When completing the Maine Bill of Sale form, many individuals often overlook the importance of accuracy and detail, leading to common errors that can have significant implications. One major mistake is not providing complete details about the item being sold, such as its make, model, year, and serial number for vehicles or boats. This omission can cause confusion and disputes regarding the item's condition or authenticity at the time of sale.

Another frequent error involves failing to verify the identities of both the buyer and the seller. Proper identification is crucial to ensure the legality of the transaction and to protect against fraud. This means that both parties should check and confirm each other's identification (such as a driver's license or state ID) and include this information in the form.

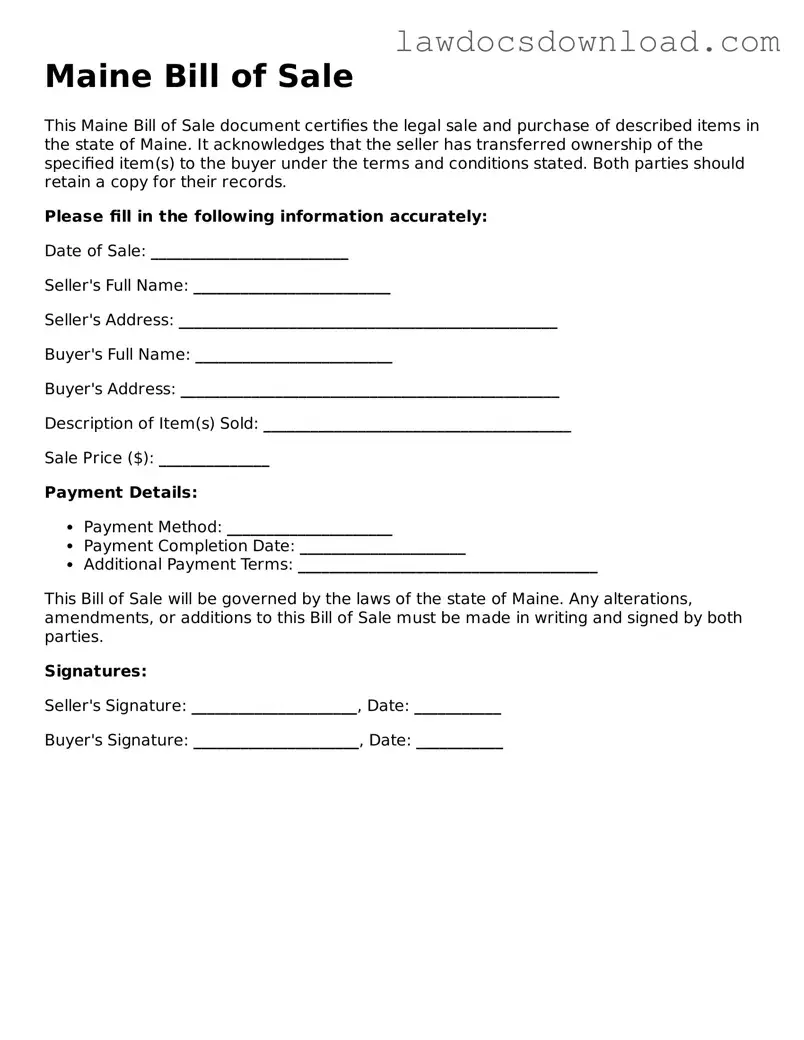

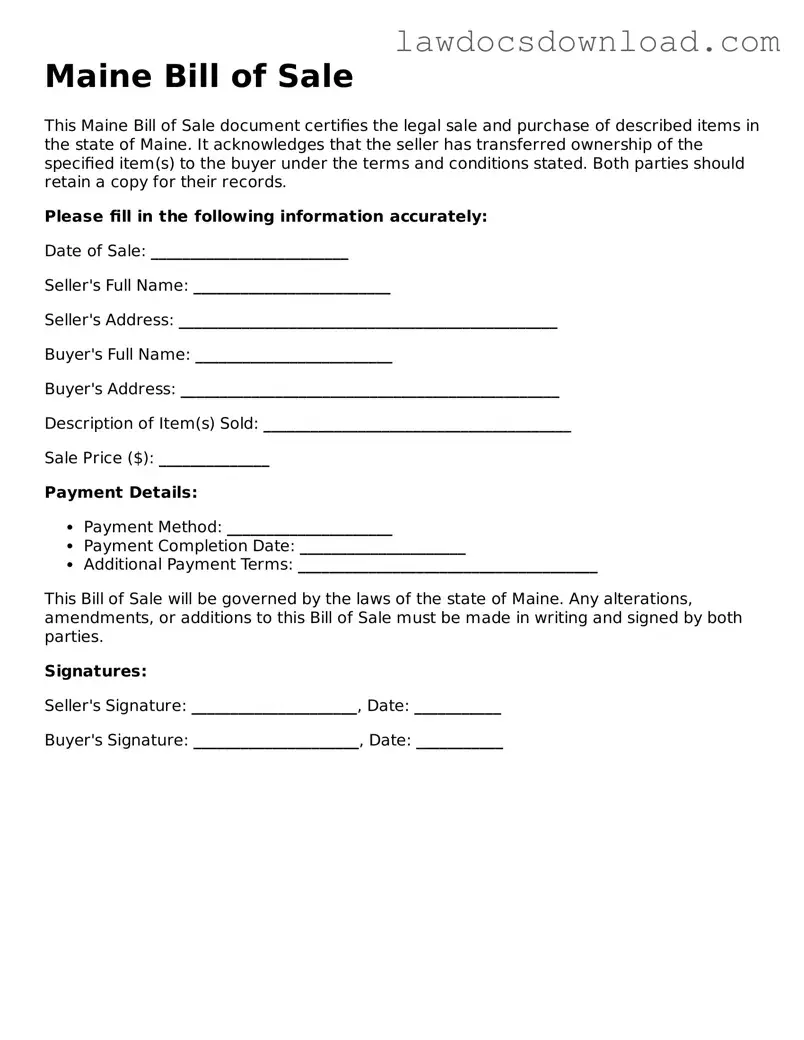

Additionally, many individuals mistakenly leave the date of sale field blank or enter an incorrect date. This oversight can lead to legal ambiguities regarding the ownership and liability of the item before and after the sale, potentially complicating insurance claims or responsibility for damages.

A common pitfall is neglecting to specify the sale price or the terms of the transaction accurately. It is essential to state clearly whether the amount paid is in cash, check, trade, or another form of payment. This detail is critical for both tax purposes and to prevent misunderstandings regarding the transaction’s financial terms.

Another error is failing to acknowledge whether the item is sold "as is" or with a warranty. This specification helps to protect the seller from future claims if the buyer encounters issues with the item. Without this clarification, the seller may inadvertently agree to implied warranties, leading to potential legal battles.

Some individuals mistakenly do not sign or date the bill of sale. Both the buyer's and seller's signatures, accompanied by the date of signing, are essential to validate the document. A bill of sale without these signatures may not be recognized as a legal instrument, rendering it useless in proving ownership or settling disputes.

Overlooking the necessity to provide multiple copies of the bill of sale is another common mistake. Both the buyer and the seller should keep a signed copy of the form for their records. These copies serve as proof of the transaction and may be required for registration, tax, or warranty purposes.

Failure to check the form for completeness before finalizing the transaction can lead to significant issues. It's advisable for both parties to review the document carefully, ensuring that all fields are accurately filled and that no essential information is missing. This final check can prevent legal and financial problems down the line.

Lastly, a critical yet often overlooked error is not recording the method of payment. Documenting whether the payment was made in full or in installments, and under what conditions, can prevent disputes regarding the payment status. This clarity is especially important if the buyer fails to fulfill their payment obligations, as it influences the seller's recourse options.