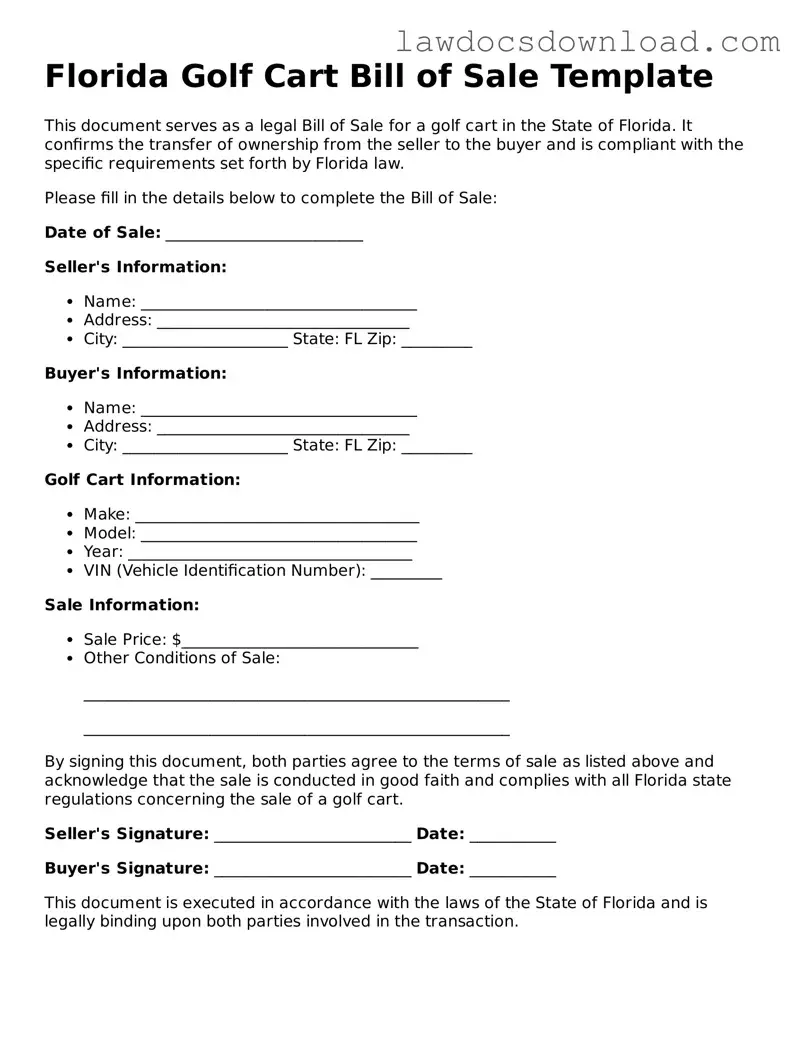

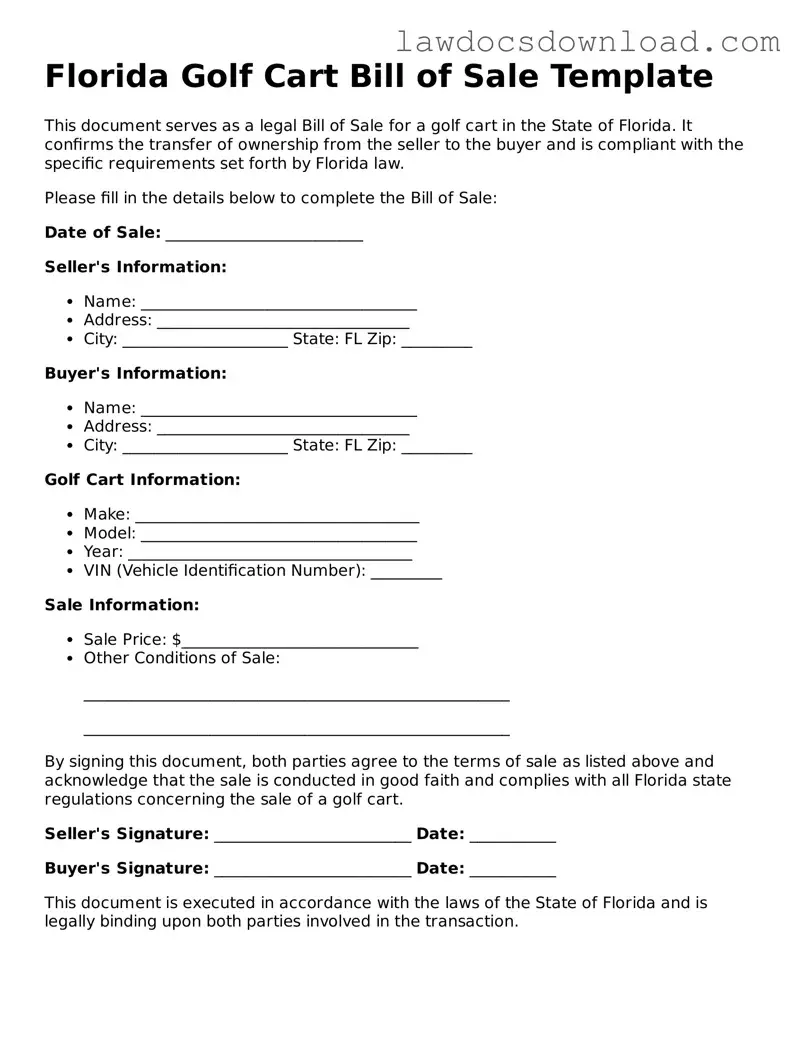

One common mistake people make when filling out the Florida Golf Cart Bill of Sale form is not properly identifying the golf cart. Specific details, such as the make, model, and serial number, are crucial. Without this information, the document may not provide clear proof of the transaction. It's like buying a house without knowing the address; you know you bought something, but what exactly?

Many forget to check or accurately state the golf cart's condition. Whether it's new, used, or needs repairs, this detail directly impacts the value and expectations of the buyer. Imagine thinking you purchased a ready-to-use golf cart, only to find out it needs significant repairs. This clear communication helps both parties set realistic expectations.

Another oversight is neglecting to include the sale date. This seems like a minor detail, but it's incredibly important for record-keeping and legal purposes. The date of sale can affect warranty periods, and it might also be necessary if there are any disputes about the timing of the sale.

Incorrectly documenting the sale price is additionally problematic. This doesn't just lead to potential misunderstandings between buyer and seller; it can also have tax implications. Adjustments and corrections down the line can be a hassle nobody wants to deal with, especially when it involves finances.

Omitting buyer and seller information is another common error. Full names, addresses, and contact details are fundamental for a valid bill of sale. This oversight can lead to complications if disputes arise or if contact between the parties is needed post-sale.

Some individuals also fail to obtain or provide the necessary signatures. This can invalidate the entire document. Imagine the frustration of thinking you've finalized a purchase, only to realize the transaction isn't legally recognized because someone forgot to sign the dotted line.

Not specifying warranty information is a frequent mistake, too. Whether the golf cart is sold as-is or with a warranty can significantly influence the buyer's decision. Clarifying this information upfront can prevent disagreements and dissatisfaction.

Forgetting to include payment terms, if applicable, can also lead to misunderstandings. In cases where payment will be made in installments, detailing the amounts and due dates is key. Without this clarification, the seller might expect a lump sum when the buyer believes smaller, periodic payments were agreed upon.

Another error lies in not using a notary public to witness the signing. While not always legally required, having a notarized bill of sale adds a layer of authenticity and can be crucial in resolving future disputes. Notarization serves as an additional proof that the parties entered into the agreement willingly.

Lastly, failing to make copies of the completed form for both parties is a significant oversight. Each party should have a record of the transaction. Without this, if the original document is lost, proving the details of the sale could become a major issue.