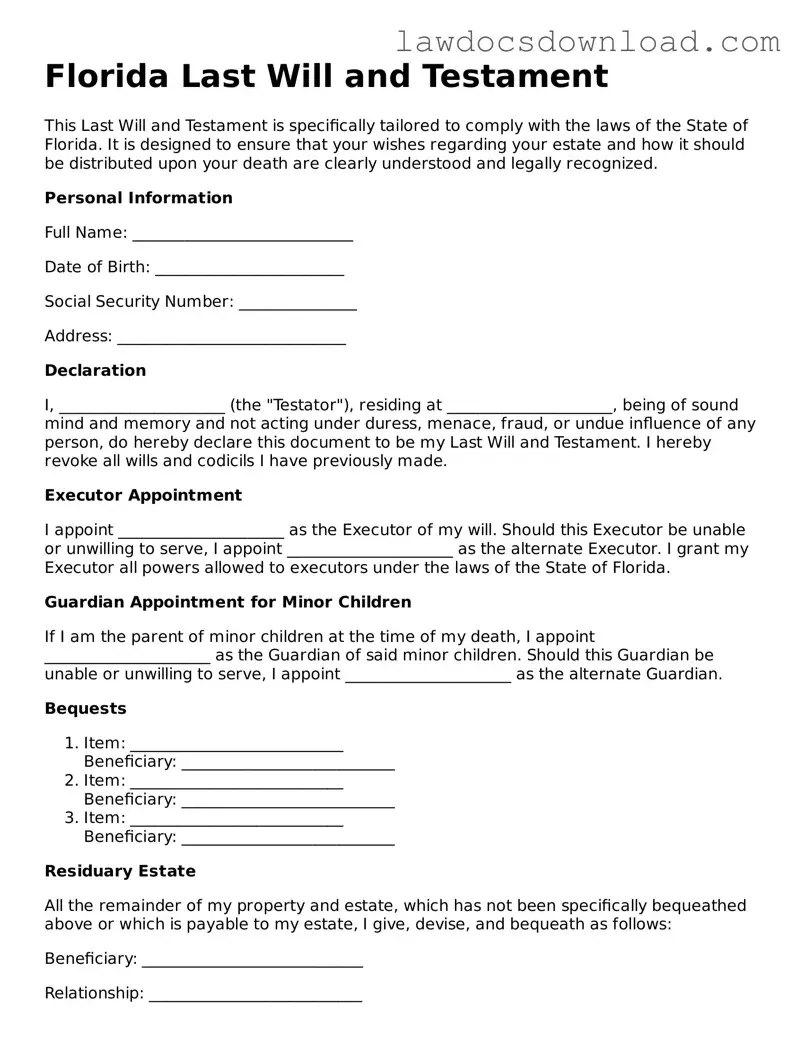

Florida Last Will and Testament

This Last Will and Testament is specifically tailored to comply with the laws of the State of Florida. It is designed to ensure that your wishes regarding your estate and how it should be distributed upon your death are clearly understood and legally recognized.

Personal Information

Full Name: ____________________________

Date of Birth: ________________________

Social Security Number: _______________

Address: _____________________________

Declaration

I, _____________________ (the "Testator"), residing at _____________________, being of sound mind and memory and not acting under duress, menace, fraud, or undue influence of any person, do hereby declare this document to be my Last Will and Testament. I hereby revoke all wills and codicils I have previously made.

Executor Appointment

I appoint _____________________ as the Executor of my will. Should this Executor be unable or unwilling to serve, I appoint _____________________ as the alternate Executor. I grant my Executor all powers allowed to executors under the laws of the State of Florida.

Guardian Appointment for Minor Children

If I am the parent of minor children at the time of my death, I appoint _____________________ as the Guardian of said minor children. Should this Guardian be unable or unwilling to serve, I appoint _____________________ as the alternate Guardian.

Bequests

- Item: ___________________________

Beneficiary: ___________________________

- Item: ___________________________

Beneficiary: ___________________________

- Item: ___________________________

Beneficiary: ___________________________

Residuary Estate

All the remainder of my property and estate, which has not been specifically bequeathed above or which is payable to my estate, I give, devise, and bequeath as follows:

Beneficiary: ____________________________

Relationship: ___________________________

Percentage of Estate: ____________________

Signatures

This Last Will and Testament was signed and declared by the Testator, _____________________, as their Last Will and Testament, in our presence, who in their presence and in the presence of each other, have hereunto subscribed our names as witnesses on this ____ day of ____________, 20__.

- Testator's Signature: ___________________________

- Witness #1 Signature: ___________________________

- Name: ___________________________

- Address: ___________________________

- Witness #2 Signature: ___________________________

- Name: ___________________________

- Address: ___________________________

Declaration by Witnesses

We, the undersigned, declare that the Testator willingly signed and executed this document as their Last Will and Testament in our presence, that they signed it willingly, and that they appear to be of sound mind and under no duress, menace, fraud, or undue influence.

Note: This template is provided for general informational purposes only and may not reflect all legal requirements of the State of Florida. It is recommended to consult with a licensed attorney in the State of Florida to ensure that your Last Will and Testament complies with all state and local laws and requirements.