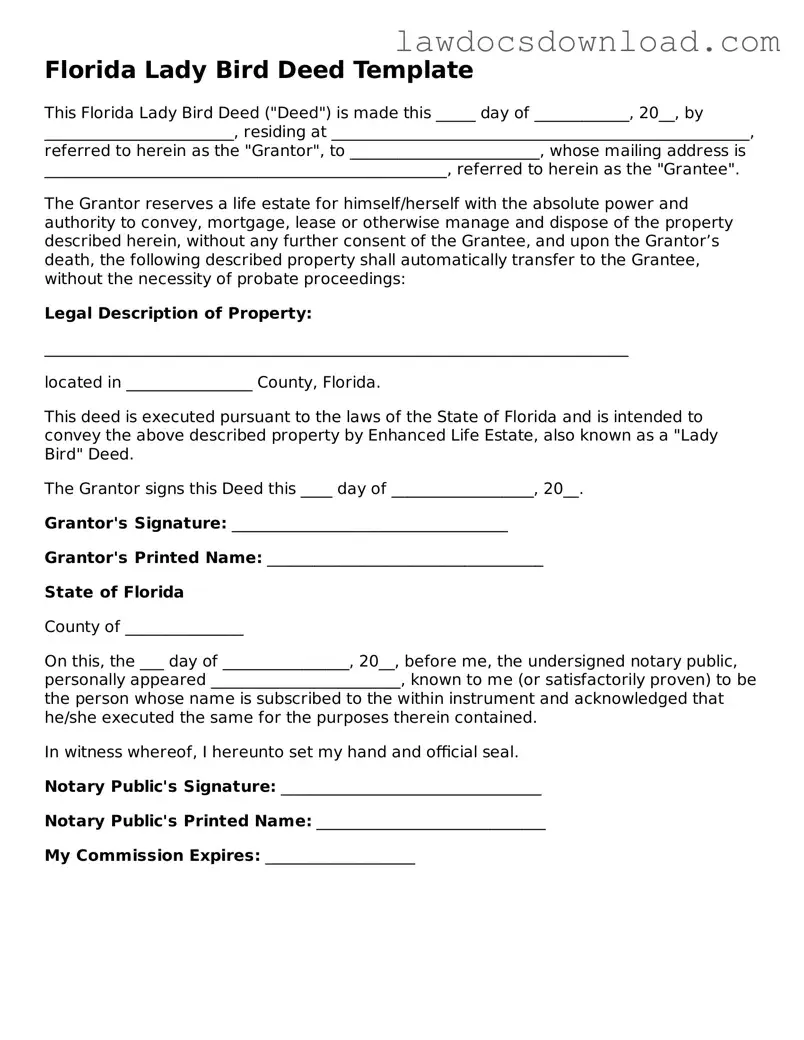

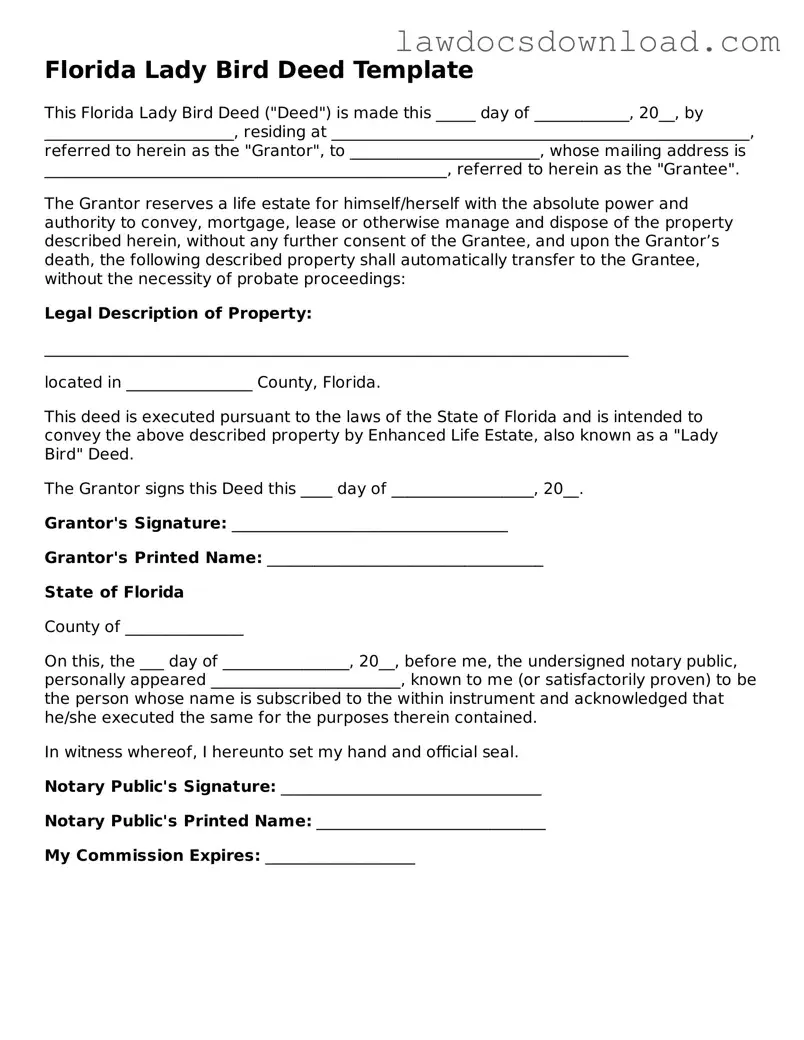

Legal Florida Lady Bird Deed Form

A Lady Bird Deed, used in Florida, is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate court. This form of deed is a powerful tool for estate planning, offering a simple yet effective way to manage asset distribution. With its unique features, it provides a seamless transition of property, ensuring loved ones are taken care of with minimal hassle.

Launch Lady Bird Deed Editor Here

Legal Florida Lady Bird Deed Form

Launch Lady Bird Deed Editor Here

Launch Lady Bird Deed Editor Here

or

Free Lady Bird Deed

Get this form done in minutes

Complete your Lady Bird Deed online and download the final PDF.