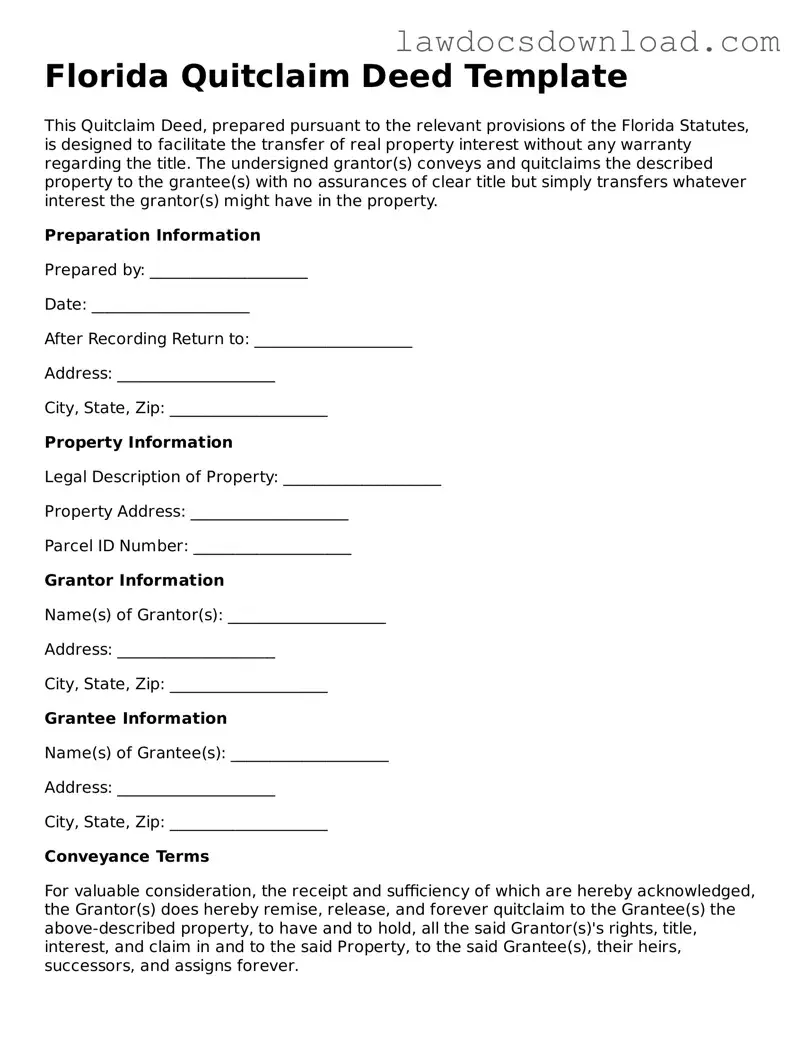

Legal Florida Quitclaim Deed Form

A Florida Quitclaim Deed form is a legal document used to transfer ownership of property in Florida without guaranteeing the title is clear. This means the person receiving the property, known as the grantee, takes it "as-is," understanding the current owner, or grantor, makes no promises regarding the property’s ownership free of claims or liens. It's commonly used among family members or when a property is not being sold for its full market value.

Launch Quitclaim Deed Editor Here

Legal Florida Quitclaim Deed Form

Launch Quitclaim Deed Editor Here

Launch Quitclaim Deed Editor Here

or

Free Quitclaim Deed

Get this form done in minutes

Complete your Quitclaim Deed online and download the final PDF.