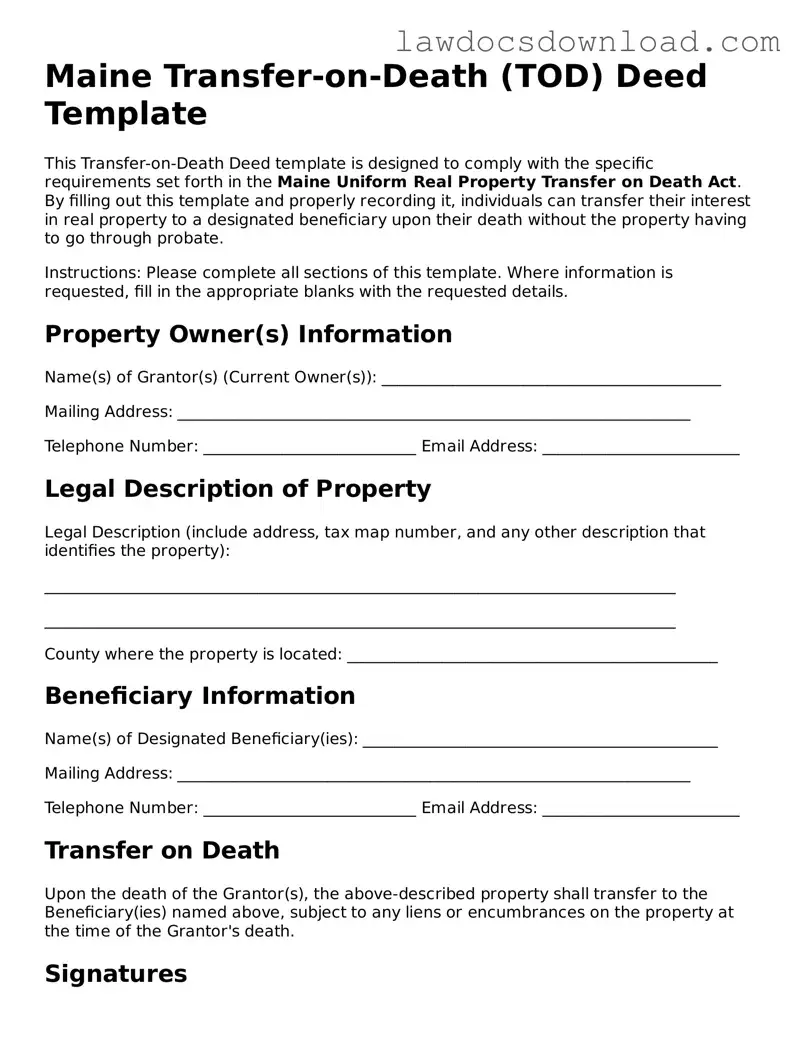

Legal Maine Transfer-on-Death Deed Form

A Maine Transfer-on-Death Deed form is a legal document that allows property owners to pass on their real estate to a beneficiary without going through the probate process. This deed becomes effective upon the death of the owner, making the transition of property ownership smooth and straightforward. It's a valuable tool for estate planning, ensuring that your assets are distributed according to your wishes with minimal hassle.

Launch Transfer-on-Death Deed Editor Here

Legal Maine Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.