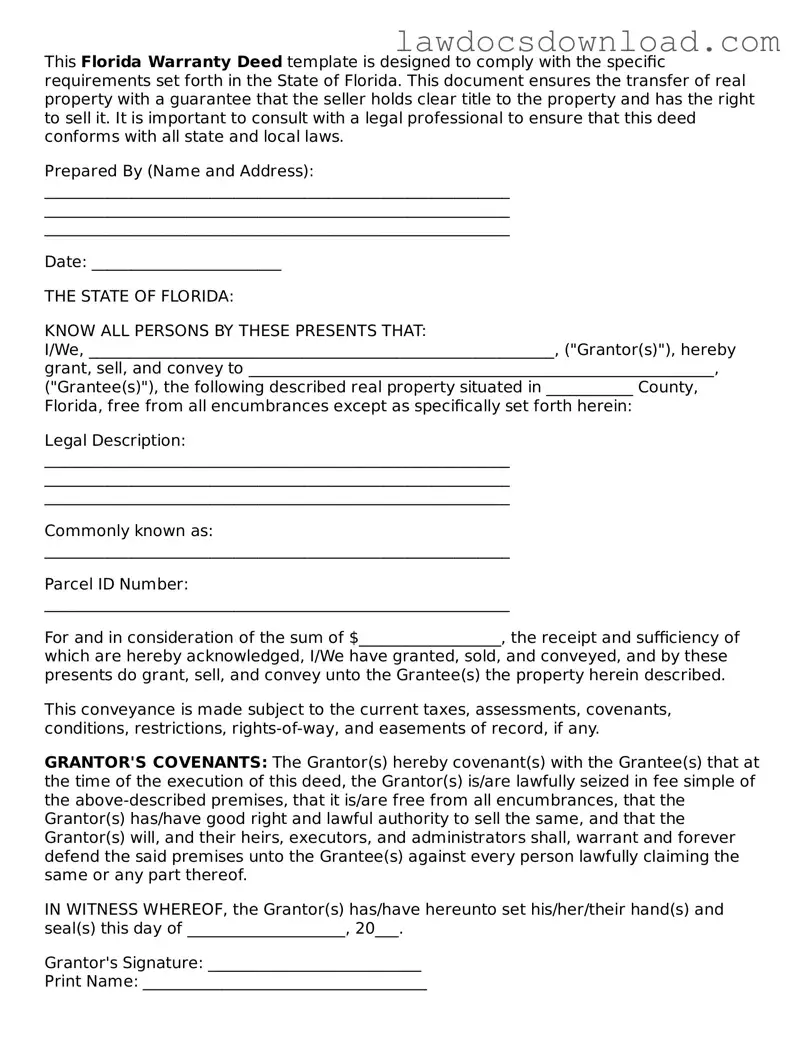

This Florida Warranty Deed template is designed to comply with the specific requirements set forth in the State of Florida. This document ensures the transfer of real property with a guarantee that the seller holds clear title to the property and has the right to sell it. It is important to consult with a legal professional to ensure that this deed conforms with all state and local laws.

Prepared By (Name and Address):

___________________________________________________________

___________________________________________________________

___________________________________________________________

Date: ________________________

THE STATE OF FLORIDA:

KNOW ALL PERSONS BY THESE PRESENTS THAT:

I/We, ___________________________________________________________, ("Grantor(s)"), hereby grant, sell, and convey to ___________________________________________________________, ("Grantee(s)"), the following described real property situated in ___________ County, Florida, free from all encumbrances except as specifically set forth herein:

Legal Description:

___________________________________________________________

___________________________________________________________

___________________________________________________________

Commonly known as:

___________________________________________________________

Parcel ID Number:

___________________________________________________________

For and in consideration of the sum of $__________________, the receipt and sufficiency of which are hereby acknowledged, I/We have granted, sold, and conveyed, and by these presents do grant, sell, and convey unto the Grantee(s) the property herein described.

This conveyance is made subject to the current taxes, assessments, covenants, conditions, restrictions, rights-of-way, and easements of record, if any.

GRANTOR'S COVENANTS: The Grantor(s) hereby covenant(s) with the Grantee(s) that at the time of the execution of this deed, the Grantor(s) is/are lawfully seized in fee simple of the above-described premises, that it is/are free from all encumbrances, that the Grantor(s) has/have good right and lawful authority to sell the same, and that the Grantor(s) will, and their heirs, executors, and administrators shall, warrant and forever defend the said premises unto the Grantee(s) against every person lawfully claiming the same or any part thereof.

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set his/her/their hand(s) and seal(s) this day of ____________________, 20___.

Grantor's Signature: ___________________________

Print Name: ____________________________________

Grantee's Signature: ___________________________

Print Name: ____________________________________

State of Florida

County of __________

This document was acknowledged before me on (date) ___________________ by (name of Grantor) _________________________________________ who is personally known to me or who has produced ______________________________ as identification and who did/did not take an oath.

Signature of Notary Public: _____________________

Print Name: ______________________________________

(Seal)