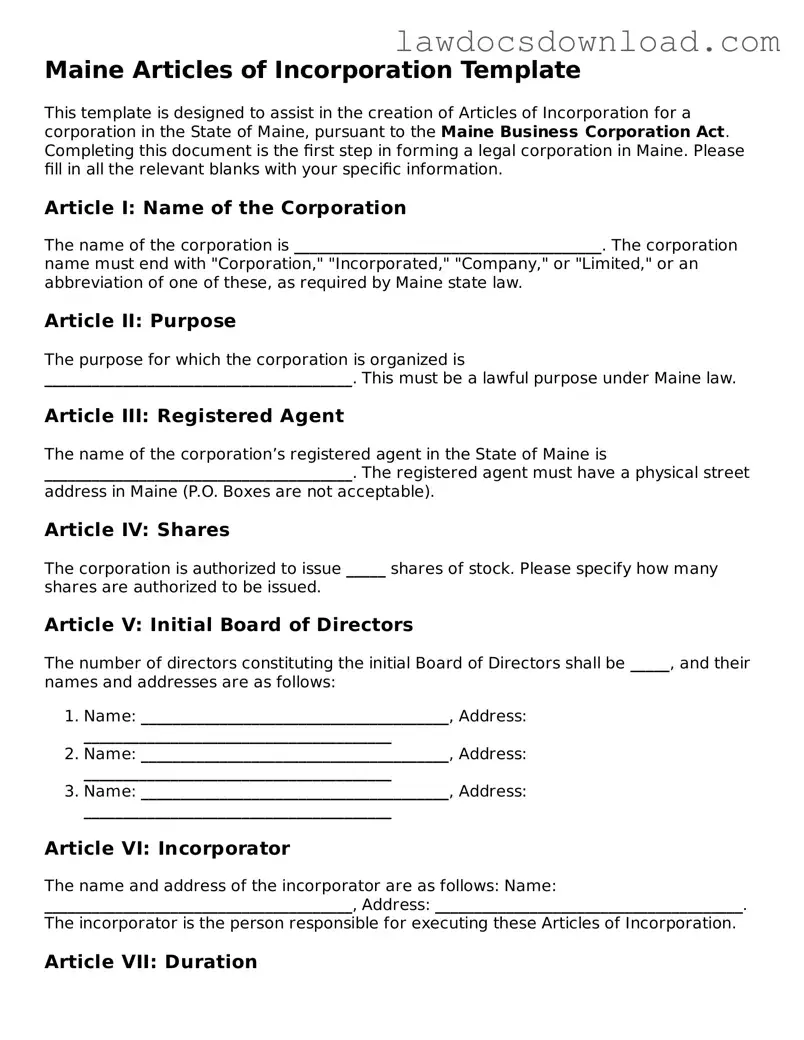

Maine Articles of Incorporation Template

This template is designed to assist in the creation of Articles of Incorporation for a corporation in the State of Maine, pursuant to the Maine Business Corporation Act. Completing this document is the first step in forming a legal corporation in Maine. Please fill in all the relevant blanks with your specific information.

Article I: Name of the Corporation

The name of the corporation is _______________________________________. The corporation name must end with "Corporation," "Incorporated," "Company," or "Limited," or an abbreviation of one of these, as required by Maine state law.

Article II: Purpose

The purpose for which the corporation is organized is _______________________________________. This must be a lawful purpose under Maine law.

Article III: Registered Agent

The name of the corporation’s registered agent in the State of Maine is _______________________________________. The registered agent must have a physical street address in Maine (P.O. Boxes are not acceptable).

Article IV: Shares

The corporation is authorized to issue _____ shares of stock. Please specify how many shares are authorized to be issued.

Article V: Initial Board of Directors

The number of directors constituting the initial Board of Directors shall be _____, and their names and addresses are as follows:

- Name: _______________________________________, Address: _______________________________________

- Name: _______________________________________, Address: _______________________________________

- Name: _______________________________________, Address: _______________________________________

Article VI: Incorporator

The name and address of the incorporator are as follows: Name: _______________________________________, Address: _______________________________________. The incorporator is the person responsible for executing these Articles of Incorporation.

Article VII: Duration

The duration of the corporation is _______________________________________. If the corporation is to have a perpetual duration, indicate "Perpetual".

Article VIII: Principal Office

The address of the initial principal office of the corporation is _______________________________________. This address must be a physical address in the State of Maine.

Upon completion, this document should be filed with the Secretary of State of Maine along with the appropriate filing fee. It is advisable to consult with a legal advisor to ensure compliance with all state requirements and to address any specific legal issues your corporation may face.