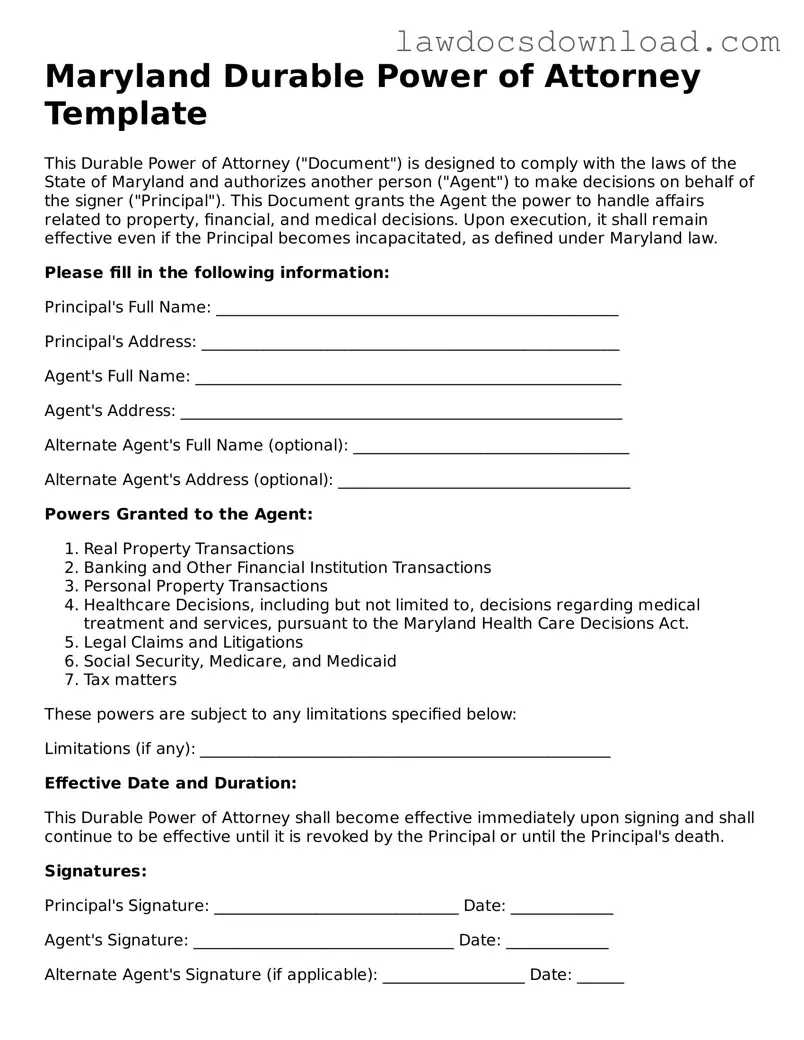

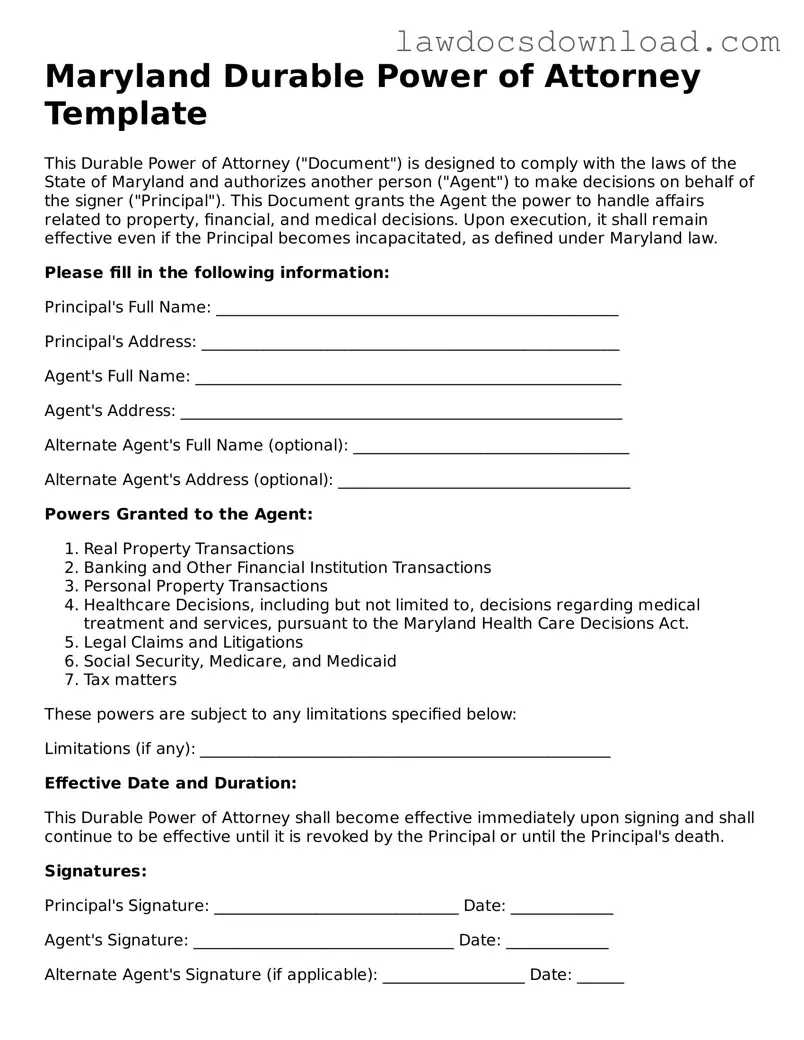

Legal Maryland Durable Power of Attorney Form

A Maryland Durable Power of Attorney form allows an individual to appoint someone they trust to manage their financial affairs. This form remains in effect even if the person who created it, known as the principal, becomes incapacitated. It's a critical document for anyone seeking to ensure their affairs are handled according to their wishes, regardless of what the future holds.

Launch Durable Power of Attorney Editor Here

Legal Maryland Durable Power of Attorney Form

Launch Durable Power of Attorney Editor Here

Launch Durable Power of Attorney Editor Here

or

Free Durable Power of Attorney

Get this form done in minutes

Complete your Durable Power of Attorney online and download the final PDF.