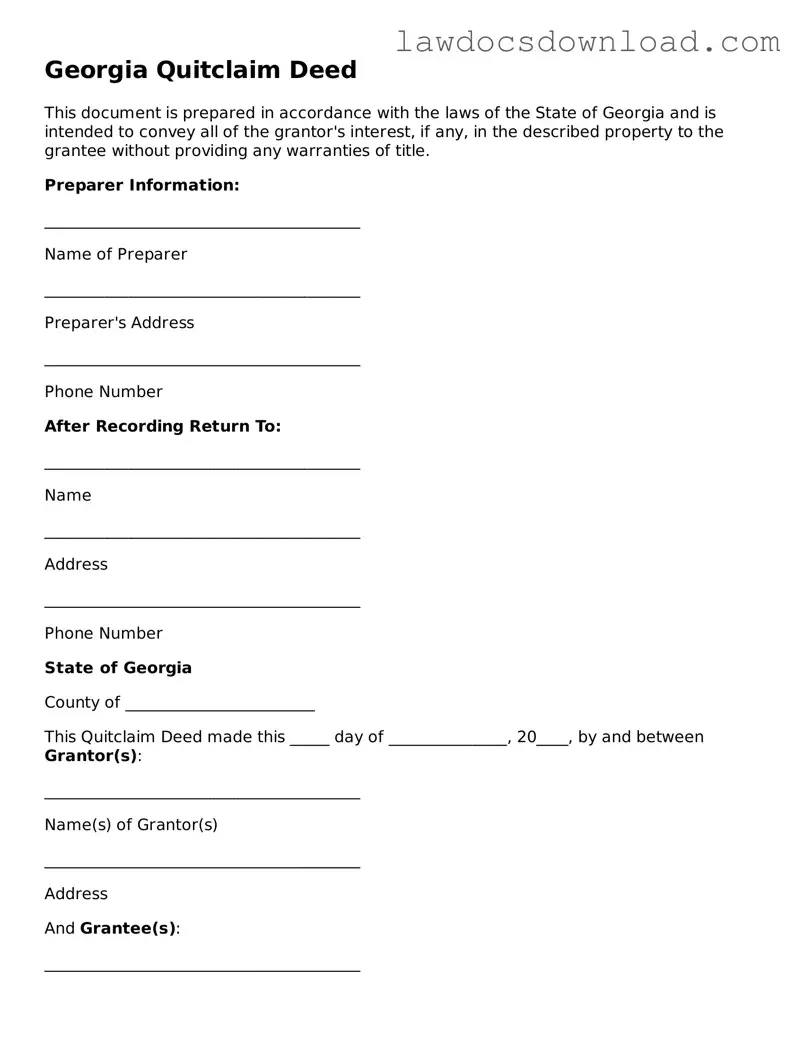

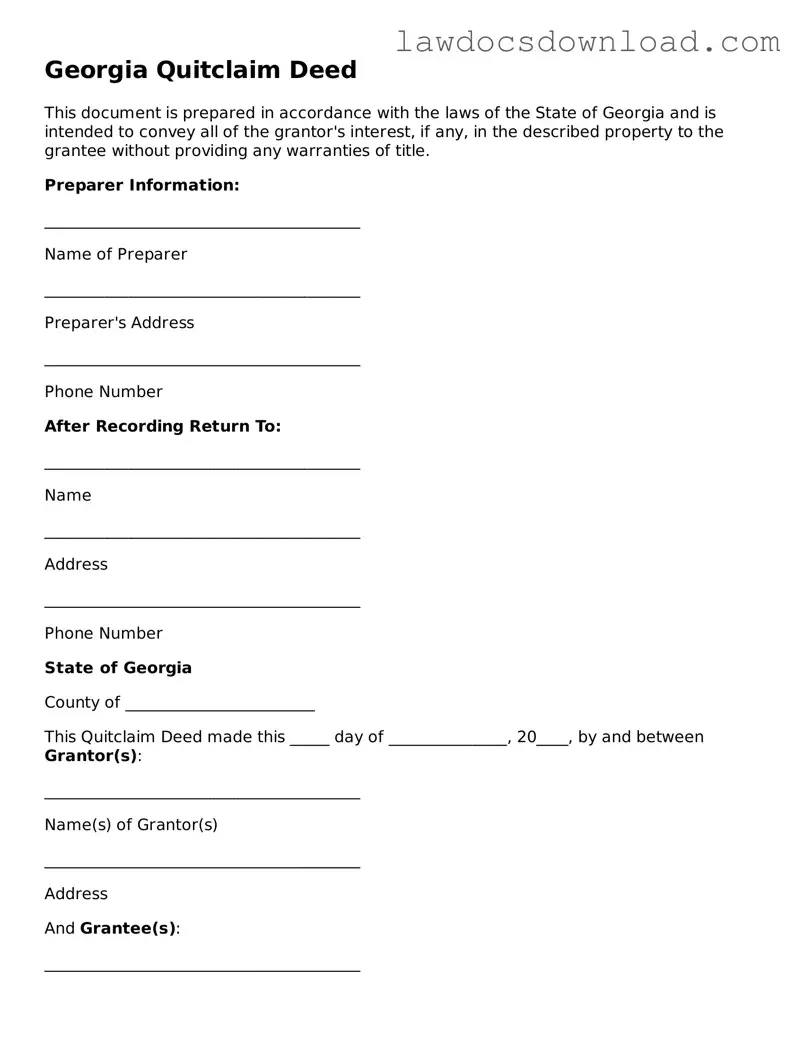

Legal Georgia Quitclaim Deed Form

A Georgia Quitclaim Deed is a legal document used to transfer interest or ownership in property from one party to another, without warranties regarding the title's condition. This form is often employed between parties who know each other, such as family members or close friends. The process provides a swift way to convey property rights, albeit with minimal protection for the buyer.

Launch Quitclaim Deed Editor Here

Legal Georgia Quitclaim Deed Form

Launch Quitclaim Deed Editor Here

Launch Quitclaim Deed Editor Here

or

Free Quitclaim Deed

Get this form done in minutes

Complete your Quitclaim Deed online and download the final PDF.