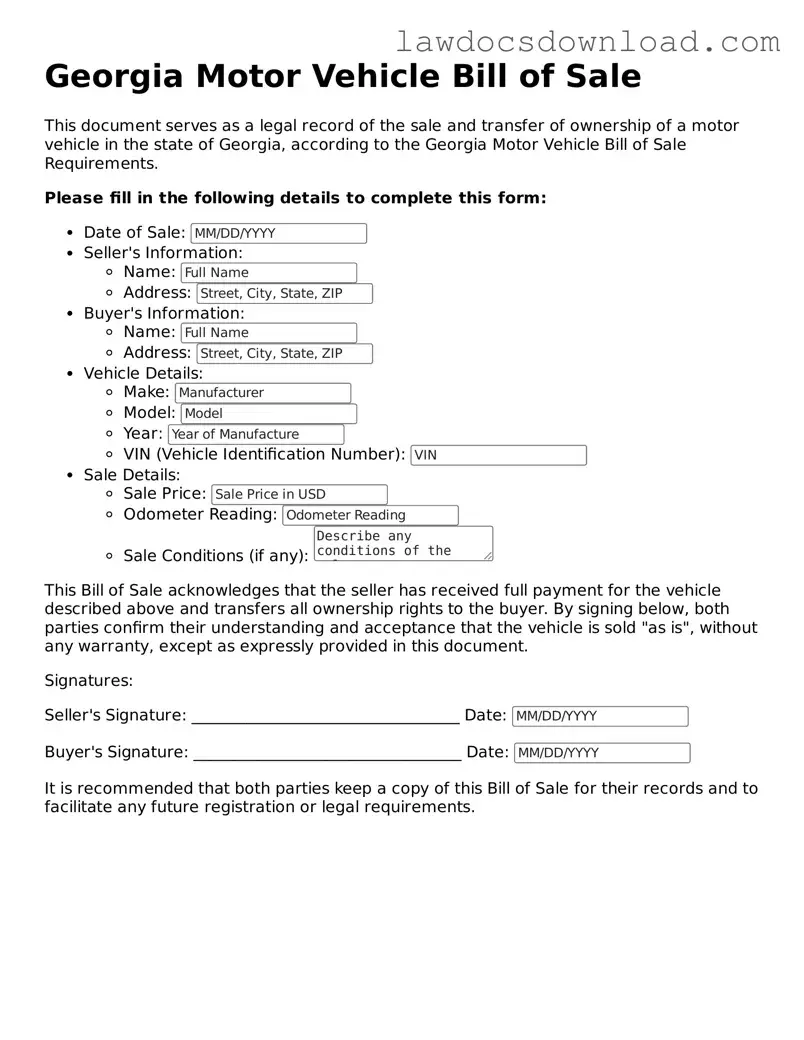

When completing the Georgia Motor Vehicle Bill of Sale form, individuals often overlook or inaccurately fill out essential details, leading to unnecessary complications. A common mistake is not providing a complete description of the vehicle. This includes the make, model, year, and Vehicle Identification Number (VIN). Without these crucial details, the document may fail to provide adequate proof of the transaction's specifics, potentially leading to legal or registration problems down the line.

Another frequent oversight is neglecting to specify the sale price in clear, unambiguous terms. It is important to write the amount in both words and numbers to avoid any confusion or discrepancies. This clarity ensures that both the buyer and seller agree on the fundamental aspect of the transaction, which is the payment exchanged for the vehicle.

Failing to record the date of sale accurately is a mistake that can have significant consequences. The sale date establishes when the ownership officially changed hands, which is essential for both registration purposes and for the protection of both parties involved in the transaction. An incorrect or missing sale date may invalidate the document or complicate the transfer of ownership.

Individuals often neglect to include their full legal names and addresses, or they provide incomplete information. For the Georgia Motor Vehicle Bill of Sale form to be legally binding and effective, both the buyer and seller must provide this information accurately. This detail validates the identities of the parties involved and facilitates any necessary future contact.

One of the major errors is not ensuring that all required signatures are on the document. The signatures of both the buyer and seller, and sometimes a witness or notary, are essential for the bill of sale to be recognized as a valid legal document. An unsigned or improperly signed document can lead to disputes about the validity of the sale or the authenticity of the bill of sale itself.

Often, sellers forget to declare any lien or encumbrance on the vehicle. This declaration is crucial as it informs the buyer of any financial obligations that are attached to the vehicle, ensuring transparency and preventing legal issues for the buyer. Omitting this information can lead to significant problems post-sale, including potential legal action against the new owner.

A lack of acknowledgment regarding the 'as-is' condition of the sale is another common error. This acknowledgment is important as it indicates that the buyer accepts the vehicle in its current state, with all its faults, and has no recourse against the seller for any issues that were not disclosed before the sale. Failure to include this clause can lead to misunderstandings and disputes between the buyer and seller.

Incorrectly or not specifying the method of payment is a detail that is sometimes overlooked. Whether the transaction involves cash, check, or another form of payment, detailing this information clearly in the bill of sale is essential. It serves as a record of the transaction and can be crucial in the event of a dispute over payment.

Forgetting to detail any additional terms and conditions of the sale is a mistake that can lead to ambiguity about the agreement's scope. These might include warranties, the inclusion of vehicle accessories, or specific terms agreed upon by the buyer and seller. Without this information, enforceability of these terms may be in question.

Lastly, not retaining a copy of the signed bill of sale for personal records is a common oversight. Both the buyer and seller should keep a copy of the fully executed document. This serves as a receipt and proof of transaction, which could be invaluable for tax purposes, future disputes, or as a reference for the vehicle's history.