Legal Georgia Promissory Note Form

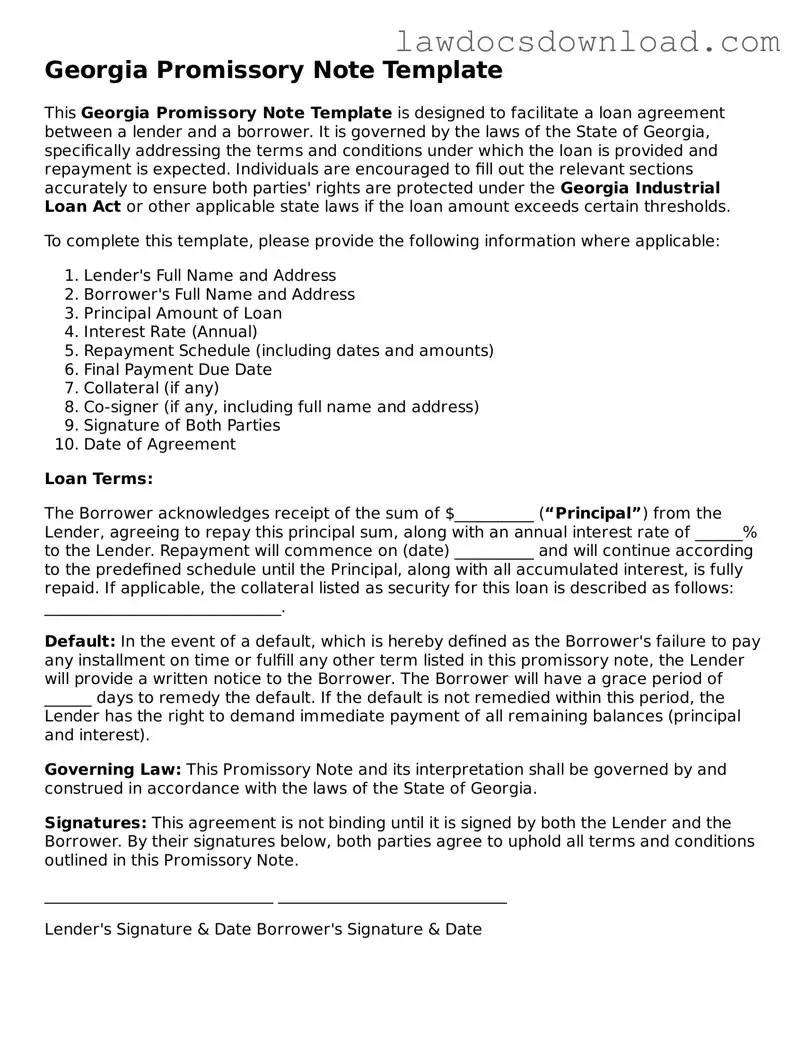

A Georgia Promissory Note form serves as a legally binding document between two parties: the borrower and the lender. It outlines the amount of money loaned, the interest rate applied, and the repayment schedule to be followed. This document plays a crucial role in formalizing the loan process within the state of Georgia, ensuring clarity and legal protection for both involved parties.

Launch Promissory Note Editor Here

Legal Georgia Promissory Note Form

Launch Promissory Note Editor Here

Launch Promissory Note Editor Here

or

Free Promissory Note

Get this form done in minutes

Complete your Promissory Note online and download the final PDF.