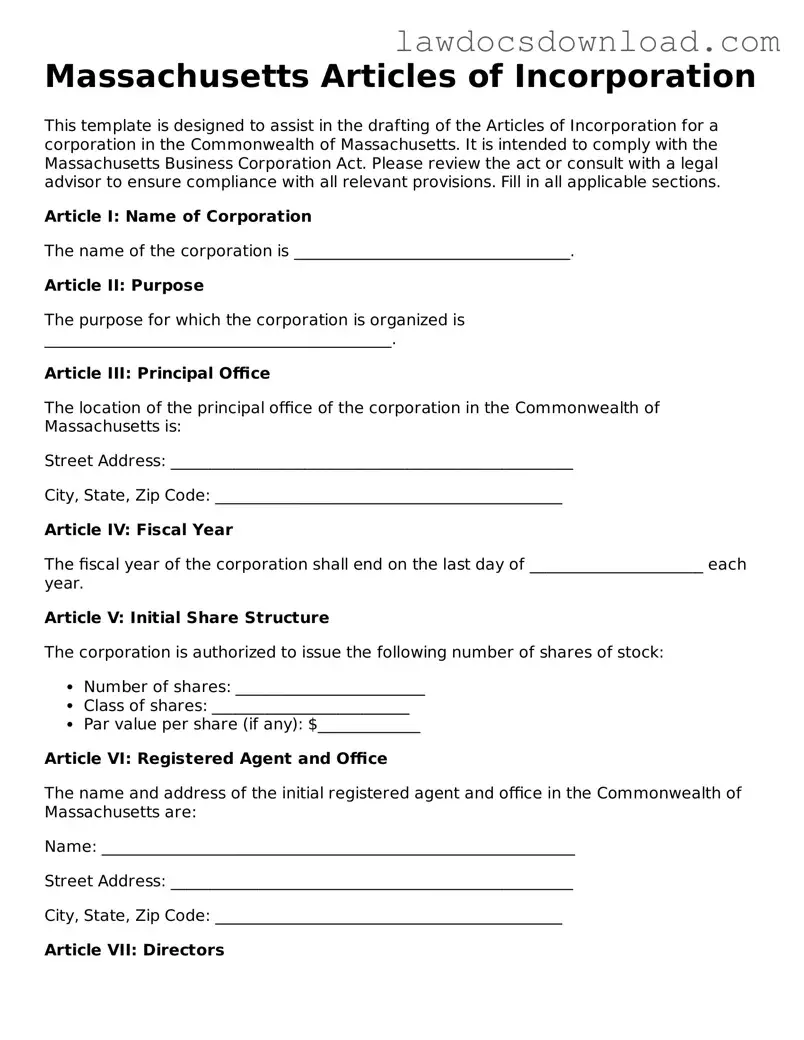

Massachusetts Articles of Incorporation

This template is designed to assist in the drafting of the Articles of Incorporation for a corporation in the Commonwealth of Massachusetts. It is intended to comply with the Massachusetts Business Corporation Act. Please review the act or consult with a legal advisor to ensure compliance with all relevant provisions. Fill in all applicable sections.

Article I: Name of Corporation

The name of the corporation is ___________________________________.

Article II: Purpose

The purpose for which the corporation is organized is ____________________________________________.

Article III: Principal Office

The location of the principal office of the corporation in the Commonwealth of Massachusetts is:

Street Address: ___________________________________________________

City, State, Zip Code: ____________________________________________

Article IV: Fiscal Year

The fiscal year of the corporation shall end on the last day of ______________________ each year.

Article V: Initial Share Structure

The corporation is authorized to issue the following number of shares of stock:

- Number of shares: ________________________

- Class of shares: _________________________

- Par value per share (if any): $_____________

Article VI: Registered Agent and Office

The name and address of the initial registered agent and office in the Commonwealth of Massachusetts are:

Name: ____________________________________________________________

Street Address: ___________________________________________________

City, State, Zip Code: ____________________________________________

Article VII: Directors

The number of directors constituting the initial Board of Directors of the corporation and the names and addresses of the persons who are to serve as directors until their successors are elected and qualify are:

- Name: _______________________________, Address: _________________________________________

- Name: _______________________________, Address: _________________________________________

- Name: _______________________________, Address: _________________________________________

Article VIII: Incorporator

The name and address of the incorporator are as follows:

Name: ____________________________________________________________

Address: _________________________________________________________

Article IX: Indemnification

The corporation shall indemnify its directors, officers, employees, and agents to the fullest extent permitted by the Massachusetts Business Corporation Act, as it may be amended from time to time.

Signature and Acknowledgment

In witness whereof, the undersigned incorporator has executed these Articles of Incorporation on this ___ day of ___________, 20___.

_______________________________________

Signature of Incorporator

Printed Name: ___________________________