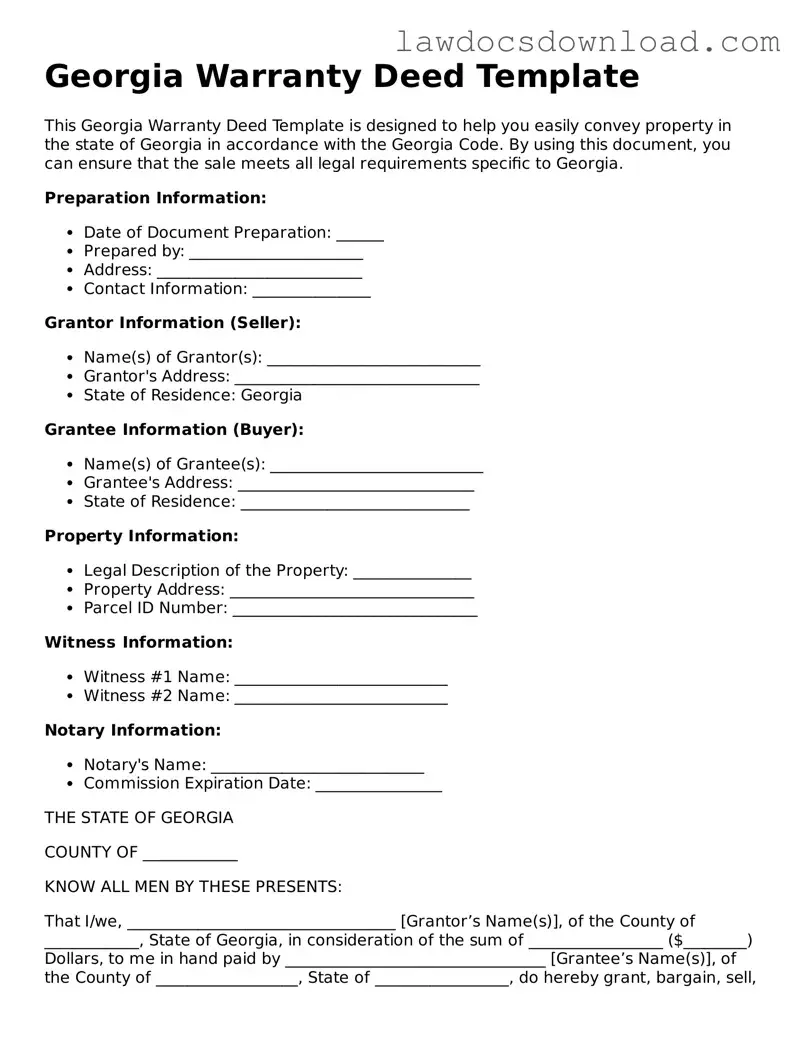

Georgia Warranty Deed Template

This Georgia Warranty Deed Template is designed to help you easily convey property in the state of Georgia in accordance with the Georgia Code. By using this document, you can ensure that the sale meets all legal requirements specific to Georgia.

Preparation Information:

- Date of Document Preparation: ______

- Prepared by: ______________________

- Address: __________________________

- Contact Information: _______________

Grantor Information (Seller):

- Name(s) of Grantor(s): ___________________________

- Grantor's Address: _______________________________

- State of Residence: Georgia

Grantee Information (Buyer):

- Name(s) of Grantee(s): ___________________________

- Grantee's Address: ______________________________

- State of Residence: _____________________________

Property Information:

- Legal Description of the Property: _______________

- Property Address: _______________________________

- Parcel ID Number: _______________________________

Witness Information:

- Witness #1 Name: ___________________________

- Witness #2 Name: ___________________________

Notary Information:

- Notary's Name: ___________________________

- Commission Expiration Date: ________________

THE STATE OF GEORGIA

COUNTY OF ____________

KNOW ALL MEN BY THESE PRESENTS:

That I/we, __________________________________ [Grantor’s Name(s)], of the County of ____________, State of Georgia, in consideration of the sum of _________________ ($________) Dollars, to me in hand paid by _________________________________ [Grantee’s Name(s)], of the County of __________________, State of _________________, do hereby grant, bargain, sell, and convey unto the said party/parties of the second part, the following described property, to-wit:

Description of Property: _____________________________________________________

Together with all and singular the rights, members, and appurtenances thereof, to have and to hold the said premises unto the said Grantee(s), their heirs, and assigns, forever. And I/we do warrant and forever defend the right and title to the above-described property, against the claims of all persons whomsoever.

IN WITNESS WHEREOF, I/we have hereunto set my/our hand(s) and seal(s) this ____ day of ____________, 20__.

___________________________________

Signature of Grantor

___________________________________

Signature of Grantor

State of Georgia, County of ___________

Subscribed and sworn before me this ____ day of ____________, 20__.

_____________________________________

Notary Public

My commission expires: _______________

This document is not intended as legal advice. We recommend consulting a lawyer or a professional legal consultant to ensure compliance with state laws and regulations.