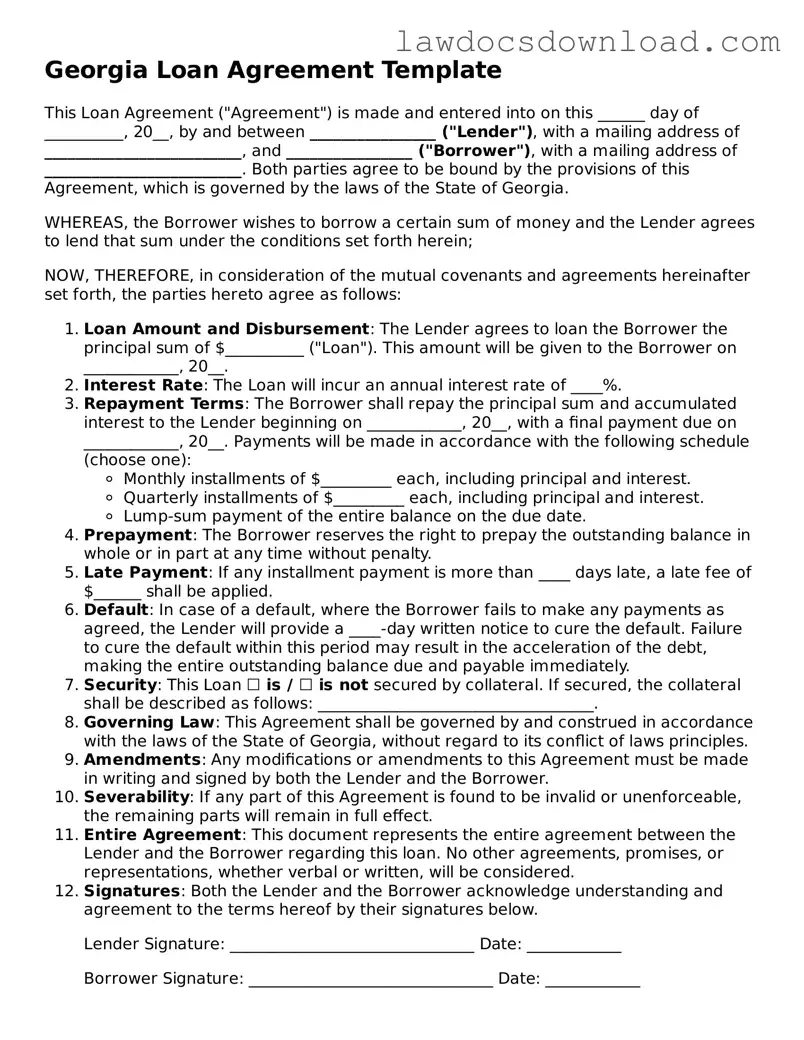

The Georgia Loan Agreement form shares similarities with a Promissory Note. Both documents are binding agreements involving a lender and a borrower, where the borrower agrees to pay back a certain amount of money to the lender under specific conditions. A promissory note is more streamlined, focusing mainly on the repayment schedule and interest rates, lacking the detailed provisions about the borrower's obligations and rights that a loan agreement includes.

Mortgage Agreements have a notable resemblance to the Georgia Loan Agreement form, primarily because both secure loans with property. In a mortgage, the property acts as collateral in case the borrower defaults on the loan. The Georgia Loan Agreement might also include terms about securing the loan with collateral, detailing the obligations of the borrower to maintain the property and the rights of the lender to seize the property if the borrower fails to make payments as agreed.

The Line of Credit Agreement bears similarities to the Georgia Loan Agreement form. Both outline the terms under which money is borrowed, including interest rates, payment schedules, and the consequences of default. However, a Line of Credit Agreement differs by offering a revolving fund that the borrower can draw from, repay, and draw from again, up to a set limit, providing more flexibility than a conventional term loan as outlined in a typical loan agreement.

Personal Guarantee forms are related to the Georgia Loan Agreement form because they both deal with the assurance that a loan will be repaid. In a loan agreement, the borrower is directly responsible for repayment. A Personal Guarantee, however, involves a third party agreeing to repay the loan if the original borrower defaults, offering an additional layer of security to the lender that is not typically detailed in the loan agreement itself.

Debt Settlement Agreements share objectives with the Georgia Loan Agreement form, as both aim to outline the terms for handling a debt. While the loan agreement sets the original terms of the loan, a Debt Settlement Agreement comes into play when the borrower cannot meet those terms, offering a plan to settle the debt, usually by reducing the owed amount or altering repayment terms. This is a reactionary measure not anticipated in the original loan agreement but crucial for renegotiating terms when the borrower encounters financial difficulties.

Lastly, Business Loan Agreements and the Georgia Loan Agreement form are closely related, with the primary difference being that Business Loan Agreements are specifically tailored to the needs and considerations of businesses borrowing money. These agreements might include provisions for investments, operations, and the allocation of profits that are not typically found in personal or standard loan agreements. However, both documents define the relationship between borrower and lender, repayment terms, and the legal recourse available if either party fails to meet their obligations.