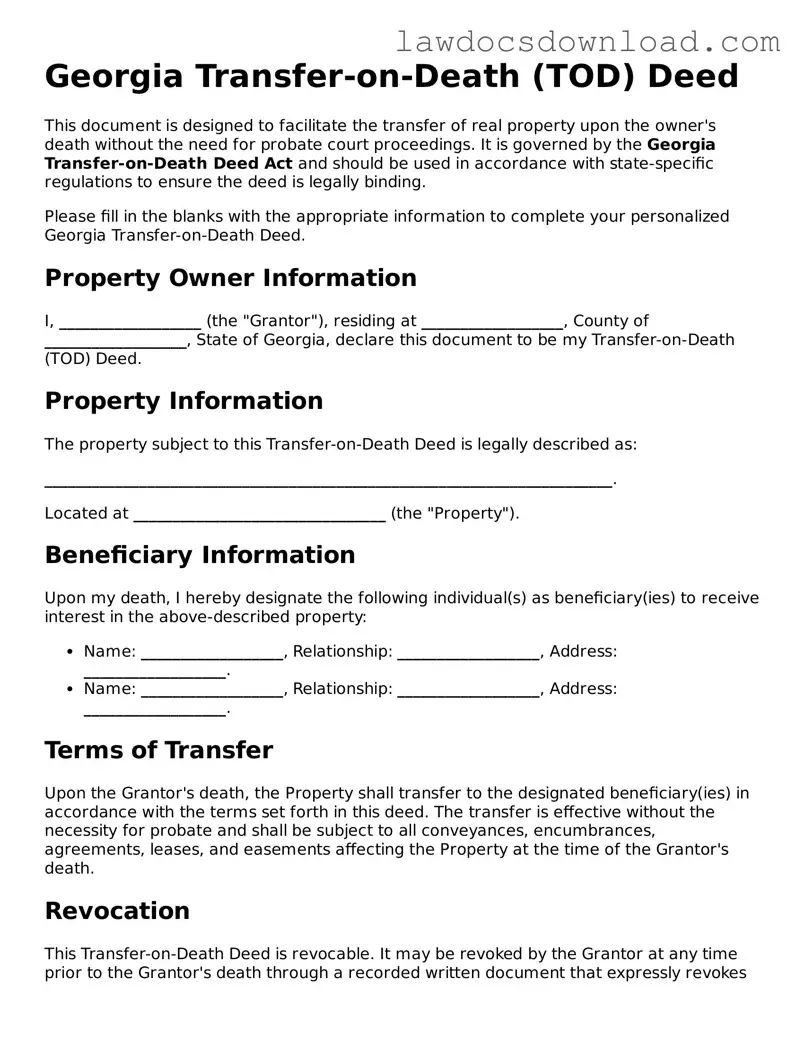

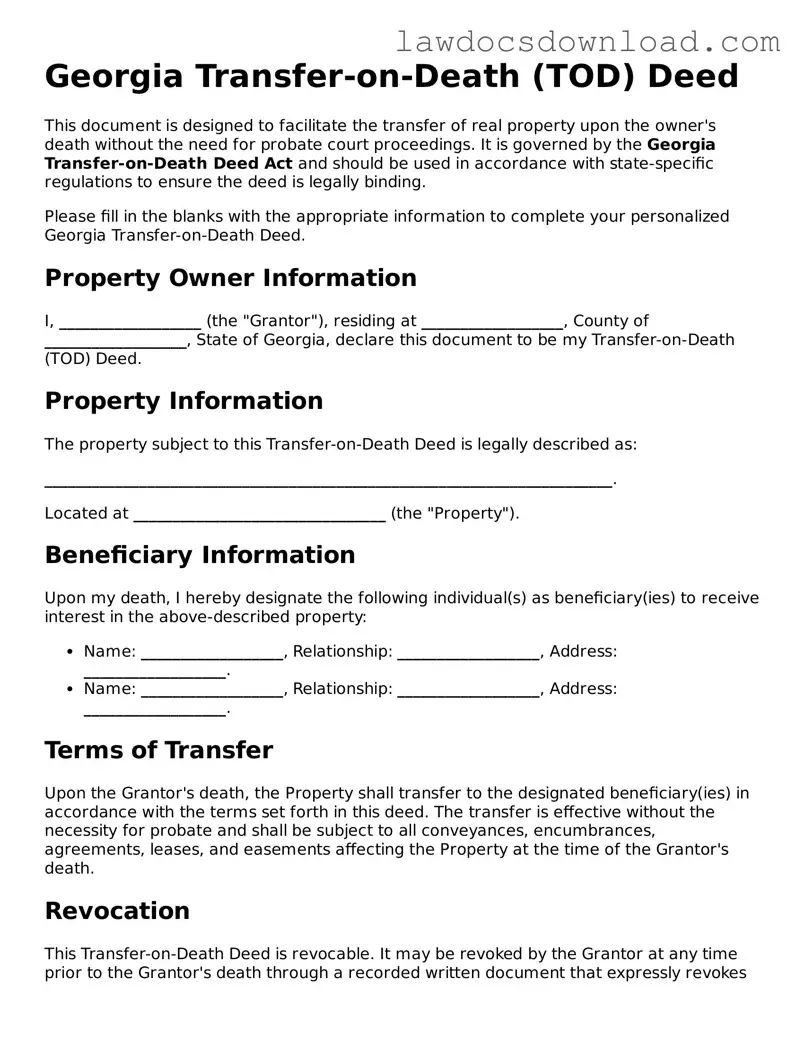

Legal Georgia Transfer-on-Death Deed Form

The Georgia Transfer-on-Death Deed form serves as a straightforward mechanism for property owners to pass on real estate to a beneficiary without the need for probate proceedings upon their death. It allows for an efficient transfer of property rights, simplifying the process for loved ones during an already difficult time. This document is pivotal for estate planning, ensuring your real estate assets are handled according to your wishes.

Launch Transfer-on-Death Deed Editor Here

Legal Georgia Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.