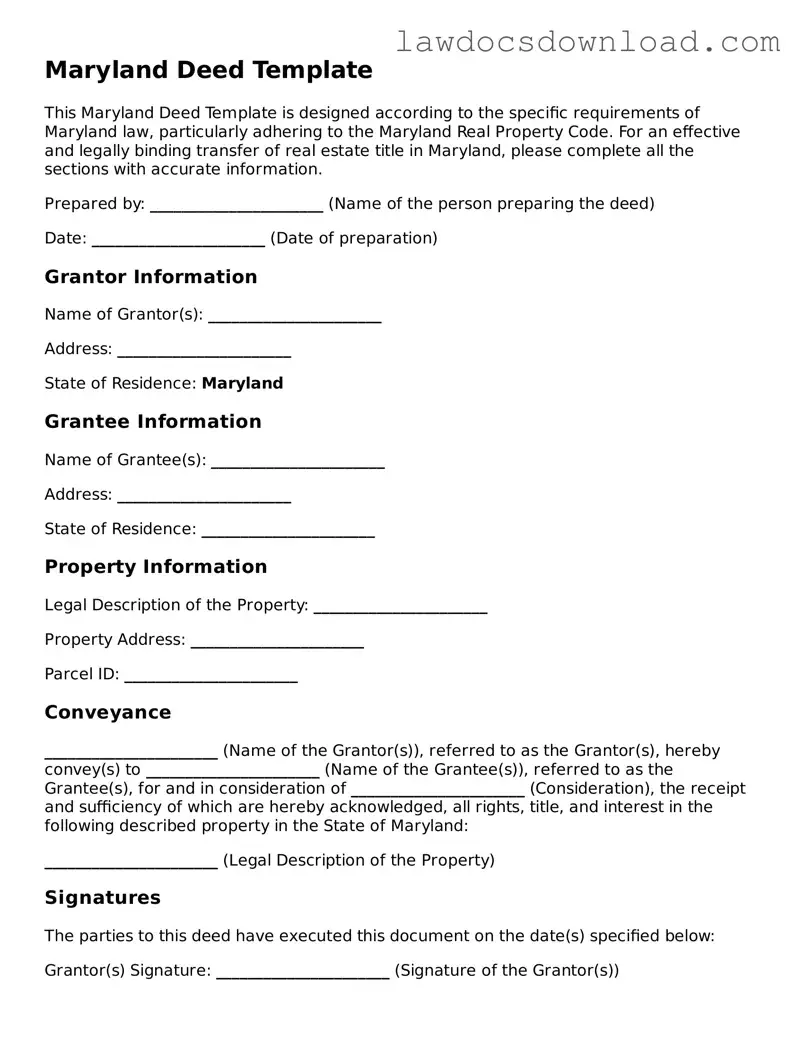

Legal Maryland Deed Form

A Maryland Deed form is a legal document used to transfer property ownership from one person to another. It outlines the details of the property, the identities of the old and new owners, and any conditions or warranties associated with the transfer. This document is essential for the legal process of buying or selling real estate in Maryland.

Launch Deed Editor Here

Legal Maryland Deed Form

Launch Deed Editor Here

Launch Deed Editor Here

or

Free Deed

Get this form done in minutes

Complete your Deed online and download the final PDF.