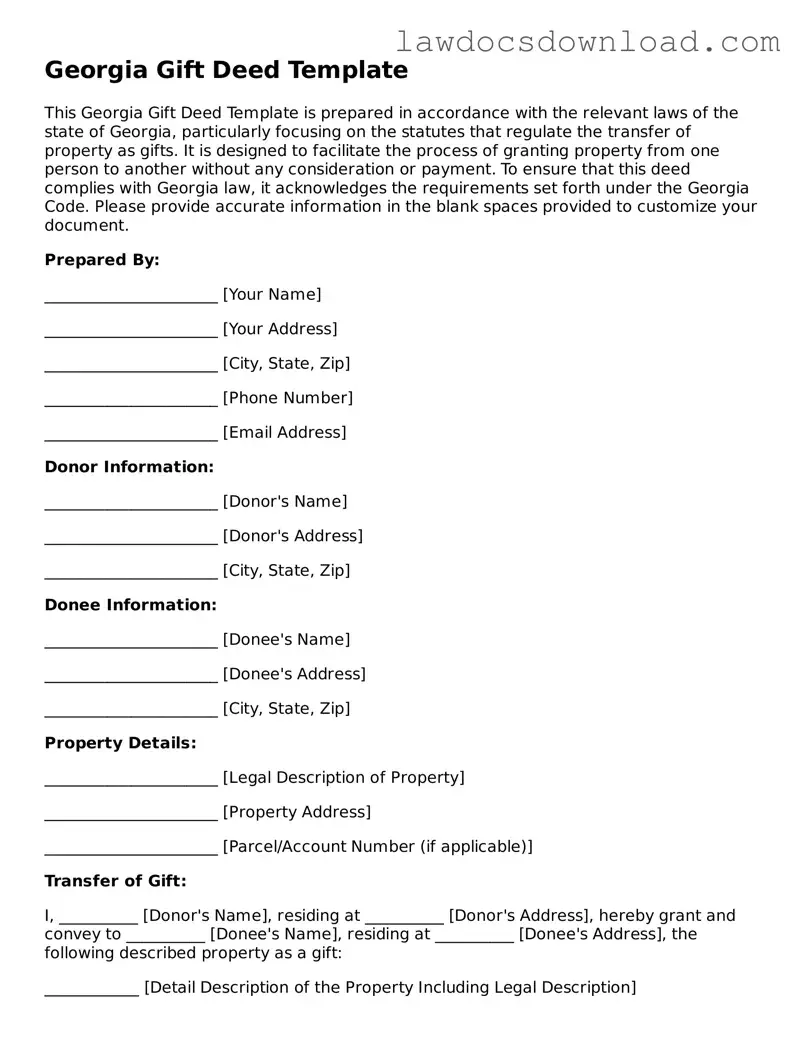

Georgia Gift Deed Template

This Georgia Gift Deed Template is prepared in accordance with the relevant laws of the state of Georgia, particularly focusing on the statutes that regulate the transfer of property as gifts. It is designed to facilitate the process of granting property from one person to another without any consideration or payment. To ensure that this deed complies with Georgia law, it acknowledges the requirements set forth under the Georgia Code. Please provide accurate information in the blank spaces provided to customize your document.

Prepared By:

______________________ [Your Name]

______________________ [Your Address]

______________________ [City, State, Zip]

______________________ [Phone Number]

______________________ [Email Address]

Donor Information:

______________________ [Donor's Name]

______________________ [Donor's Address]

______________________ [City, State, Zip]

Donee Information:

______________________ [Donee's Name]

______________________ [Donee's Address]

______________________ [City, State, Zip]

Property Details:

______________________ [Legal Description of Property]

______________________ [Property Address]

______________________ [Parcel/Account Number (if applicable)]

Transfer of Gift:

I, __________ [Donor's Name], residing at __________ [Donor's Address], hereby grant and convey to __________ [Donee's Name], residing at __________ [Donee's Address], the following described property as a gift:

____________ [Detail Description of the Property Including Legal Description]

This transfer is done with the intention of delivering a present gift, and I, the Donor, do hereby deliver to the Donee possession and all rights of ownership of the above-described property.

The Donor affirms that the gift is made voluntarily and without any consideration, reservation, or expectation of remuneration. The property mentioned above is free of all encumbrances, except as explicitly stated herein:

______________________ [Details of Any Encumbrances]

Witnesses:

The undersigned witnesses hereby affirm that the Donor has declared in their presence that the property is given as a gift, voluntarily and without consideration.

__________ [Witness #1 Name]

__________ [Witness #1 Address]

__________ [Witness #2 Name]

__________ [Witness #2 Address]

Notarization:

This document was acknowledged before me on __________ [Date] by __________ [Donor's Name] and __________ [Donee's Name], who are personally known to me or have produced identification as proof of their identities.

______________________ [Notary Public's Name]

Notary Public, State of Georgia

Commission expires: __________

Instructions for Recording:

After completion and notarization, this Georgia Gift Deed should be filed with the county recorder's office in the county where the property is located. Ensure all information is accurate and complete for a valid transfer of property.